If you’re a sole trader and you work from home, you may be able to claim a portion of your home running costs as business expenses. Neat!

But it’s not as straightforward as working from home, and then claiming all your household costs as a tax deduction. In general, you can only claim deductions for expenses directly related to earning business revenue.

Home office expenses could fall under this category. But in order to get it right, you’ll need to do the maths. Because you’re working out of your home, and not in a dedicated office, you’ll only be able to claim the business percentage of your home office expenses.

There are several different ways IRD recommends you calculate home office expenses – here are the two simplest.

To work out an appropriate Home Office percentage, you can either base it on the size of your home office, relevant to the size of your home, or calculate it based on the percentage you use your home for business

Option 1: Based on the area of your home office

This option is generally only for people who have an area of their home dedicated to their business – eg. a literal home office.

You’ll need to figure out the area of the part of your house that you use solely for business, and then calculate the percentage of your house taken up by that area. This is the percentage of household expenses you may be eligible to claim.

Step 1: Measure the floor area of your home office. Remember NCEA level 1 geometry: area = length x width.

Step 2: Divide the total floor area of your entire home by the floor area of your home office, then multiply this by 100. What you’re left with is the percentage of your home used for your home office. Tada!

💡 If you’re not sure what the floor area of your house is, you can always try looking up your address on homes.co.nz!

For example: If you have a 100m2 house and have a 12m2 office.

In this instance, the percentage of your home used for your home office would be 12%.

Provided you meet the rest of the criteria, here are a few examples of the expenses you could claim:

- 12% of power, gas, and heating

- 12% of mortgage interest or rent

- 12% of hand soap and toilet roll

- 12% of lightbulbs

- 12% of your home insurance

Option 2: Based on time spent using your home office

This option is for those of you who don’t have a dedicated working-from-home space – eg. if you conduct your business from a small desk crammed into a corner of your laundry room. We’ve all been there.

To claim home office expenses in this situation, you’ll need to know the time spent working from home, as well as the area of the space you use for business purposes. Fair warning, this will involve a fair amount of maths.

Step 1: Start by calculating the area percentage of your home office, like in option one.

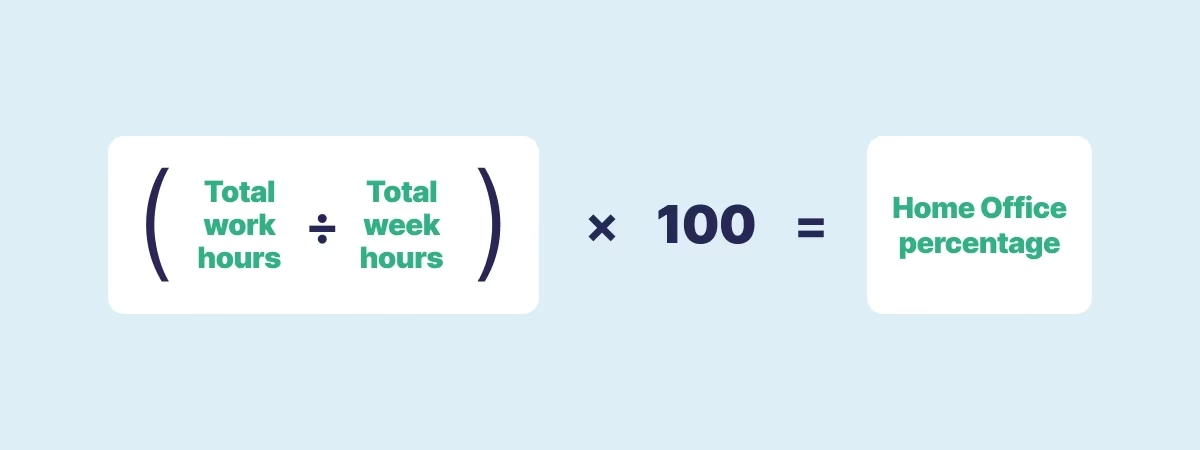

Step 2: Then, you’ll need to record the time you spend working from home over a four week period. Divide your total working hours by the number of hours in a week (fun fact: there are 168), then multiply that number by 100. This will give you the business-usage percentage for your home office space.

Step 3: Finally, you’ll need to calculate the percentage of the percentage – that is, the what percentage of the home office area is used for business purposes. You can do this using a percentage of a percentage calculator – just make sure to input your home office area percentage first, and business usage percentage second. Getting them the wrong way round will completely throw off your numbers!

Let’s say that the floor area of your laundry-turned-office is 12%, like in the example for option one. The next step is to calculate how many hours a week you spend working in it – for simplicity’s sake, let’s say it’s 25. Dividing that by hours in a week, then multiplying the answer by 100 will give you your business use percentage:

Then, you’ll need to use a percentage of a percentage calculator to calculate 15% of 12%. Use the floor area (12%) as the first input, and business usage (15%) as the second.

This gives you a final, cumulative percentage of 1.8% – which is how much of your running costs you may be able to claim as business expenses. Phew!

💡 It is extremely unusual to have a home office percentage greater than 25%, no matter which method you use to calculate your expenses. The IRD does regularly check home office expense percentages, so you may be asked to verify how you’ve calculated your claims!

What you can’t claim (using either method)

Things that can’t be claimed as a home office expense include:

- Food and drink

- Furniture and electronics that are not used solely for work purposes

- TV subscriptions, unless they are used only for work

It may seem easy to claim various expenses as home office expenses, but it’s important that you only claim what you legitimately use for your business.

Even if your accountant signs off on all your expenses, you’re ultimately the one who bears the risk – and the IRD can come down hard on fraudulent claims. Beware of big fines!

Let Hnry do it

Alternatively, Hnry can manage your expenses for you. It’s all part of the service!

For just 1% +GST of your self-employed income, capped at $1,500 +GST a year, Hnry will automatically calculate, deduct, and pay your taxes, levies, and whatnot for you. This includes:

You can use our app to raise expenses on the go, which we then manage for you and claim at the end of the financial year. Oh, and did we mention that we also file your annual tax return on your behalf? It’s all part of the service!

Better still, using the Hnry platform costs less than using a traditional accountant, and is entirely tax deductible. So what are you waiting for? Join Hnry today.

Share on: