If you’re a Kiwi with a degree, you’re probably familiar with New Zealand’s student loan system. Essentially, you borrow a small fortune to get a degree, and then when that degree gets you work, you use your wonderfully big salary to pay that small fortune back.

The problem is, if you’re a sole trader, you’re entirely responsible for managing your own repayments. And it’s no small sum – you’re required to pay 12 cents of every dollar you earn above the repayment threshold (currently $24,128). If you put it off till the end of the financial year, you could be hit with a bill for thousands of dollars.

That’s why we thoroughly recommend saving for your student loan repayments throughout the year, instead of leaving it until the very end. And if you have exceptionally high student loan debt (our sympathies), there are a few things you might want to consider when planning your repayments.

Let’s get cracking!

- Student loans in New Zealand

- How student loans work

- Checking your student loan balance

- Repaying your student loan

- Should you pay your student loan off faster?

- Automate student loan repayments with Hnry

Student loans in New Zealand

Once upon a time, studying at a university in New Zealand used to be free.

This changed in 1989, when tuition fees were introduced by the then government. To help fund their university education, students were asked to pay a whopping $129 a year (around $292.95 in today’s money).

Then in 1990, this flat fee was raised to $1,250 (about $2,652.35 today) – a raise of 869%. And then in 1991, the subsequent government decided to do away with flat fees entirely, allowing universities to set their own fees for their courses.

To offset this and help keep education affordable, the Student Loan Scheme Act 1992 was introduced later that year. This allowed students to borrow money from the government to fund their studies. These loans generally garnered interest until 2006, when loans became interest free for all borrowers residing in New Zealand.

(If we’re being technical about it, the loans aren’t actually interest-free – the interest is just written off for those who live in Aotearoa).

All that brings us to the present day, where 658,000 people are currently in student-loan related debt worth a total of $16 billion. So really, if you still have a hefty student loan, welcome! You’re in great company.

How student loans work

Alright, we’ve covered the history – here’s how it all works in practice.In Aotearoa, student loans are made up of a few different components – it’s more than just straight course fees. And some, like living costs and course related costs, are opt-in, depending on your situation.

- Compulsory fees

- For every tertiary course you undertake, there will be a course fee. This is listed in your student loan bill as “compulsory fees”.

- Living costs

- A weekly amount borrowed to cover living expenses, up to a maximum of $302.32.

- Unlike the similar student allowance, this is part of your loan, and must be repaid.

- Course related costs

- Course related costs are an extra $1000 made available for students to cover course-related bits and bobs.

- Unfortunately, this counts as part of your loan, and must be paid back.

- Remember those hefty textbooks you bought that you only used once? Ah, memories.

- Administration fees

- The IRD charges you $40 a year to manage your student loan. Fun times.

- This administration fee will automatically be added to your account if you have a balance of $20 or more by the 31st of March each year.

- Establishment fees

- Studylink charges you $60 every time you make an application for a student loan.

- Fun fact: even if you did the same course year after year, you technically have to reapply for your student loan every year. So if you studied for three years, you’d owe $180 in administration fees.

- The good news is that you’re not charged an administration fee for the years you’re charged an establishment fee.

- Interest

- You may see a line for interest in your student loan statement. This is because interest is technically charged on your loan, but as long as you live in New Zealand, the interest is written off.

- (There should be a line in your student loan statement that subtracts the interest)

These are the main pieces of your student loan, but you may also see charges for penalties, transfers, or other increases. For more information, you can visit the IRD website.

And that’s it! The whole shebang.

Checking your student loan balance

You can find a full breakdown of your student loan costs, as well as how much you’ve already repaid, in your myIR account.

💡 If you’re not registered with myIR, it’s fairly straightforward to get set up. You’ll need your IRD number and an email address, and that’s it!

While you’re there, the IRD also has a pretty nifty tool that’ll help you figure out how long your loan will take to pay off. It inputs your loan details for you, you just need to add your annual earnings.

It’ll even estimate how long you’ll take to pay off your student loan when you live overseas. Which brings us to –

Repaying your student loan

While living in New Zealand

As long as you stay in Aotearoa, your student loan will generally be interest free. (If you don’t make your payments on time, you may be charged late payment interest.)

What this means is that once you stop studying, your loan generally won’t grow (other than the yearly administration fee). The balance is your final balance, and you have until the end of time to pay it off. Or until bitcoin moons, whichever one comes first.

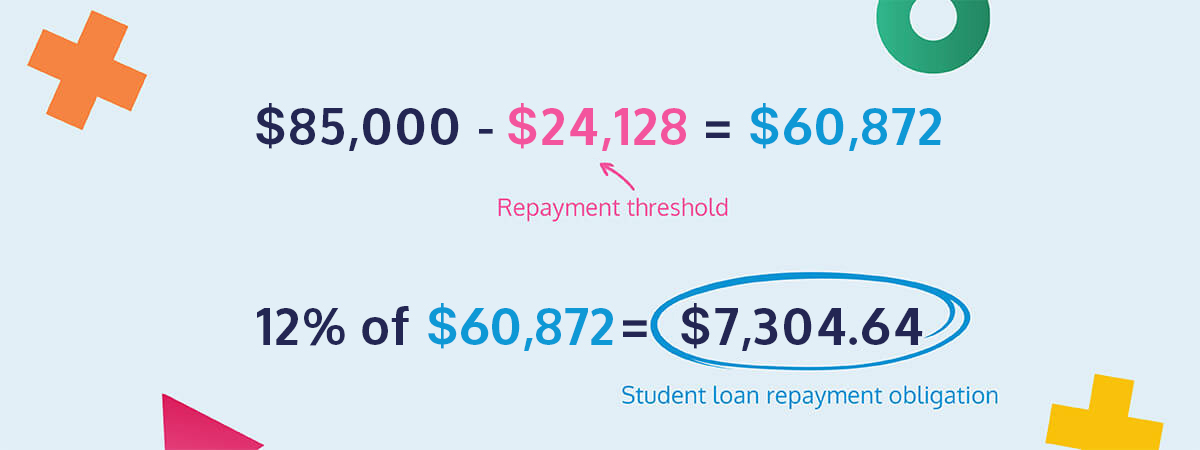

The amount you have to repay on your student loan is $0.12 for every dollar you earn over the repayment threshold ($24,128 for the financial year 2023/24).

Because it’s a set amount, it’s easy enough to calculate – but it’s also easy to underestimate.

For example, let’s say you earn $85k in self-employed income. Your student loan repayment obligation is $7,460.64. That’s no picnic!

They both have full time PAYE jobs, meaning that their repayment threshold is accounted for, and they owe $0.12 of every dollar they make in student loan repayments.

Shan Jun prepares for this ahead of time, and diligently sets 12% of each paycheck aside. Mav, however, spends every last dollar.

At the end of the financial year, they both owe around $2,000 each. Mav struggles to pay, while Shan Jun has enough funds to cover the bill.

Mav is upset that Shan Jun didn’t tell him about student loan repayments. Shan Jun realises he’s tired of working through tax admin. The next year, both Mav and Shan Jun sign up for Hnry and save their friendship.

Your student loan repayment obligation is due once you file your tax return. The IRD will then send you a Notice of Assessment, letting you know how much you owe in student loan repayments. You’ll then have until the 7th of February to pay any outstanding amounts (unless you have an accountant or tax agent like Hnry sorting your taxes!).

💡 If you don’t meet the 7th February deadline, you’ll be charged interest on the overdue amount. This is why we recommend preparing for it well ahead of time!

Interim student loan repayments

It’s important to note, however, that if you have an end-of-financial-year student loan repayment obligation of more than $1,000, you’ll be required to pay interim student loan repayments for the next financial year. This is in addition to the EOFY student loan repayment you already owe. Yikes!

Interim student loan repayments are calculated based on your most recent EOFY student loan repayment obligation + 5%.

If you didn’t file a tax return for the most recent financial year, it’ll be calculated based on your student loan repayment obligation from two years ago, +10%

This total is then divided into three instalments, which you generally have to pay on three different due dates:

- 28th August

- 15th January

- 7th May

They both started their businesses in the last two years, and are coming to terms with the whole “tax thing” – but it’s slow going. Jamie just registered for GST, Alex is trying to accurately calculate their ACC levies, and neither of them are having a good time.

Jamie filed her last tax return a year ago, and was informed that she had a student loan repayment obligation of $3,861. Because this balance is over $1,000, Jamie has to pay interim student loan repayments. The full amount across the three deadlines is $3,861 + $193.05 (5%) = $4,054.05.

Alex, however, last filed a tax return two years ago (she’s getting round to it, ok?!). Her student loan repayment obligation was $2,661. For this financial year, her interim student loan repayments are calculated using that previous amount + 10% ($266.10) = $2,927.10.

Neither Alex, nor Jamie want to deal with this malarkey anymore. They both sign up for Hnry.

There is an option to change your student loan interim repayment amounts if you’re confident you’ll earn less this year than before. But before you go down this route, you should triple check your numbers. If your estimation ends up being less than you actually owe, the IRD may charge you a penalty.

While living overseas

When you live outside of Aotearoa, your student loan will accrue interest.

How interest is charged

Interest is charged at an annual flat rate of 3.3%, but is calculated and added daily. This means that if you knock down your balance steadily throughout the year, the daily interest charged will drop accordingly.

The good news is that the interest you gain won’t become part of your loan balance until the 31st of March each year. What this means is that your interest will not accrue its own interest – so long as you pay it off in time!

📖 Compound interest sucks when it comes to your student loan, but is absolute magic when it comes to KiwiSaver – read more.

For the first six months, this interest won’t be added to your overall balance. But as soon as you pass the six month threshold, interest will be calculated and added starting the day after you left New Zealand.

Minimum repayments

While New Zealand-based borrowers repay their loans based on their earnings, for overseas-based borrowers, it all depends on the value of your loan. Basically, the bigger the loan, the higher your minimum repayments are.

Overseas-based borrowers have two deadlines each year: 30th September and 31st of March. The amount you owe will depend on the amount left on your loan:

| Loan balance | Amount due 30th September | Amount due 31st March | Total amount due annually |

|---|---|---|---|

| Less than $1,000 | Half your total loan balance | The remaining half of your total loan balance | Total loan balance |

| $1,000 - $15,000 | $500 | $500 | $1,000 |

| $15,000 - $30,000 | $1,000 | $1,000 | $2,000 |

| $30,000 - $45,000 | $1,500 | $1,500 | $3,000 |

| $45,000 - $60,000 | $2,000 | $2,000 | $4,000 |

| Over $60,000 | $2,500 | $2,500 | $5,000 |

The good news is that unless your loan is over $142,860, your minimum repayments will cover any interest charged. The bad news is that the more you owe, the more interest you’ll accrue, meaning your minimum repayments are less likely to knock down the capital (sorry team).

Should you pay your student loan off faster?

Outside of the minimum repayments and obligations, should you be proactively paying off your loan?

We’re going to satisfy no one with our answer – it really does depend (sorry!). When asking yourself this question, there are a few things you need to consider for yourself and your situation.

1. Inflation and value

Firstly, because New Zealand student loans don’t earn interest (so long as you’re in NZ), it means that the overall value of your student loan will diminish over the years due to inflation.

For example, let’s say you bought a remote-controlled pterodactyl ten years ago for $50 (don’t worry, it’s super high tech – you definitely got your money’s worth). Since then, inflation has reduced our purchasing power by 22.1%, meaning that the same pterodactyl now costs $64.17, and you’re stuck buying a stegosaurus with your $50 instead.

Similarly, if you “bought” a degree for $30k ten years ago, inflation means that debt is worth approximately $38k today – but you still only owe $30k. The value of your loan stays the same, but its monetary worth is dropping by the day.

2. The % pay cut

The flip side of this coin, though, is that 12% of your earnings above the repayment threshold are required to go towards your student loan. Once you pay your loan off, it’s similar to getting a raise – that percentage that used to go towards your student loan repayments will now go straight into your pocket (metaphorically speaking)

Imagine what you could do with those extra funds?

3. Overseas interest

If you’re heading overseas for a long period of time, it’s worth thinking about how much interest you might accrue over the time you’ll be away. Believe us when we say, it’ll stack up! In this scenario, extra repayments might really be worth it.

You can use the IRD repayments calculator to see how long it’ll take you to repay your student loan while overseas, with and without extra repayments.

4. The mental load

Many ex-students are grateful for the education they were able to undertake, but still feel burdened by the weight of their student loan. If this is the case for you, all the maths in the world can never compare to the weight off your shoulders once you’re done paying it off.

Don’t forget to throw a massive shindig when that loan balance hits $0. You’ll have earnt it.

Automate your student loan repayments with Hnry

Look. You’re busy. We get it. You don’t need to be reading yet another article about money you owe the IRD. Which is why we really recommend you start using Hnry.

(Yes, we’re biased; hear us out.)

Hnry is an award-winning tax and financial administration service for sole traders. For just 1% of your self-employed income, we will completely sort out student loan repayments (no interim repayments guaranteed!) alongside your:

We also file your annual tax returns, as part of the service.

Whether you’re just starting out, or an industry veteran, Hnry is designed for all sole traders. We make sure that you never know the horror of an unpaid tax bill – ever. And that’s a big deal, believe us.

Forget your student loan exists. Join Hnry today.

Share on: