If you’re a sole trader who uses a car or other motor vehicle as part of running your business, you should absolutely be claiming motor vehicle expenses. It’s a no brainer!

Motor vehicle expenses are the most common expense type raised through the Hnry app, and we love to see it – claiming everything you’re eligible for is a great way to get tax relief.

That in mind, vehicle expenses are a bit trickier than most, just because there are a few different ways you can go about claiming them. There are two main methods for claiming expenses: Mileage (or Logbook), and Actual Costs (more on both in a sec). Each method has slightly different requirements, and the method you decide to use will depend on your usage and needs.

You can also only claim expenses for your business usage of your vehicle – unfortunately, those quick trips to the shops for groceries won’t cut it with the IRD!

With all that in mind, let’s get you in the driver’s seat, ready to claim with confidence.

What motor vehicle expenses can you claim?

Great question!

The good news is that you can claim almost all expenses related to the business use of your vehicle (although it’s slightly different depending on your claiming method).

This includes things like:

- Petrol

- Maintenance costs

- Road user charges

- Parking and toll fees

- Insurance

- WOF costs

- Depreciation

💡 It’s important to note that you can’t claim any fines, parking tickets, or towing fees you incur, even if they’re earned while you’re on the job. Sorry!

Importantly, and we can’t stress this enough, you can also only claim tax relief on expenses related to the business use of your vehicle.

Basically, if you’re using your vehicle in connection with business activities, it may qualify as business use, and you may be able to claim expenses for it.

But, there are limitations. For example, trips between your home and your place of work are classed by the IRD as personal travel, ruling out any deductions.

“Business use”

What counts as business use when it comes to claiming motor vehicle expenses?

You may be eligible to claim a tax deduction for travel expenses in your vehicle when you:

- Travel from your usual workspace to another work location (for instance, a client’s office) while working.

- Deliver goods or fetch materials

- Attend work-related conferences or gatherings outside your usual working location

- Commute between distinct job locations, especially if you have multiple roles

These trips generally count as “business use” of your vehicle, in the eyes of the IRD. Trips outside these guidelines may be considered “personal use”.

We’ll discuss how to calculate business use vs. personal use in just a minute, but first –

How to claim car and other vehicle expenses

To claim vehicle expenses, you’ll need to choose either the mileage method (aka the logbook method), or the actual costs method, depending on your vehicle type.

Once you’ve chosen a method, you’ll need to use that same method throughout the duration of your vehicle’s life – so choose wisely! The good news is that if you have more than one vehicle, you don’t have to use the same method for all of them – you can decide which method best fits each separate vehicle.

The IRD categorises vehicles by the type of fuel they use:

- Petrol

- Diesel

- Hybrid

- Electric

(We honestly aren’t sure what other types of fuels there are, but if you’re driving a spaceship filled with deuterium and antimatter like the USS Enterprise, let us know!)

How you claim vehicle expenses will depend on what your vehicle runs on:

- If your vehicle is petrol, diesel, hybrid or electric you can use either method. But please note that:

- if you’re going the mileage route, you can’t claim your vehicle’s depreciation as it’s already included in this method!

- different vehicle types are entitled to different mileage rates. Make sure you’re claiming the right rate!

- If your vehicle isn’t petrol, diesel, hybrid, or electric (???), then you must use the actual costs method.

Let’s take a deeper dive into each one:

Mileage method (petrol, diesel, hybrid, and electric vehicles only)

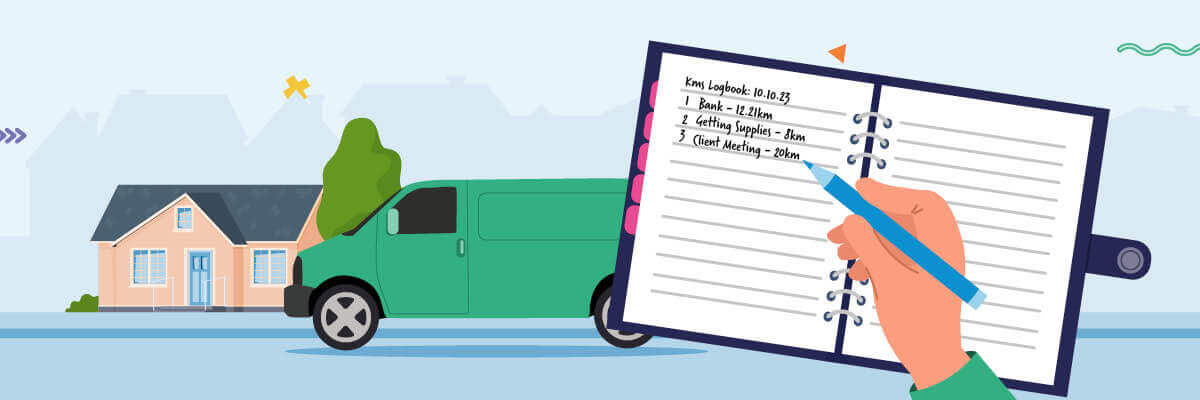

To use the mileage method, you’ll need to keep a logbook.

Keeping a logbook

A logbook is a document that ‘logs’ relevant data regarding your business-related trips.

In your logbook, make sure you record:

- Where you’re going and why for each trip

- Odometer readings at the beginning and end of every journey

- Total distance in kilometres you’ve travelled

- Odometer readings for the beginning and end of the logbook period.

Claiming mileage

The IRD provides kilometre rates each year for you to claim for the business use of your vehicle. You’ll need to double check you’re using the right rates for the financial year you’re claiming for.

The Tier 1 rate covers both fixed and running costs for the business-related use of the 14,000km of your vehicle’s annual travel, which includes personal trips too.

The Tier 2 rate is used for any business-related travel over 14,000km, and only covers running costs.

💡 Kilometre rates are depreciation inclusive – if you choose the mileage method, you can’t claim the depreciation of your vehicle as well!

💡 The IRD releases their kilometre rates around May each year, after the financial year is over. The most recent rates available are for the FY 2024/25

Kilometre rates for FY 2024/25

| Vehicle type | Tier 1 rate (first 14,000km) | Tier 2 rate (over 14,000km) |

|---|---|---|

| Petrol | $1.17 per km | $0.37 per km |

| Diesel | $1.26 per km | $0.35 per km |

| Petrol hybrid | $0.86 per km | $0.21 per km |

| Electric | $1.08 per km | $0.19 per km |

Actual costs method

To claim actual costs, you’ll need to keep a logbook for 90 consecutive days (as covered in the last section), and save all your:

- Receipts for fuel

- Receipts for other car-related costs, such as

- registration,

- insurance,

- lease payments,

- repairs,

- interest charges (phew!)

💡 Note: If you don’t keep a logbook, you can only claim 25% of your vehicle’s running costs.

Your logbook needs to show the reasons for all business travel, and the distances of all work and personal trips. It should cover a minimum of 90 consecutive days and represent your typical vehicle usage in a financial year.

After you’ve completed your logbook, you need to work out the percentage you used your vehicle for business, based on the information you collected:

- Determine the total distance in kilometres you travelled during the logbook duration.

- Identify the business-related kilometres within that time frame.

- To find the business usage percentage, divide the business-related kilometres by the total distance and multiply by 100.

Once you have your business-use percentage, you can claim that percentage of all your vehicle expenses, including running costs and depreciation. Easy!

Finally, you can use your logbook calculation for three years, provided the proportion of business use doesn’t increase by more than 20%. After three years you’ll need to start a new logbook.

How to claim the purchase of your vehicle

💡 Note: If you’re using the mileage method to claim vehicle expenses, you can’t double-dip by also claiming the vehicle’s purchase. It’s already baked into that deduction!

You can claim the cost of your vehicle in two ways:

- As an expense, if it’s under the low value asset threshold

- Through depreciation, if it’s above the low value asset threshold

Low value asset threshold

Since 2021, the low value asset threshold has been $1,000. So if your vehicle costs $1,000 or less (an absolute steal!), you can claim its entire cost immediately as an expense.

Depreciation

Assets like vehicles decrease in value over time. This reduction in value is called depreciation. If you paid more than $1,000 for your vehicle, you’ll need to claim depreciation on the purchase.

Depreciation rates vary according to the methods used, the type of vehicle you have, and the business use percentage. The IRD’s depreciation calculator can work this out.

💡 Note: You can still only claim depreciation on your business usage percentage of the purchase of your vehicle. For instance, if your business use is 80% of a $60,000 car, you can claim depreciation on $48,000 (80% of $60,000).

We’re not going to lie, depreciation can be an absolute pain – which is why we recommend that you just use Hnry. As part of your 1% +GST Hnry fee, we’ll calculate and claim the depreciation of all your assets for you. Basically, we do all the maths, so you don’t have to. Easy!

Let Hnry take the driver’s seat (for your expense claims)

When it comes to sole trader taxes, Hnry makes it all seriously easy.

Hnry is an award winning app and tax service, designed specifically for sole traders. For just 1% + GST of your self-employed income, capped at $1500 a year, Hnry will calculate and pay all your taxes, levies and whatnot for you, including:

Let Hnry take the driver’s seat on your tax admin, so you can focus on what you do best – the actual work. Join Hnry today!