Need to fill in an IR330? Confused about tax codes? You’re in the right place!

Tax codes are basically how employees let their employers know what they need to be taxed. Different tax codes correspond to different situations, and you’ll need to pick the right one for your circumstances in order to be taxed at approximately the right level.

Thing is, after a certain point, the system can get kind of confusing. How do you know what the right tax code is if you work multiple jobs, for example? Or if you’re self-employed – what happens then? And why does it feel like you’re being taxed so much more on your secondary income?

(You’re not being taxed more, by the way. We explain why in detail in our guide to secondary tax, but that’s a whole other thing.)

Great questions, all. Here’s what you need to know.

- What is a tax code?

- How do tax codes actually work?

- Common tax codes in New Zealand

- How to find your tax code

- How to change your tax code

- What happens if you use the wrong tax code?

- Tax codes for sole traders and contractors

- Hnry sorts it all for you

What is a tax code?

Ah, yes. Good starting point.

A tax code is a single, or a series of letters that corresponds to a specific level of taxation. When you start working at a company, you’ll need to declare a tax code to your employer through an IR330 form, who then deducts income tax from your pay accordingly.

Basically, we use tax codes in Aotearoa to help us calculate the right amount of tax for an individual, depending on things like:

- Whether they work one or more jobs

- Whether they receive a taxable benefit

- If they have an outstanding student loan

- If they work in a specific industry

Without tax codes to help guide employers, workers could end up being under or over taxed.

How do tax codes actually work?

Aotearoa operates using a progressive tax rate system. What this means is that not every dollar you earn is taxed at the same amount.

📖 We get into all this in way more detail in our guide to tax rates. If you’re lost, it’s well worth a quick squiz!

To keep things very simple, let’s say you get taxed 15% on all income from $1 to $50, and 30% on all income from $51 to $100.

If you earn $50 with Employer A, you’ll need to be taxed 15% on that income, so $7.50.

But then, if you earn an additional $50 with Employer B, bringing you up to $100 total, you’ll need to be taxed at 30% on this income in order to pay the right amount of tax overall.

This is where tax codes come into play. The right tax code will tell Employer B that you’ve already earned income with Employer A, meaning they’ll have to charge you tax at a higher rate. If you don’t declare the right tax code, Employer B might tax you at 15% instead of 30%, meaning you’ll have tax owing at the end of the financial year.

Common tax codes in New Zealand

Ok, now we have all that laid out, what actually are the different tax codes? And when would you use them?

The most common tax codes are split between main income and secondary income:

| Tax code | Used if: | |

|---|---|---|

| Primary tax codes:Used for your main source of income(whether employment or a taxable benefit) | M | You won’t earn between $24,000 and $70,000 from this income source. |

| ME | You will earn between $24,000 and $70,000 from this income source. | |

| Secondary tax codes:Used for secondary sources of income (whether employment or a taxable benefit) | SB | Your total income will be less than $15,600 |

| S | Your total income will be between $15,601 and $53,500 | |

| SH | Your total income will be between $53,501 and $78,100 | |

| ST | Your total income will be between $78,101 and $180,000 | |

| SA | Your total income will be more than $180,000 |

💡 You can only use a primary tax code for one source of income. All other sources of income will need to be under secondary tax codes.

If you have a student loan, you’ll need to include “SL” as part of each tax code you declare (eg. M SL, or ST SL). This lets your employer know that they’ll need to deduct student loan repayments from your income as well (sorry!).

There are also a few other tax codes you may need to use, depending on the work that you do. For example:

| Tax code | Used if: |

|---|---|

| WT | You’re a contractor receiving schedular payments (more on that in just a tick!). |

| CAE | You’re a casual agriculture worker, eg. you’re doing casual work on a day-to-day basis for up to three months, and earn no other income during this period. |

| NSW | You’re a recognised seasonal worker. |

| EDW | You’re helping with election day work. |

… and that’s pretty much it! Pick the tax code that fits your situation, declare it in the relevant IR330 form, and you’re good to go!

How to find your tax code

Forgotten what tax code you gave which employer? One way you can figure out what you’ve declared with who is through the myIR portal.

(You could also just ask, by the way! But, if you’d rather not talk to your boss, we totally get that. This is your next best bet.)

Log into your profile. On the main page, click on “Income summary” in the “Income tax” section. From there, click the “View breakdown” option next to “Salary, wages, benefits and taxable pensions”.

You should see a list of all salary, wages, benefits and taxable pension payments. In this section, the companies you work for should be listed, with the applicable tax codes listed alongside.

How to change your tax code

Alright, say you accidentally declared an M tax code with two different employers, and you need to change your tax code with one of them. What should you do?

The good news is that it’s actually super simple to change your tax code. All you need to do is fill in another IR330 form with the right tax code, and submit it to your employer. They’ll take it from there. Easy!

What happens if you use the wrong tax code?

The short answer is: you may end up being under or over taxed.

For example, if you work two different jobs and use an M primary tax code for each of them, they’ll both tax you at a lower effective tax rate than you’re eligible for.

💡 An effective tax rate is exactly what it says on the tin: the actual percentage of your total income that you pay in taxes. For more information, check out our explainer on tax rates and how they work.

Conversely, if you somehow get your wires really crossed and use a secondary tax rate for both your primary and your second jobs, you could be charged a higher rate of tax than you actually owe. This is because secondary tax codes are meant to correspond to your marginal tax rate – that is, the highest rate of tax that your income qualifies for.

Let’s say you were earning $190,000, putting you in the very top tax bracket (niiiiiice!). Your marginal tax rate is the tax rate applied to the very tippy top of your income – which, at this point in time, is 39%.

If you worked two jobs, and used the top secondary tax code for both (SA), all your income will be taxed at 39%, instead of at your actual effective tax rate of 28%. That’s going to make a huge difference to your cash flow!

These are extreme examples, but you get the point – declaring the right tax code could be the difference between getting it as right as possible, or getting it very, very wrong.

Tax codes for sole traders and contractors

Tax codes generally only apply to PAYE income, so sole traders won’t need to apply them to their self-employed income.

If you’re a sole trader with a PAYE job, you’ll need to declare a tax code with your employer, and then calculate the rest of what you owe on everything else you earn.

(Or, you could just use Hnry.)

The exception to this is if you are a contractor earning schedular income. In this case, you’ll need to declare a WT tax code for withholding tax, using an IR330c form, and nominating a flat rate of tax to be deducted from your income.

Ideally, you’d want this number to be as close as possible to your effective tax rate, to avoid paying too much or too little tax across the financial year. But in practice, it’s difficult to get your withholding tax rate to be spot on, especially if your income is seasonal and/or variable.

(Seriously though, you could just use Hnry.)

All in all, when it comes to calculating and paying tax, sole traders are generally on their own. At the end of the day, getting your taxes right is your responsibility.

(Unless you make it our responsibility. Hi, it’s us, we’re the solution, it’s Hnry.)

Hnry sorts it all for you

Let’s be real. Juggling income tax on various sources of income can feel like trying to solve a jigsaw puzzle with pieces from three different boxes.

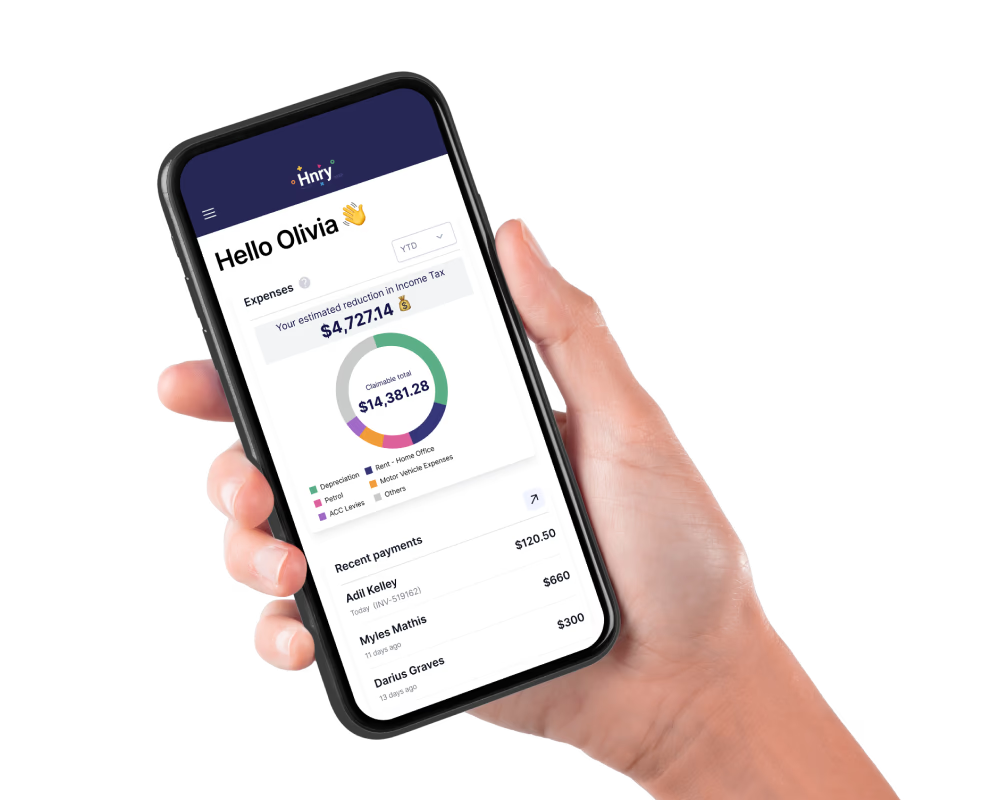

But it doesn’t have to be like this! Hnry was created to solve this exact problem – we’re an award-winning tax app and service for sole traders, and we sort all your tax admin on your behalf.

For just 1% + GST of your self-employed income, capped at $1,500+GST a year, Hnry will calculate and pay all your taxes, levies and whatnot for you, including:

- Income tax

- GST (if applicable)

- ACC levies

- Student loan repayments

- KiwiSaver contributions (optional)

You can also use our app to do things like:

- Send unlimited invoices

- Send unlimited quotes

- Raise expenses (which we then manage for you)

- Create and manage a client database

- Track your business profit

- Allocate a percentage of each pay to go towards a savings account, or a charity, or anything you like really

- … and so much more!

Basically, we make it so you never have to think about tax again. If this sounds good to you, why not give it a whirl?

Join Hnry today.

Share on: