Getting a tax refund can sometimes feel like hitting the jackpot. A few hundred dollars hitting your bank account out of nowhere? Sweet!

But tax refunds really aren’t a lottery. Instead, they’re a logical feature of our tax system – pay too much income tax throughout the financial year, and it’ll be refunded to you once you file a tax return.

The mechanics of this, however, is where it gets complicated. How do you know when you’re paying too much tax? What happens when you underpay? When do you know if you’re eligible for a refund? And when will that refund come through?

We’ve got you covered. Let’s break it all down.

- What a tax refund is

- What a tax refund isn’t

- How do you get a tax refund?

- When does the IRD pay tax refunds?

- How to get it right every time

What is a tax refund?

A tax refund is, quite simply, a refund paid to you if you overpay your income tax. Tada!

It’s not uncommon to accidentally underpay or overpay income tax. This is mostly because how much you’ll earn in any given financial year can be difficult to predict.

For example, say you’re a PAYE employee making $70,000 a year, and you decide to take six unpaid months off to trek through the Himalayas (good luck!). Your employer will have spent the first six months of the year deducting tax from each pay based on your $70k salary. But because of your unpaid six months off, you’ll only have earned half that – $35k.

What this means is that you will have paid six months worth of tax for a $70k salary – so $7,010 at an effective tax rate of 20.03%.

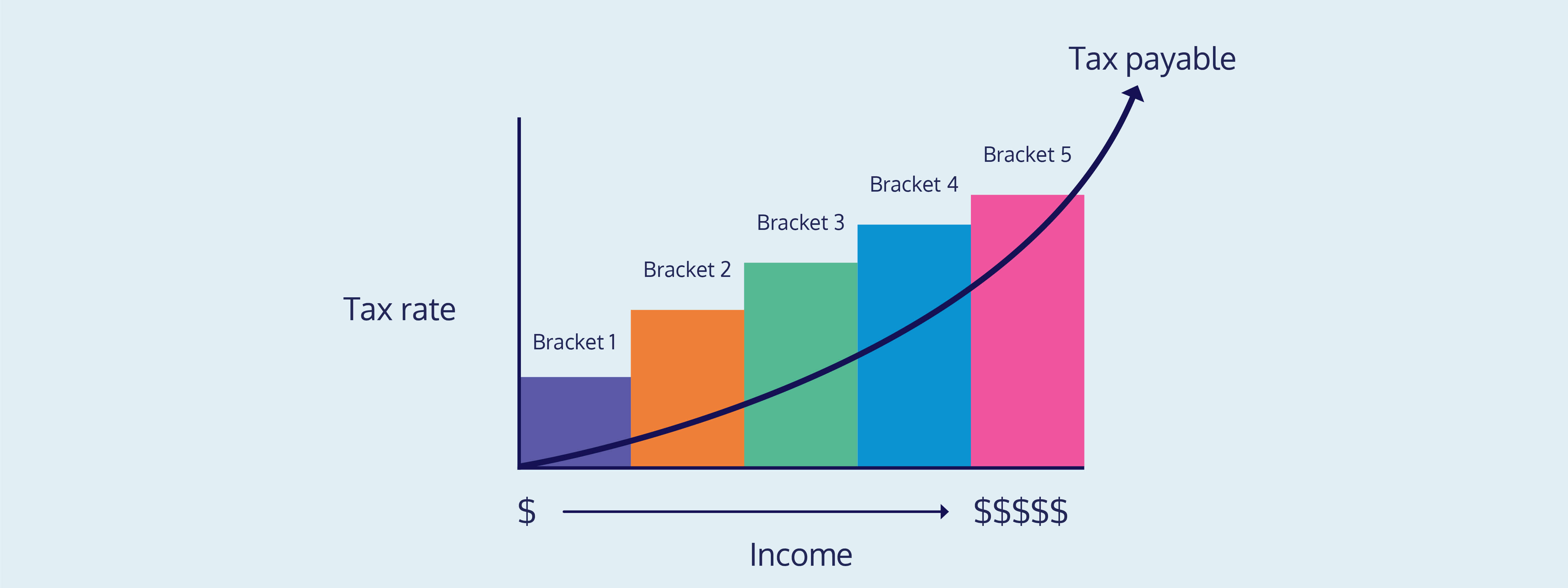

But what you owe is income tax on $35k. Because of our progressive tax system, where your effective tax rate rises the higher your salary, your final tax bill is less than what you’ve already paid – so $5,145, with an effective tax rate of 14.70%.

Because your PAYE employer deducted more than what you owe in your six months of employment, you’ll receive the balance as a tax refund of $1,865.

Sole trader income can be even trickier, depending on your line of work. If the income you earn is variable, you may accidentally set aside too little to cover your annual tax bill, or pay too much in withholding or provisional tax.

If you pay more than you owe in income tax, you’ll receive a refund. If you pay less than you owe, you’ll end up with a tax bill. Simple!

What a tax refund isn’t

There are more than a few misconceptions about what a tax refund is, and who gets one. Let’s bust some of these myths.

1. A tax refund is a refund of business expenses claimed

This one’s the biggie. And if this is what you thought a tax refund was, you’re definitely not alone!

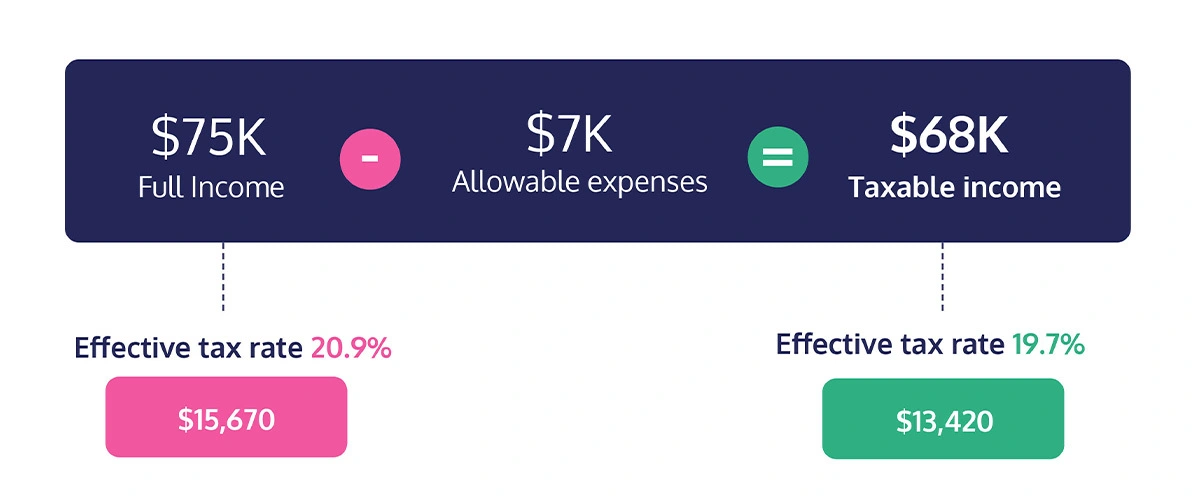

Basically, there’s a myth that if you claim $7,000 worth of business expenses, that money is refunded to you in the form of a tax return. This is not true!

Instead, the value of claimed business expenses is deducted from your taxable income. As your taxable income is lowered, so is the amount of tax you’ll owe.

📖 For more information about taxable income and effective tax rates, check out our guide to tax rates for sole traders.

📖 Not sure what business expenses you can claim? We have a guide for too.

2. IRD has miscalculated – you’re paying too much tax

The IRD is generally pretty accurate with their income tax calculations. It’s unlikely their system has miscalculated!

If anything, there’s a chance that they have the wrong information. There are a few things you can double check:

- If you have a PAYE job, are you on the right tax code?

- If you are on the wrong tax code, you may have overpaid your income tax!

- This is even more likely if you work more than one PAYE job – neither employer knows how much you earn at your other job, so both rely on you to get it right! It may be that you need to be on a secondary tax rate for one of your jobs.

- If you earn schedular income, what withholding tax rate did you use?

- A withholding tax rate is a flat rate, in contrast to progressive income tax rates and bands, so it’s likely that you’ve paid too much or too little in income tax.

- Have you claimed business expenses correctly?

- If you realise you accidentally double claimed certain expenses, you will need to amend your return, leaving you with a higher tax bill than you have realised.

- Have you accurately reported your income to the IRD?

- It goes without saying, the more income recorded with the IRD, the higher your tax bill! If you’ve double-entered anything, like schedular payments your client has already reported to the IRD on your behalf, the amount of tax you owe will be inaccurate.

- Have you overlooked a tax credit in a previous financial year?

- If you feel like your tax bill is much higher this year than last year, part of the reason why may be a tax credit you were eligible for.

- For example, the Early Payment Discount is applied to self-employed earners’ tax bills during their first year of operation if you make voluntary repayments before the end of the tax year, with some caveats. If you were eligible for it last year, it will have significantly lowered your tax bill without you even realising!

If all these things are in order, chances are your tax bill is correct. When it comes to calculating income tax, the IRD is usually on the money (literally).

💡 Join Hnry, and we manage your expenses for you, so you’re always getting the right amount of tax relief. See how it works!

3. Hnry pays your tax refund

For all you Hnry users out there, we just want to clarify – we don’t pay you your tax refund. The IRD does!

So if you’re waiting for your refund to hit your bank account, you’re waiting for the IRD, not Hnry.

You can get in touch with them through your myIR account, call their support team, or if you’re feeling a bit fancy, send them a letter.

How to get a tax refund

Well for starters, to get a tax refund, you need to be eligible for one! You’ll automatically get a tax refund if you’ve paid more in income tax than you actually owe.

But to get the ball rolling on a tax refund, you’ll need to submit a tax return.

A tax return essentially lets the IRD know:

- How much you’ve earned across the financial year, including:

- Self-employed income

- PAYE income

- Rental income

- Interest

- Dividends

- Income from a family trust

- Cryptocurrency

- What business expenses you’re claiming against your taxable income

From there, they’ll be able to calculate how much you owe in income tax, and whether or not you’re owed a tax refund – or have an outstanding bill.

May the odds be ever in your favour.

📖 Need help preparing your tax return? Check out our guide to the end of the financial year.

💡 Or better yet, use Hnry. We complete and file your tax return for you - join now. Easy as!

When does IRD pay tax refunds?

Once you file, the IRD can take up to 10 working weeks to process your return (although it’s usually much quicker), and notify you if you’re eligible for a refund.

They have a list of current processing times available on their website, although they do say that it might take them longer than expected in some situations.

Unfortunately, from the moment you (or we!) file your tax return, it becomes a waiting game. There isn’t much you can do on your end to speed up IRD’s process, other than making sure all the information you provide them in your tax return is accurate and up to date.

If you make a mistake in your tax return, you’ll need to amend it as soon as you can and resubmit – and the clock will restart on the full 10 weeks.

How to get your taxes right every time

We may be biased, but we really believe that the best way for sole traders to stay on top of their taxes is to use Hnry.

Hnry is an award-winning tax and financial administration service for sole traders. For just 1% +GST of your self-employed income, capped at $1,500 +GST a year, Hnry will calculate and pay all your taxes, levies and whatnot for you, including:

We also complete and file your annual tax return, GST returns (if you’re GST registered), and manage your expenses for you – it’s all part of the service!

If this sounds good to you, it’s quick to sign up. Start using Hnry, and never think about tax again!

Share on: