DISCLAIMER: The information on this page is intended to be general in nature and is not personal financial product advice. It does not take into account your objectives, financial situation, or needs.

If you’re a sole trader running your own business, there’s a good chance contributing to KiwiSaver is sitting at the bottom of your to-do list.

That’s probably because you’re wearing all the hats and doing all the things. You’re too busy managing your business (and life!) day-to-day to think about the faraway future you. But what’s going to happen when you actually retire?

For starters, unlike employees, there’s often no real mechanism that keeps sole traders investing in their KiwiSaver – it’s a self-motivated thing. We all know that saving for retirement is important. Whether or not we do something about it is the real question!

There are some real reasons for getting started as soon as possible, and putting it off can cost you a lot of money in the long run. When the money you’ve invested generates investment returns, those returns are then reinvested again as part of your original investment, and generate returns of their own, which are then reinvested etc. Putting in a wee bit of effort today can pay huge dividends (potentially literally) down the line!

But how do you get started? How much should you be putting away? How do you balance saving for retirement – which may be a long way away – with investing and growing your business right now?

What excellent questions. You’re a sharp cookie. Let’s go!

- What is KiwiSaver?

- Why KiwiSaver rather than another savings scheme?

- What can you use KiwiSaver for?

- How to set up KiwiSaver as a sole trader

- Tl;dr: 5 top KiwiSaver tips

- Automate your KiwiSaver with Hnry

What is KiwiSaver?

Let’s start at the very beginning. (A very good place to start).

In New Zealand, the age of retirement is 65. This doesn’t mean that everyone hands in their resignation letter on their 65th birthday; rather, it’s the age where superannuation and other pension payments begin.

NZ superannuation (super) is a universal weekly payment for all New Zealand citizens and residents aged 65 and up. You can start your super application when you’re 12 weeks out from your 65th birthday, and it’ll kick once you hit the 65 milestone. And unlike other government benefits, it’s yours whether you’re a pauper or a gazillionaire.

How much super you will receive depends on your situation – but even those who qualify for the highest super payments may struggle to live on it for the rest of their lives. That’s why in 2007, the NZ government of the day introduced KiwiSaver, as a supplementary, voluntary, work-based retirement savings scheme.

KiwiSaver was designed to encourage people to commit to a long-term savings plan, meaning they’d be more financially independent by the time their retirement rolled around. Whenever someone joins the workforce past the age of 18, they are automatically enrolled in the KiwiSaver scheme, and have to opt out if they don’t want to participate. (Sole traders have to opt themselves in as they don’t have an employer to do it for them – we’ll get to it in just a sec).

Believe it or not, KiwiSaver was the first of its kind globally – no other country (other than the UK, who started after us) has an auto-enrolment savings scheme like we do. It’s a fantastic system to help people prepare for retirement in the easiest way possible, and is one of the best ways to save.

Why KiwiSaver over another savings scheme?

You could always stash your savings in a low-interest bank account, under your pillow, or in a hole your dog dug in the backyard. But sooner or later, inflation may mean that your money is worth less than it once was. What’s worth $50,000 today may be worth only $30,000 a few decades from now.

📖 Struggling with inflation in the here and now? We wrote an article on how to cope with inflation as a sole trader.

That’s what gives KiwiSaver the edge here – it’s actually an investment scheme. You pick a provider, and they’ll manage your money and invest your funds on your behalf, hopefully netting you massive gains in the process. These gains will then be invested along with the capital, which compounds your returns. Depending on the market, your money could grow exponentially, hopefully faster than inflation eats into its value.

But why KiwiSaver over another managed fund, say? Well, that’s entirely up to you, but there are a few benefits to using KiwiSaver that other investment options don’t have:

1. Government contributions

For every $1 you contribute to your own fund, the government will contribute an additional $0.25, up to a maximum of $260.72 annually. Yes, even if you’re self-employed. This is the closest thing to free money we can think of.

💡 The government contribution used to be $0.50, up to a maximum of $521.43. We have thoughts on this – especially around what it means for sole traders.

To receive the maximum contribution, you’ll need to make sure you contribute at least $1,042.86 to your KiwiSaver fund in the 12 months before the cutoff date of June 30th each year.

$260.72 isn’t very much, but remember, this is an annual thing. Stay in KiwiSaver for the next twenty years, and you’ll have amassed a cool $5,214.4 in free KiwiSaver funds (not to mention the compound interest it may generate). It’s a nice way to boost your balance!

2. Employer contributions

This one’s not as relevant for sole traders, but it’s still useful to know about in case you ever go down the employment route. As long as an employee is contributing at least 3% of their earnings to their KiwiSaver account, employers have to contribute an additional 3% on top of their salary. It’s basically like a 3% pay raise, only you get to unlock it all once you retire.

Heads up though – the government plans on increasing this rate to 3.5% from 1 April 2026, and 4% from 1 April 2028. If implemented, a temporary reduction will be available in cases of hardship. But so long as you are contributing an equal amount (eg. 4% in order to receive 4%), you’ll be eligible for the maximum employer contribution.

| KiwiSaver employer contribution rate | Start date |

|---|---|

| 3% | Current |

| 3.5% | 1 April 2026 |

| 4% | 1 April 2028 |

3. It’s (mostly) locked away until you retire

If you’re that person who swears they won’t touch their savings, only to dip in to buy that brand-new mountain bike you’ve been dying to have (we see you), this is a huge draw. Other than two specific exceptions (more in a mo), your KiwiSaver is pretty much inaccessible until you turn 65. You can’t be tempted to use it to fund your cycling addiction.

4. It can be a lower-cost managed fund

Depending on your provider and their fees, KiwiSaver schemes are generally cheaper than investing in other kinds of managed funds. Most KiwiSaver funds are also Portfolio Investment Entity (PIE) funds, which have a maximum tax rate of 28% – meaning if you’re earning in the top tax bracket, you save!

What can you use KiwiSaver for?

Your KiwiSaver funds are typically earmarked for your golden years – but there are two very specific exceptions.

- You can use your KiwiSaver as a deposit for your first home.

- You will need to leave $1,000 in your account to continue accruing interest, so make sure to factor this into your calculations!

- If you fall into serious financial hardship, you can access your KiwiSaver funds to help you get back on your feet.

- For more information, visit the IRD website.

Other than in these two circumstances, your money will be locked away until you turn 65.

KiwiSaver for sole traders

Getting the most out of your KiwiSaver account is a bit different when you’re a sole trader.

For starters, unless you were a PAYE employee at some point in the past, you’re not automatically enrolled in KiwiSaver. You’re also entirely responsible for contributing to your own KiwiSaver fund, as you don’t have an employer doing it on your behalf!

The good news is that getting your KiwiSaver up and running doesn’t have to be a time-intensive thing. Take an hour or two out of your week at some point to set it up, and you’re done. Retirement ready.

Well, other than the obligatory British game show addiction and the biscuit tin full of sewing supplies.

Step 1: Choose your KiwiSaver provider and fund

Depending on your needs, this might be the trickiest part of your KiwiSaver journey.

There are many different independent KiwiSaver providers, all offering different funds with different benefits. You may have to dig a little to find the fund that’s right for you.

Three things to keep in mind while doing your research:

1. The provider’s values

Different KiwiSaver providers value different things. While some are definitely all about monetary growth, others aim for high returns while focusing on ethical investments.

If you have causes close to your heart, and the time to put in the research, picking the right KiwiSaver provider is a great way to put your money where your mouth is. Sorted have a fantastic KiwiSaver quiz that will help you narrow down the options.

📖 For more information on ethical KiwiSaver funds, check out this article from MoneyHub.

📖 You can also find a full list of KiwiSaver providers on the IRD website.

2. The risk profile of available funds

Once you’ve decided on the right provider, it’s time to pick the right fund.

KiwiSaver funds are composed of a mixture of stocks and bonds from a range of different companies and entities. When you invest money in a fund, your money is spread out between them all, instead of just one.

Spreading money out like this is called diversifying, and it’s a good way to make sure you don’t lose everything all at once. If one of the stocks you invested in were to lose all its value, you’ll still have the money invested in other assets.

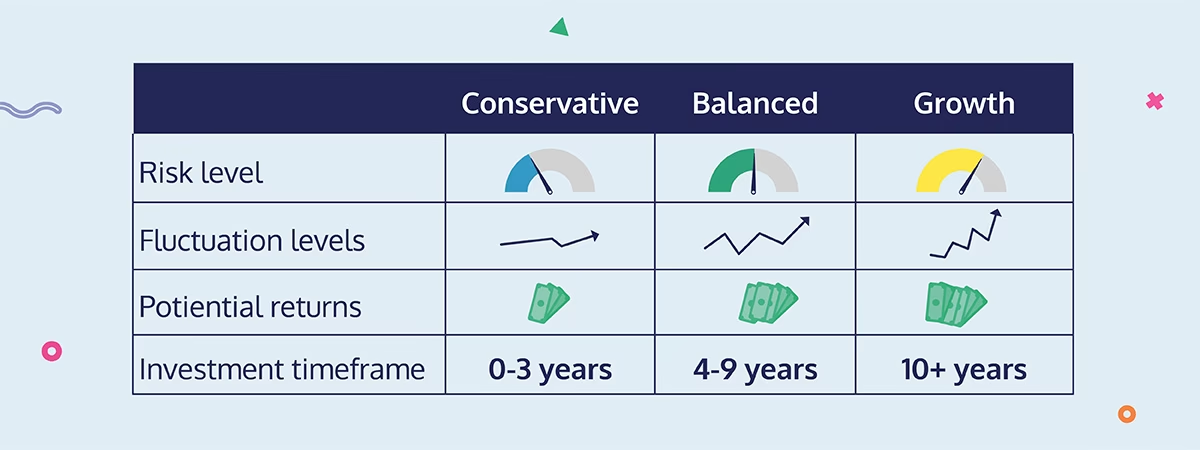

KiwiSaver funds contain a mixture of high and low-risk investments. The mix of high and low risk investments in a single fund determines its overall risk profile. Basically, the lower the risk, the lower the return. But the higher the risk, the higher the potential reward.

You’ll need to choose the level of risk and reward that’s right for you.

- If you expect to withdraw your savings within the next 3 years, a conservative fund could ensure you don’t lose money if the markets fall.

- If you are looking to withdraw in between 4-9 years, you might look at a more balanced fund.

- If your withdrawal is 10+ years away, investing in a growth fund over that timeframe could give you the best chance for the biggest returns.

You should also take into account your own appetite for risk. If you hate the idea of huge losses, a growth fund might not be right for you – even if you have 20+ years to save for retirement.

3. Management and fees

Some funds are actively managed, meaning there’s someone in charge of buying and selling stocks as the market fluctuates.

Other funds are passively managed – investments have been picked, and they’re unlikely to change, even if the market changes.

Generally, the more actively managed a fund is, the more fees there will be. Make sure you know exactly what you’re signing up for from the outset, so you don’t end up paying more than you’re comfortable with.

Step 2: Decide how much to contribute

Now the hard part’s over, the fun begins!

You are the captain of your own ship, the SS Retirement, meaning you call the shots of when, and how much you contribute.

How much will you need?

Having a goal may help make saving for retirement feel more real. If you know what you’re aiming for, you’re less likely to put it off!

Sorted.org.nz has a fantastic KiwiSaver calculator that can show you the trajectory you’re currently on, and what happens if you were to contribute more or less. Have a play with the numbers, until you get to a savings amount that feels right for you.

How much can you afford?

How much you’d like to save is one thing, how much you can realistically afford to save is entirely different!

Take stock of your current financial situation. How much are you currently saving? Can any of that go into your KiwiSaver account?

We know finances can be tight for many sole traders. But anything you can set aside now could save you a financial crisis down the line.

Make contributions automatic

Once you’ve decided on how much you can afford to set aside, it’s time to make those contributions automatic.

One of the biggest draws of KiwiSaver for PAYE employees (other than the whole being automatic enrolled thing, of course) is that their contributions are taken out of their paycheck before they’ve ever had time to see it. They don’t feel like they’re missing anything, because it never came through to begin with.

If you’re paid regularly, you can mimic this system by setting up a weekly or monthly automatic payment into your KiwiSaver. If it’s automatic, you’re less likely to notice or feel it.

If you earn sporadically, you might decide it’ll be easier to save a percentage of each pay instead. The easiest way to do this is through a Hnry Allocation. Decide how much you want to contribute, set up an automatic allocation in our app, and you’re done!

Step 3: Check in every so often

The last thing you might want to do is review your KiwiSaver fund when you need to. Maybe life has changed, and you have a bit more to set aside – you absolutely should!

Be prepared to see fluctuations in the value of your fund, especially if you’re investing in a growth fund. More often than not, this isn’t something to worry about – as the saying goes, time in the market is more important than timing the market. Over time, your money should grow.

Remember though, you’re not locked in to your provider or your fund – you can switch at any point. If your circumstances change, you can change your KiwiSaver scheme to fit your needs.

Tl;dr: 5 top KiwiSaver tips

- Sign up for KiwiSaver

- When it comes to signing up for KiwiSaver, it’s less a question of “why?”, and more a question of “why not?”

- Contribute regularly

- Not contributing regularly means missing out on the magic of compound interest, as well as the government contribution!

- Factor in the “motherhood” penalty

- When people take a break in earning, for whatever reason, they (and their employer) often stop contributing to their KiwiSaver account. This has become an especially big problem for women who take maternity leave – the “motherhood” penalty in New Zealand has been found to result in up to $318k less in retirement savings.

- If you or your partner takes parental leave, it’s worth having a discussion about the best way to continue contributing to both KiwiSaver accounts.

- Choose the right fund for your needs

- If you need to access your funds in the next few years, being in the wrong fund could make a huge difference to your final balance!

- Stay on top of your KiwiSaver fees

- Remember to read the T&Cs before you sign up!

Automate your KiwiSaver with Hnry

Being a sole trader is hard enough, without having to actively contribute to your own retirement fund. That’s why we’ve made saving simple with our Allocations feature.

Set up an allocation to your KiwiSaver account, and we’ll automatically squirrel away a percentage of your earnings for you every time you get paid. Whatever you receive in your personal bank account is yours to spend – you won’t even have to think about it!

Alongside your automatic KiwiSaver allocation, we’ll also:

- Calculate, deduct, and pay ALL your taxes, including your GST and ACC levies, every time you get paid

- File your tax and GST returns whenever they’re due

- Manage and claim your business expenses

- Chase up late-paying clients (politely!)

- … and more!

For just 1% of your self-employed income, Hnry will make it so you never have to think about taxes, levies, and saving for retirement again. Join Hnry today!