Let’s get straight to business: depreciation is confusing. Not just because it can involve a lot of rates and spreadsheets and maths, but also because there are two main ways to do it, and the method you pick will depend on your needs.

Firstly, there’s straight line depreciation, where you claim the same depreciation amount each year. Secondly, the diminishing value method, where you claim less each year as the value of your asset, well, diminishes. On top of this, you’re also only allowed to claim the business usage of your asset, which is an added layer of calculation complication.

But don’t worry – we’ll walk you through it all. Here is everything you need to know about assets, depreciation, and claiming depreciation as a sole trader.

- What are assets?

- What is depreciation?

- Why depreciate assets?

- How to calculate asset depreciation

- Ditch the maths. Use Hnry.

What are assets?

Firstly, the basics.

In financial accounting, a capital asset is a resource owned or controlled by a business that should provide future benefits. This includes physical things like laptops, vehicles, furniture, and the coffee machine that fuels you through mind-numbing client meetings. But it also includes intangible things like intellectual property, logos, licences, and films.

Low value assets

To make things marginally simpler, the IRD allows you to claim the full value of what they term a low value asset – that is, any asset under the low value asset threshold. This threshold used to be $500, up until 16 March 2020, when it was temporarily increased to $5,000 between 17 March 2020 and 16 March 2021 (pandemic, anyone?), before being reset to $1,000 from 17 March 2021 onwards.

| Dates valid | Low value asset threshold |

|---|---|

| Up to 16 March 2020 | $500 |

| 17 March 2020 - 16 March 2021 | $5,000 |

| 17 March 2021 onwards | $1,000 |

Tl;dr: If your business asset costs less than $1,000, you can claim it in full the year it was purchased. If it costs more than $1,000, you’ll have to depreciate the asset.

💡 Like with all expenses, if your asset is purchased for both business and personal use, you can only claim the business portion of the depreciation.

📖 For more on how business expenses and tax deductions work, check out our monster guide to tax deductions.

Pooling low value assets

Now, if you want to depreciate your low value assets, you actually can – by pooling them together.

Basically, you’d create a pool of low value assets by grouping them together, allowing you to claim the depreciation on the value of the pool as a whole using the diminishing value method. You’d need to use the lowest depreciation rate for assets in the pool.

It’s important to note that you can’t then claim these low value assets separately. And once you add a low value asset to the pool, you can’t then take it out.

But why might you want to pool assets? Well, let’s start by getting to grips with what depreciation actually is.

What is depreciation?

Great question.

Depreciation is the reduction in value of an asset over its effective life, usually due to wear and tear. For example, if you buy a brand-new car for $40k and then use it for a few years before selling it, it will usually only be worth a chunk of what you originally paid for it. This drop in price is the depreciation.

Why depreciate assets?

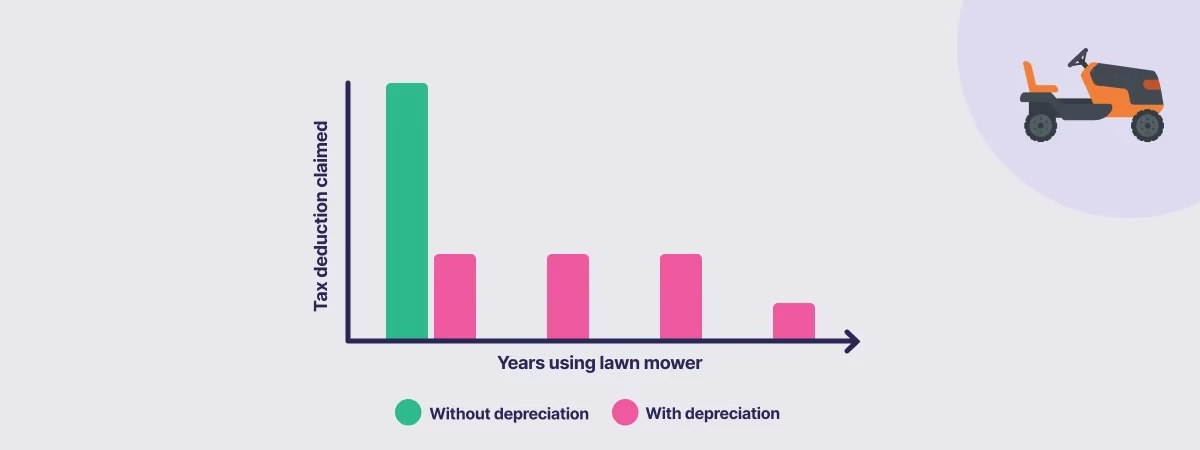

Hang on, we hear you say. If it’s possible to claim other business expenses and low value assets, why isn’t it possible to just claim the value of all business assets in full?

There are actually a few reasons depreciation is a useful tool (as much as we all hate doing the maths). From a business perspective, depreciation is mostly about accuracy.

Assets held by a business (or a sole trader!) can be quite costly to acquire. By claiming the depreciation of an asset over a series of years, you spread out the tax benefit across the asset’s working life. Doing it this way is more reflective of the way you’d use a costly asset.

Say you buy that electric ute as part of your plumbing business. You wouldn’t just use that ute for one year, and then get rid of it! Instead, you’d use it for several years – and claiming the depreciation reflects the value the ute has as part of your business.

How to calculate asset depreciation

💡 Remember, just like with business expenses, you can only claim the business usage of a capital asset.

So, you’ve decided you have to depreciate your assets. Great! To be honest, it wasn’t really your choice to begin with, but it’s good to have you on board!

Like we mentioned earlier, there are two main ways to depreciate assets: straight line depreciation, and diminishing value depreciation. But first, we’ll need to take a wee detour and talk about rates.

Depreciation rates

Unfortunately, you don’t get to decide the rate of depreciation of your assets – it’s all completely up to the IRD.

IRD depreciation rates depend on your industry, and the type of asset owned. You can use their depreciation rate finder and calculator to calculate the depreciation on your assets, using both the straight line or diminishing value methods.

You can then export the depreciation schedule – the rate and value of an asset’s depreciation over its useful life – as a spreadsheet you can keep on hand.

Alternatively, you could just use Hnry. We’ll keep a record of all your depreciating assets for you, and claim them for you when we file your tax return at the end of the financial year.

Straight line depreciation

This is the method we generally use for ourHnry customers (unless they specify otherwise). It’s really the simplest way to do it.

Claiming depreciation using the straight line method means that you claim the same percentage of the original cost in depreciation every year, until you’ve claimed the total value of the asset.

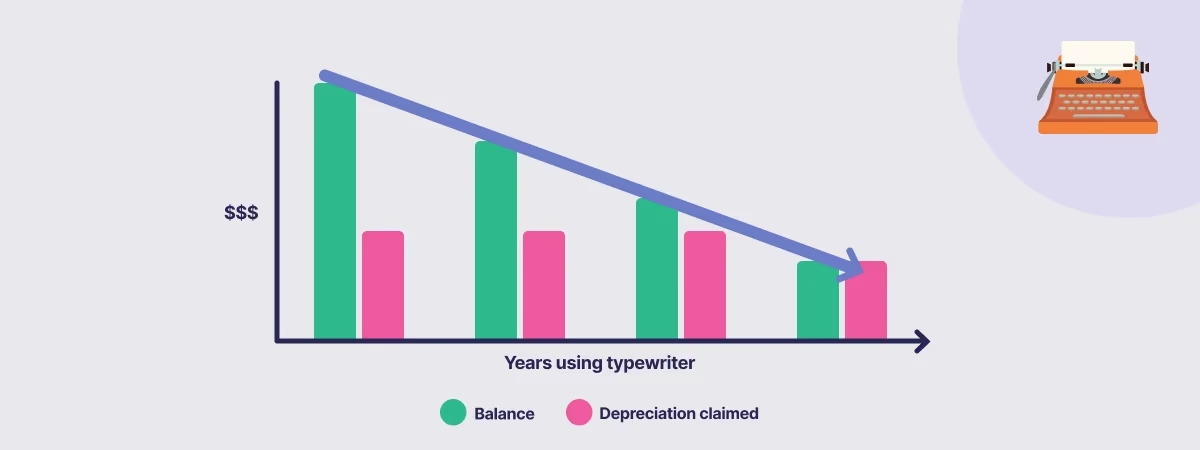

For example, if you bought a typewriter for your office for $2,000 (fancy!), and you wanted to depreciate it using the straight line method, you’d claim depreciation at the IRD-prescribed rate of 30% each year.

This means that for the first year of use, you’d claim $600, the next year you’d claim another $600, the year after you’d claim another $600, and the year after that you’d claim the outstanding $200, for a total value of $2,000 claimed over four years.

Diminishing value depreciation

The diminishing value method is more reflective of how an asset usually depreciates – that is, loses its value over time.

For example, take that old saying about a car losing half its value as soon as you drive it off the lot. While that’s not exactly true, your car usually depreciates rapidly in the first few years – then slowly taper off in value.

Put even more simply, A 10 year old car is around the same price as an 11 year old car, but the difference in cost between a brand new car and a one-year old vehicle is pretty hefty!

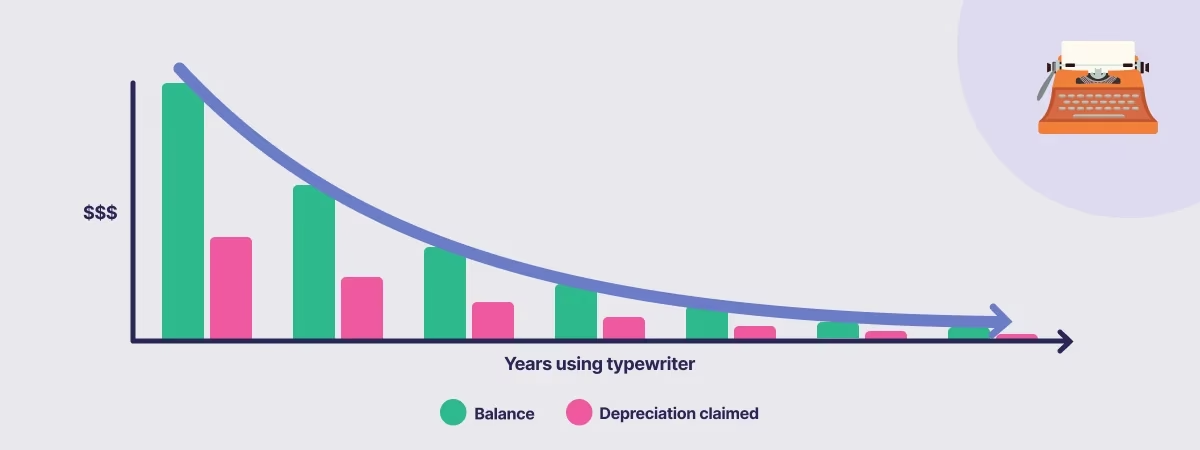

This is where the diminishing value method comes into play. Unlike the straight line method, you’ll claim the same percentage on the balance of the cost, rather than the total. Essentially, you’d claim more in depreciation for the first few years of use, tapering off as the years go on.

Going back to our typewriter example, the rate of depreciation using the diminishing value method is currently set at 40%. This means you’d claim 40% of the original $2,000 in the first year ($800), then 40% of the resulting balance next year ($480), then another 40% of the remaining balance the year after that ($288) and so on and so forth.

Ditch the maths by using Hnry

We know we just taught you how to DIY depreciation – but we still think you should just use Hnry instead.

Hnry is an award-winning service designed specifically for sole traders. For just 1% +GST of your self-employed income (capped at $1,500 +GST annually), we will become your tax agent. This means we will:

- Do all the depreciation stuff for you automatically (!!).

- Calculate, deduct, and pay your income tax, GST (if applicable), ACC levies, and student loan repayments, every time you get paid through your Hnry Account.

- File your tax return at the end of the year.

- Manage your expenses so you get your tax relief in real time.

- Chase late-paying clients (politely!), so you get paid faster

Basically, we’re an accountant in an app. And we’re on a mission to free up sole traders from the shackles of tax and financial admin. No, we’re not dramatic at all.

If this sounds good to you, join Hnry today! And you’ll never have to read another article like this one again.

Share on: