If you’ve been self-employed for a while now, you’re probably more than aware that sole traders are fully responsible for preparing, paying, and filing their own taxes. Unfortunately, it’s all part and puzzle of running your own business.

Even so, setting aside the right amount of tax can be complicated. If you’re off in your calculations, or accidentally overlook something, you could be hit with a pretty hefty bill at the end of the financial year.

So to help you accurately plan ahead, we’ve put together a quick explainer to take you through the different taxes you may owe, how they’re calculated, ways to reduce your tax bill, and how to get it right every time.

Let’s get started!

- Overview

- Income tax

- The Independent Earner Tax Credit

- ACC levies

- GST

- Student loan repayments

- KiwiSaver contributions

- How Hnry sorts it all

An overview of sole trader taxes

There are three kinds of taxes and levies that sole traders need to be aware of:

As well as these main three, you might also need to factor in:

How much you’ll eventually owe depends on your individual circumstances. For example, you may be eligible for the Independent Earner Tax Credit, which could reduce your final tax bill. You can also lower your taxable income by claiming business expenses – but more on both of these in a bit.

Because of all this, preparing your taxes isn’t as straightforward as setting aside a set percentage of your income every time you get paid. Instead, you’ll need to understand which rules apply to you, so you can prepare accordingly and avoid expensive surprises.

Income tax

Aotearoa operates using a progressive tax system, meaning that you don’t pay a set percentage of income tax across all your income. Instead, your income will be split across several bands, each with its own tax rate.

Income tax rates for FY 2025/26

| Previous threshold | New threshold | Tax rate |

|---|---|---|

| <$14,000 | <$15,600 | 10.5% |

| $14,001 - $48,000 | $15,601 - $53,500 | 17.5% |

| $48,001 - $70,000 | $53,501 - $78,100 | 30% |

| $70,001 - $180,000 | $78,101 - $180,000 | 33% |

| $180,001 and over | $180,001 and over | 39% |

💡 Note: for FY 2024/25, we’re using a temporary system of mashed-up rates because the thresholds changed mid financial year. We explain all this and more in our guide to the tax threshold changes.

Calculating progressive tax rates

Let’s say that you earn $30k as a part-time employee, and $50k as a sole trader. Your taxable income is the sum total of all income – so in this case, $80k.

Even though $80k falls into the 33% tax rate band, you won’t owe 33% across your entire income. Instead, you calculate your income tax by applying the bands progressively:

| Income band | $80k income in band | Tax Rate % | = Tax Owed |

|---|---|---|---|

| $0 - $15,600 | $15,600 | 10.5% | = $1,638 |

| $15,601 to $53,500 | $37,900 | 17.5% | = $6,632.50 |

| $53,501 to $78,100 | $24,600 | 30% | = $7,380 |

| $78,101 to $180,000 | $1,900 | 33% | = $627 |

| $180,001 and over | $0 | 39% | = $0 |

Total income tax bill: $16,277.50.

Only $1,900 of an $80k income is actually taxed at 33%!

You’ll also need to remember that your employer will be deducting and paying tax on your behalf. Through your PAYE income, you should have already paid around $4,157.50 in income tax.

All you’re directly responsible for paying is your self-employed income tax – in this case, the remaining $12,120. Phew!

The Independent Earner Tax Credit

If you earn between $24,000 and $70,000 a year, you may be eligible for the Independent Earner Tax Credit (IETC).

The IETC is just that – a tax credit for independent earners. Meaning, a tax credit for anyone who earns an income independent of certain benefits and allowances, not just people who earn on their own (eg. sole traders).

(We know, we were disappointed to find out there isn’t a sole-trader-specific tax credit too.)

You can’t get the IETC if:

- you or your partner are entitled to Working for Families Tax Credits

- you receive an income-tested benefit

- you receive New Zealand Superannuation

- you receive a Veteran’s Pension

- you receive an overseas equivalent of any of the above.

If are are eligible for the IETC, you’ll receive:

- $10 a week if your income is between $24k-$66k

- $10 minus $0.13 for every dollar you earn over $66,001, up to the maximum of $70k.

The most you’ll receive towards your tax bill in a single year is $520. Every little helps!

🙋 If you’re eligible for the IETC and you use Hnry, we’ll automatically include the IETC in our tax calculations.

ACC Levies

The Accident Compensation Corporation (bet you didn’t know their full name!) collects levies from all working people in Aotearoa.

For regular employees, they’re only subject to a single levy – the Earner’s levy – while corporations pay the Work levy and Working Safer levy. Unfortunately, because sole traders are their business, they’re required to pay all three.

Each levy is calculated slightly differently, with rates updated every April. As of April 2025:

- the Earner’s levy is a flat rate of $1.67 per $100 of your liable income

- this helps fund cover for injuries that happen during everyday, non-work activities

- the Working Safer levy is a flat rate of $0.08 per $100 of your liable income

- this helps fund Worksafe NZ, New Zealand’s primary workplace health and safety regulator

- the Work levy is based on the industry you operate in

- this helps funds cover for injuries that happen at work

- the riskier your line of work, the higher this levy will be

💡 To calculate the Work levy, you’ll need to find your Classification Unit, and then look up the corresponding levy rate in ACC’s levy guidebook. See our ACC guide for more info.

To make things slightly more complicated, ACC levies are calculated using your liable income – that is income between the minimum and maximum thresholds as set by the ACC. These tend to change every financial year, so it’s something you’ll need to stay on top of.

The good news is that having a maximum threshold for liable income means that the Earner’s levy is essentially capped – it should never be more than $2,277.

📖 For more information on the three levies and how they’ve calculated, check out our sole trader guide to the ACC.

GST

GST, short for “Goods and Services Tax”, is a flat-rate consumption tax levied at 15% on most goods and services sold in NZ.

If you make $60,000 or more in any 12-month period, you’re required to register for and charge GST. Luckily, this is fairly straightforward. You simply collect an additional GST charge of 15% from your clients, on top of your regular prices/fees – you generally don’t need to pay this out of pocket!

Lalita bakes and sells cakes as a side hustle. On average, she charges $200 per cake.

After five years in business, she expands her business, quits her day job, and runs her bakery full time. It doesn't take long before she's set to make $60,000 in a single 12-month period, thereby hitting the GST threshold.

Lalita registers for GST, and updates her prices accordingly. $200 per cake +15% means she now charges $230 for a cake.

You can calculate the cost of your services +GST using our GST calculator.

If you’re GST registered, you’ll need to complete and submit a GST return at regular intervals. The good news is that if you happen to pay more GST than you collect in a GST period, you may be eligible for a refund for the difference.

📖 Want learn more about GST and how it works? Check out our monster guide to GST, written specifically for sole traders!

Student Loan

It’s not a tax, but if you have an outstanding student loan, it is something you’ll need to make payments on to the IRD.

Luckily it’s a straightforward calculation – student loan repayments are $0.12, or 12% of every $1 you earn over the repayment threshold. This threshold is subject to change each financial year – for FY 2025/26, it’s set at $24,128.

It’s important to remember that your loan is interest free, so long as you remain in Aotearoa. If you head overseas, you’re in charge of calculating and sorting your compulsory repayments, the amount of which will depend on the outstanding balance of your loan. It’ll also become subject to interest.

📖 For more information on paying back your student loan as a sole trader, check out our guide to student loans repayments.

KiwiSaver Contributions

Finally, it’s definitely not a tax, but while we’re talking about things you need to set money aside for, you may want to consider contributing to your KiwiSaver fund.

One huge benefit of putting money towards your KiwiSaver is the government co-contribution – for every $1 you contribute, the government will top up your fund by $0.25, up to a maximum of $260.72 each year.

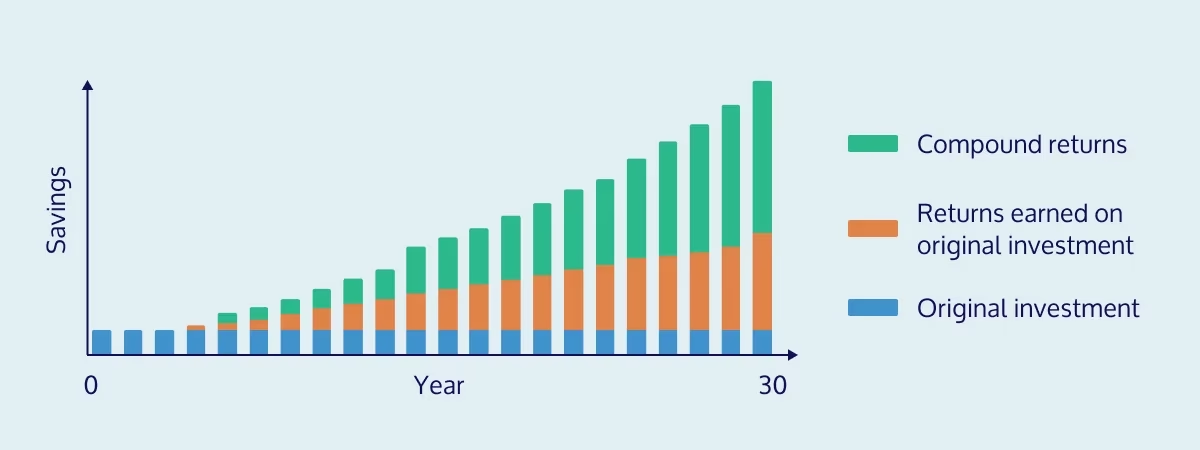

Another real benefit is the magic of compounding returns. Basically, when you invest in a KiwiSaver fund, you’ll ideally earn returns on the money you invest (there are no guarantees!). The returns are then added to the capital to be reinvested, allowing both to generate further returns.

In theory, the more you invest now, the longer your fund has to earn compounding returns, resulting in hopefully a bigger KiwiSaver balance down the track. Taking a break from investing in your KiwiSaver fund could mean a difference of hundreds of thousands of dollars, when it comes time to retire.

Geoffrey and Luiz started their family in their early 30s. They decided that Geoffrey would take a break from work for five years to stay at home with their children, while Luiz continued his lucrative career as an IT contractor.

During this five year period, Luiz continued to contribute 6% of his earnings to his KiwiSaver, while Geoffrey wasn’t directly earning an income and therefore made no contributions (although being a stay-at-home parent is the real hard mahi!). When Geoffrey joined the workforce again, he resumed his KiwiSaver contributions.

When Geoffrey and Luiz hit retirement age, they were surprised to discover that Luiz had $300,000 more in his KiwiSaver fund than Geoffrey, due to Geoffrey’s break in contributions.

They solve the issue by pooling their KiwiSaver funds so they’re both equally supported.

How Hnry Helps

Hnry is an award-winning app and tax service designed to help sole traders with their financial admin. For just 1% +GST of your self-employed income, capped at $1,500 +GST a year, Hnry will calculate and pay all your taxes, levies and whatnot for you, including:

We also complete and file your tax return for you, including claiming any tax relief you might be entitled to. It’s all part of the service!

More importantly, we free up thousands of hours for sole traders to focus more on what they do best – their jobs. Hnry is on a mission to make being a sole trader simple, affordable, and accessible for anyone.

Share on: