Note: As advocates for sole traders, Hnry does have a bias when it comes to whether or not we should raise the GST threshold. For more information, see this RNZ news article.

As a diligent, responsible, and good looking sole trader, you’ve probably heard about the GST threshold, even if you haven’t hit it yet.

But what you may be missing is the background context – for example, why we have a GST threshold in the first place, what the threshold means for the economy at large, and how it impacts sole trader businesses both negatively and positively. Turns out, there’s more to it than just reaching a certain amount of income, and immediately charging GST.

Understanding the thinking behind GST rules can help you make better decisions for your business. That’s why we’ve put together this bumper explainer on all things GST threshold. Strap in gang, it’s going to get nerdy.

- What is GST?

- What is the GST threshold?

- How GST works for sole traders

- The GST threshold and the economy

- GST in other countries

- How Hnry helps

What is GST?

The Goods and Services tax, commonly known as GST, is a 15% flat rate consumption tax levied on most goods and services in Aotearoa.

Ok, now let’s lose the jargon and break that down.

GST is a consumption tax, meaning that it’s levied on things we consume (as in use up, rather than literally eat). It’s charged at a flat rate, meaning that in general the percentage it’s charged at doesn’t change, no matter who is selling or purchasing the goods (unless the sale is zero rated). Unlike our progressive income tax system, everyone pays GST at the same rate.

Everyone charges GST at the same rate as well. GST is an extra 15% of the original price added to the final total. Essentially, if you’re GST registered, you’ll need to start charging 15% extra on behalf of the government.

But, not everyone who sells goods and services actually needs to register for GST. That’s where old mate the GST threshold comes in.

What is the GST threshold?

So glad you asked! It’s currently $60,000.

Oh, you mean what it actually is? The GST threshold is the level of income at which a business is required to register for and start charging GST. At this point in time, that threshold is $60k – as soon as you expect to make $60k in any 12-month period, you’re required to be GST registered.

This hasn’t always been the case, however.

History of the GST threshold

GST as a system was first introduced in 1986, as an extra revenue stream for the then government. At this point in time, the GST threshold was set at $24,000 – somewhere around $75k in today’s dollars.

As time went on, inflation essentially lowered the threshold in real terms, meaning that the threshold had to be adjusted regularly. The last of these adjustments was in 2009, when it went from $40,000 to $60,000 – about $86k in today’s dollars.

Since then, we’ve had 15 years of inflation effectively lowering the GST threshold even more. What this means is that sole traders and businesses are hitting the GST threshold far sooner than they might have in the past, which has onflow effects for their clients and their business.

Why the GST threshold can be difficult for sole traders

GST can be tricky to navigate for sole traders who sell directly to individuals, rather than other GST-registered businesses.

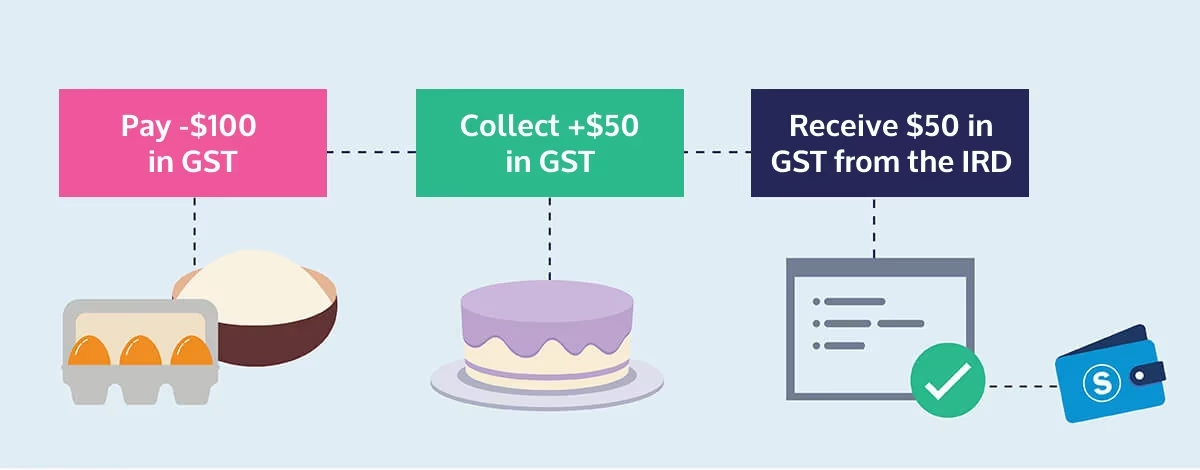

This is because GST-registered businesses can claim back any excess GST they pay on business purchases. Basically, if you pay $100 in GST through business expenses, but only collect $50 in GST through sales, you’ll be able to claim that remaining GST from the government in your GST return. Effectively, it all equals out.

But if you’re a sole trader selling directly to non-GST registered businesses or individuals, they can’t claim back the GST they’re spending on your goods/services. On their end, they’re essentially paying an extra 15% for the same products.

Consumers do understand that GST is just one of those things that we all have to pay - all the big retailers are required to charge it, so most of us end up paying GST almost daily. But for sole traders in competitive industries, adding GST to their prices may not be feasible from a business perspective. Customers may decide they can no longer afford their prices, or that they could get better value for money elsewhere. Not to mention the current cost-of-living situation, which means people are spending less than usual.

In fact, research shows that a mind-blowing 36% of all Kiwi sole traders deliberately earn less than they could earn so they can stay below the $60k threshold and not charge GST. If they do earn that $60k and decide to pay GST out of pocket so they don’t have to raise their prices, it’s the equivalent of a 13% pay cut.

You could offset the loss by gradually raising your prices, but either way it’s not ideal. Which is why 56% of sole traders support raising the GST threshold to $75k.

Raising/lowering the GST threshold

So now we’ve established the groundwork, where to from here? Let’s talk about what it could look like if we raise or lower the GST threshold.

Raising the GST threshold

Firstly, GST is a pretty significant source of income for the New Zealand government. In 2022, GST revenue was a cool $24.7 billion, making up around 25% of Aotearoa’s tax revenue (!).

Raising the GST threshold means fewer businesses will be required to charge GST. This would likely result in less GST revenue for the government overall, which means less funding available to spend on public goods and services.

But by raising the GST threshold, sole traders and businesses would be able to earn more without having to add GST to their prices. That 36% of sole traders who deliberately earn under the threshold would no longer have to stifle their potential. Because of them and others like them, overall productivity could increase.

More immediately, raising the threshold could provide inflation relief for both businesses and consumers, who would be freed up to earn and spend more.

Lowering the GST threshold

There’s an argument that part of setting the GST threshold includes considering the cost of compliance – that is, how expensive it would be for businesses to begin charging GST as part of their operational expenses.

With all the recent advances in accounting technology, the cost of financial admin isn’t as expensive as it used to be. This could be a justification for lowering the threshold – it’s easier and cheaper than ever for businesses to charge, collect, and pay GST on behalf of the government.

But lowering the GST threshold could have significant negative impacts, especially for sole traders:

- More sole traders might decide to earn below the GST threshold to avoid registering for GST, meaning decreased productivity and smaller incomes.

- The cost of compliance should actually increase – traditional accountants tend to charge their clients extra for GST filings, making it more expensive for sole traders to charge GST overall (unless they use Hnry, of course. We automatically sort all things GST-related, and we don’t charge you extra for it).

- It’ll also take time for sole traders to get set up to be GST compliant – including changing invoices, rethinking their pricing structure, and preparing regular GST returns.

- They’d either raise their prices and charge more (hello, cost-of-living crisis), or pay their GST bill out of pocket and earn less.

From our perspective, lowering the GST threshold is not a good idea.

GST in Australia and the UK

In case you were wondering, things are done differently in other countries. Take Australia and the UK, for example, who have similar tax systems to the one here in Aotearoa.

In Australia, for example, GST is charged at a flat rate of 10% – less of a jump for sole trader pricing. Their threshold is also set at $75,000 – about $81k NZD – so sole traders can earn significantly more before they have to start charging GST.

In the UK, their GST equivalent is called VAT (Value Added Tax). Their VAT rate is 20%, with a reduced rate of 5% for things like car seats and home energy, and a 0% rate for most food and childrens clothes. While 20% might sound like a lot, their VAT threshold is £90,000 – around 192k NZD.

It’s not always useful to compare – the situation in both these countries is different to the context here at home. But it certainly is food for thought!

How Hnry helps

Hnry an award-winning accounting service specifically designed for sole traders. For just 1% + GST of your self-employed income, capped at $1,500 +GST a year, Hnry will calculate and pay all your taxes, levies, and whatnot for you, including:

We’re also proud advocates for the sole trader community, who haven’t always had representation in the New Zealand economy. Our sole trader pulse is the first national research that solely (mind the pun) focuses on needs of sole traders, who have different needs to the small businesses they’re often lumped in with. Reconsidering the GST threshold is just one of the many things we’re pushing for.

Join the Hnry community, and never think about tax again.

Share on: