“I think I should pay more taxes,” said no sole trader ever.

If you’re self-employed, you know how hard it is to set aside a percentage of your hard-earned income to pay your taxes. Maybe you find yourself itching to use some of these funds to grow your business, or even take a well-deserved break (imagine!).

Luckily, there is a way to (legally) pay less in tax each year.

(And put more funds towards a bougie beach vacation – just a suggestion!)

To help sole traders and small businesses keep more of their money, the IRD allows certain business expenses to be claimed as tax deductions. What this essentially means is that you’re rewarded for investing in your business, AND you get to keep more of your money come tax day. Woohoo!

Unfortunately, the tax deduction system isn’t as straightforward as buying an asset, paying less tax. For starters:

- only specific business expenses qualify for a deduction,

- claimable expenses differ from industry to industry,

- and some purchases are only partially claimable.

So how can you make the most of this complicated system? Buckle up team. It’s time to get fiscal. Here’s what we’ll cover:

- What is a tax deduction?

- Who can claim tax deductions?

- What expenses are tax deductible?

- Types of deductible expenses

- Keeping records for the IRD

- 10 Common business expenses (as raised by Hnry users!)

- How Hnry makes claiming tax deductions easier

What is a tax deduction?

Despite having “tax” and “deduction” in its name, a tax deduction isn’t money deducted from the taxes you pay, that you then get to keep. Instead, a tax deduction reduces the amount of income you have to pay taxes on, resulting in less tax owed and a lower effective tax rate.

💡 An effective tax rate is the percentage of your total income that you pay in taxes. For more information, check out our guide to tax rates.

The IRD allows you to claim certain business expenses (or part of an expense) as tax deductions. This means that you will owe less tax, NOT that you get this amount back as a tax refund.

Sounds confusing? Let’s break it down:

💡 You can calculate your own effective tax rates before and after allowable expenses using our tax calculator. For more information about how tax rates work, see our guide to tax rates for sole traders.

💡 If you’re GST registered, claiming GST expenses happens separately from claiming tax deductions. For more information, check out our guide to GST.

Who can claim tax deductions?

In New Zealand, people who aren’t in business (eg. PAYE employees) can’t claim business expenses. Companies usually cover all work-related costs for PAYE employees, which is why they aren’t eligible to claim work-related expenses as a general rule.

However, PAYE employees are eligible to claim tax deductions for a few specific things, like:

- commission charged on earning interest or dividends

- tax preparation fees

- certain income protection insurance premiums

- interest on money borrowed for investment that produces taxable income

- (ironically) the interest they pay the IRD for late payment of tax

In contrast, sole traders can claim business expenses for costs incurred in relation to their work. As a general rule, you can claim a tax deduction for a business expense as long as:

- the expense relates directly to earning income,

- or running your business.

Claiming expenses are a brilliant way to pay less in taxes, while spending more money on your business. Huge win-win

… just make sure you’re claiming exactly what you spend, and you won’t be done for tax fraud (yikes).

💡 Remember: if an expense is for both business and personal use, you can only claim costs for the business usage.

💡 For more information on both business and personal tax deductions, check out the IRD’s handy guide to individual expenses.

Business expenses vs. tax deductions

Hang on. What exactly is the difference between a business expense and a tax deduction again?

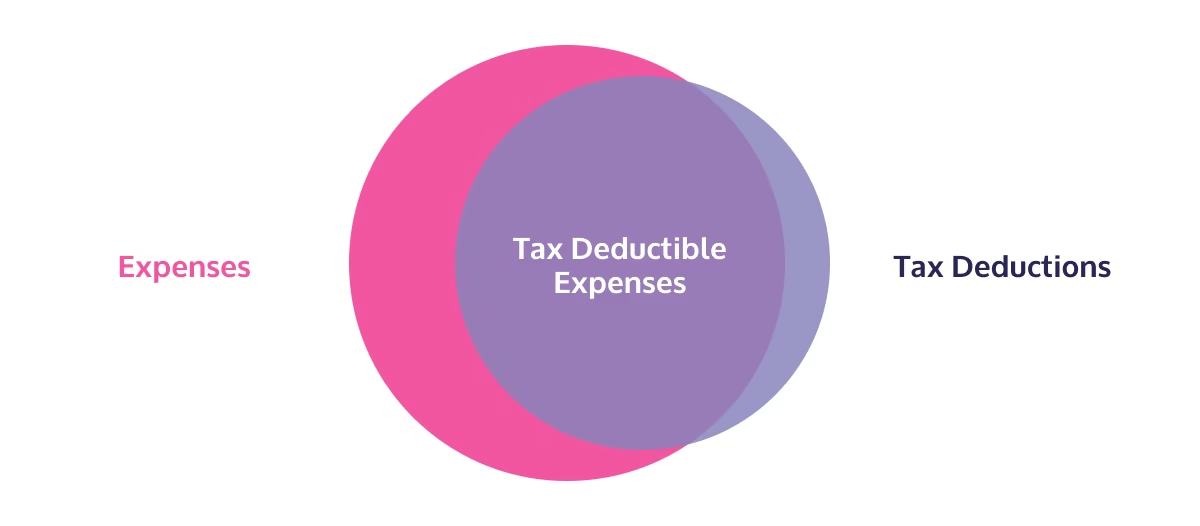

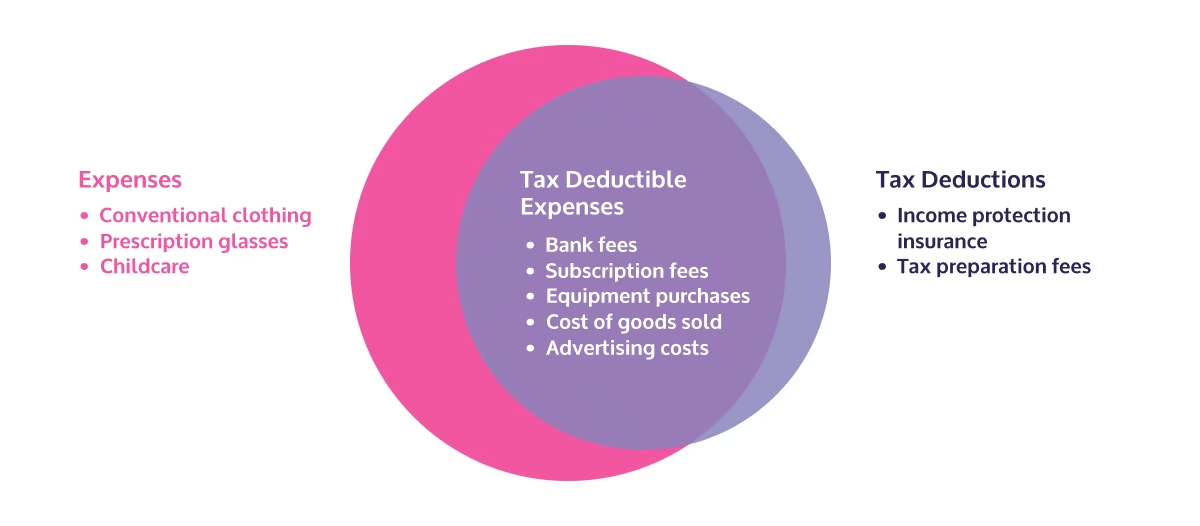

These terms are sometimes used interchangeably, but they’re definitely not the same thing. In fact, contrary to popular belief, not all tax deductions are business expenses, and not all expenses are tax deductible. The more you know!

Simple! Yet confusing. We hear you. Let’s dive in.

Business expenses

Business expenses are the costs you incur as part of running your business day-to-day. Basically, if you need something to help you get the job done, that purchase will be a business expense.

BUT the IRD won’t automatically accept every expense as a tax deduction. As we’ve already talked about, they have strict criteria for what is and isn’t tax deductible.

A good example is work clothes. The IRD only allows deductions for mandated uniforms, clothing with logos, and health and safety equipment. Even if you only use certain clothes for work, if they could feasibly be worn outside of work, you’re out of luck.

Sameer is a baker, specialising in complex cake art. Because his creations are usually quite delicate, he often cuts and serves his cakes at events as part of the service.

He recently purchased new black dress pants and a crisp white shirt to wear for these events, and only uses these clothes while working. But because he could reasonably wear this outfit to a personal event, it is not tax deductible according to the IRD.

Tax deductions

We’ve already covered what tax deductions are and how they work. But did you know that you can claim tax deductions for things other than business expenses?

The most common example for PAYE employees (who don’t run a business) is income protection insurance. If the payout you’d receive from your insurance policy is subject to income tax, you can actually claim the cost of the insurance as a tax deduction – even if you’re not a sole trader or business owner. The more you know!

With all this in mind, let’s update that snazzy venn diagram:

💡 You can use Hnry’s Allocation feature to donate a percent of every pay to your favourite charity. For more information, check out this article written by our partners at Supergenerous on charitable giving and tax deductions.

Examples of deductible expenses

Industry-specific deductions

The IRD’s guidelines are actually just a starting point – claimable expenses differ between industries and contexts. For example:

- A judge could claim the cost of judicial robes – but a tradie couldn’t

- A tradie could claim a hard hat they need to keep them safe – but not a judge

Because of this, you can’t automatically claim everything your friends and family claim – their deductions might not be applicable to your industry.

Partially-deductible expenses

Some business expenses are also only partially tax deductible. For example, you can only claim a deduction for:

- The business use of a work vehicle, not the personal

- The percentage of your internet bill you used for business purposes while working from home

- 50% of certain entertainment expenses

💡 You need to be able to prove that an eligible expense was partly or solely for business use. Otherwise, it might not fly with the IRD.

If in doubt about an expense, you should run it by your accountant or tax agent (or the friendly Hnry team!).

Depreciating Assets

Finally, there are depreciating assets, which are claimed a little differently.

A depreciating asset is an asset worth more than $1,000 that declines in value over time as it’s used. This might include cars, tools, computers, even smartphones! With these assets, you’re not actually claiming the cost of the asset itself, you’re claiming the expected amount it drops in resale value each year – the depreciation.

💡 Remember, like with all expenses, you can only claim depreciation for the business use of an asset.

If you purchase a depreciating asset, there are two main ways you can claim this as a tax deduction:

- Straight line method

- With this method, you can claim the same amount each year. It’s calculated as a percentage of the original cost of the asset.

- Diminishing value method

- With this method, depreciation is calculated each year using a constant percentage relative to the current value of the asset. It’s more reflective of the actual value of the asset, and means you’ll claim more up front but less in later years.

Both methods will have rates and timelines set by the IRD. You can make sure you’re calculating depreciation accurately using their depreciation calculator.

💡 For more information about assets, depreciation, and be pros and cons of both depreciation methods, check out our in-depth guide to depreciation.

🙋♀️ Did we mention Hnry sorts depreciation for you? Simply raise the asset like a regular expense, and we’ll automatically claim the depreciation for you. See how it works.

If you sell an asset partway through its depreciation, stop using it for business purposes, or even stop being a sole trader altogether, there will be tax and GST implications. Be sure to let your accountant (eg. Hnry!) know as soon as anything changes.

Keeping records for the IRD

There’s nothing worse than putting hours of blood, sweat, and tears into your financial admin, only to realise at the end of the financial year that you’ve lost the receipts!

Keeping clear, organised records of purchases and goods/products sold will help make tax time as stress-free as possible. It’s also good practice; the IRD requires you to save a record of your expenses (receipts) for seven years after purchase, either physically or digitally.

Imagine seven years of receipts strewn across your office floor, and you can see why a good filing system is super important!

That’s where Hnry comes in. You can raise expenses in our app, and we’ll manage them for you. We calculate your tax savings from expenses as you go, giving you immediate tax relief. Plus, we store your receipt photos for you for the required seven years – no shoebox required, ever again!

For bonus points, you could also use the Hnry Debit Card. Every time you use it to make a purchase, it automatically raises an expense in the Hnry app, so nothing slips through the cracks. From there, all you need to do is upload a pic of your receipt, confirm a few details, and you’re done. Expenses sorted!

10 most common business expenses (as raised by Hnry users!)

Now we get to the fun stuff! Here are the top 10 most-raised expenses for our users in the last financial year:

- Motor vehicle expenses

You can claim all vehicle costs as business expenses. If a vehicle is for both business and personal use (say it with us now), you can only claim the business percentage of the costs. - Equipment purchases

Any equipment purchased that you need in order to do your job e.g. mobile phones, software, camera equipment, tools. And again, if the equipment is for both business and personal use, you can only claim the business portion of the cost (but remember if the equipment is over $1,000 it needs to be depreciated!) - Cost of Goods Sold

Any costs incurred in order to create/produce your products/services are entirely tax deductible. Whoo! - Subscription fees

Any recurring subscription costs for business-related products e.g. recurring software costs, online magazines, newspaper magazine subscriptions, licensing fees. - Mobile phone bill

Remember, if the phone is for both business and personal use, you can only claim the percentage of the bill that was for business use. - Light, power, and heating

If you work from home, you can claim the business percentage of your light, power, and heating bills. Calculate the percentage by figuring out the percentage of your home dedicated to your home office. - Rent (home office)

Just like with light, power, and heating, the deductible portion of your rent depends on the size of your home office. - Internet and landline

As with your mobile phone bill, you can only claim for the cost of business use of your internet. You also can’t claim a deduction for installation or set-up costs. - Depreciation

As already mentioned, any business asset purchased for over $1000 must be depreciated. If it’s for both business and personal use, you can only claim the business use. - Entertainment

You may be eligible to claim 50% of certain entertainment expenses, if you meet IRD’s requirements.

How Hnry makes claiming expenses easier

We may be biased, but we believe that the best way for sole traders to maximise their tax deductions (legally) is to use Hnry.

Hnry is an award-winning service that’s helping sole traders spend less time on financial admin, and more time doing what they love (unless what they love is financial admin). For just 1% + GST of your sole trader income, capped at $1,500 +GST a year, we calculate, deduct, and pay all your taxes, levies, and whatnot for you, including:

… meaning you won’t have to think about any of that. Ever. We’ll even file your annual tax return for you, at no additional cost.

Raising expenses through our app is as simple as taking a photo of your receipt and inputting a few extra details. From there, our accountants will manage and claim your expenses, so you get the tax relief back in your pocket in real time (rather than having to wait until the end of the financial year). Easy as!

Get your tax ducks (and deductions) in a row by joining Hnry today!