In last year’s budget, the government announced that our tax thresholds would change starting 31st of July, 2024.

(Tax thresholds are the point in your income at which you start owing tax at a different rate – but more on this later.)

The new thresholds were designed to offer some relief for the cost of living crisis, by reducing the amount of tax we owe overall. Great!

But since the new thresholds came into effect partway through the financial year (FY), it meant that calculating tax for FY 2024/25 was going to be a bit gnarly. Basically, we were using the old thresholds up until the 30th of July 2024, at which point the new thresholds took effect on the 31st. This meant that neither the old rates nor the new rates were accurate for the financial year as a whole.

To help clear up the confusion, the IRD has prepared what we’re thinking of as a series of transitional tax rates, to help payroll providers and sole traders (that’s you!) calculate and pay the right amount of income tax in FY 2024/25.

Then, for FY 2025/26, we’ll all be on the new system entirely – far more straightforward.

Confused? We can help. Grab a cuppa, and let’s break it all down.

- What are tax thresholds, and why are they changing?

- Why are the thresholds changing on the 31st of July?

- Current and future tax thresholds

- Financial Year 2024/25 tax calculator

- How Hnry helps

What are tax thresholds, and why are they changing?

Great questions, all.

Without getting too into the weeds, Aotearoa operates using a progressive tax system for income tax, meaning that the more you earn, the more you pay in tax.

The way we do this is through a system of tax rates and brackets. Lower earners will owe less on their income, but as you earn more, the rate at which you pay tax increases.

It’s important to note that it’s a stacking system – if you earn in the 33% tax bracket, say, that doesn’t mean you owe 33% in tax on all your income. Instead, you’ll owe 33% on income earned within that bracket.

💡 If you’re getting a bit lost (and we wouldn’t blame you), we explain all this in more detail in our guide to tax rates for sole traders.

Now, tax thresholds are simply the point at which you go from one tax bracket to the next. For example, say that the tax threshold is $100, with a tax rate of 10%. What that means is that you’d owe 10% of all income you make, until you earn $100. Your next dollar is above the threshold, meaning it’ll be subject to a different, higher rate of tax. With us so far?

In raising the tax thresholds, the government is allowing you to earn more before you cross into the next bracket up, and pay a higher rate of tax on those earnings. What this translates to in real terms is tax relief – putting aside tax deductions etc, you should owe less tax this financial year than you did last year, on the same amount of income.

Why are the thresholds changing on the 31st of July?

The initial plan was for these changes to go live on the 1st of July 2024, the first month after the budget announcement. But there was some concern that payroll companies wouldn’t be able to switch things up that fast, which is why the live date was postponed.

Starting the 31st of July means we’ll use the old tax thresholds for 121 days of the 2024/25 financial year, and the new thresholds from then onwards.

But, you may be wondering. If the old system and the new system are not fully accurate, what’re we left with? Well, may we present the Frankenstein’s monster-esque solution of the tax world: transitional tax rates.

The current and future tax thresholds

To recap: the old thresholds aren’t accurate, and neither are the new rates. So what do we do? We (rather, the IRD) mash them both together to create a temporarily more complicated, but more accurate, system of thresholds and rates.

Just for this financial year, we’ll need to use this one-off system. Then, once this year is over, we can switch to using the new thresholds only.

Tax rates and thresholds for Financial Year 2024/25

| Taxable income | Transitional tax rate | Income tax per range |

|---|---|---|

| $0 - $14,000 | 10.5% | $1,470.00 |

| $14,001 - $15,600 | 12.82% | $205.12 |

| $15,601 - $48,000 | 17.5% | $5,670.00 |

| $48,001 - $53,500 | 21.64% | $1,190.20 |

| $53,501 - $70,000 | 30% | $4,950.00 |

| $70,001 - $78,100 | 30.99% | $2,510.19 |

| $78,101 - $180,000 | 33% | $33,627.00 |

| $180,001 and over | 39% | + |

For context, this is the new system – much simpler!

Tax rates and thresholds for Financial Year 2025/26

| New threshold | Tax rate |

|---|---|

| <$15,600 | 10.5% |

| $15,601 - $53,500 | 17.5% |

| $53,501 - $78,100 | 30% |

| $78,101 - $180,000 | 33% |

| $180,001 and over | 39% |

Tax calculator for Financial Year 2024/25

Want to see what this looks like in practice, including any other taxes and levies you may owe? Don’t worry, we gotchu.

Use our free calculator to estimate your income tax, ACC levies, and take-home pay with the transitional tax rates for the 2024/25 financial year.

*Assuming an average ACC work levy rate. For more information, check out our guide to ACC levies.

Disclaimer: Please note the numbers shown above are an estimate based on the figures you have provided. If you have any questions, please reach out to the team.

Tax calculator for Financial Year 2025/26

As a sneak preview, we’ve set up a tax calculator for financial year 2025/26, which uses the new thresholds set to go completely live 1st April 2025. Go on, give it a try!

Try the 2025/26 Tax Calculator →

Tax calculator for Financial Year 2023/24

If you’re really, really curious, you can also use our old tax calculator to see what you would have owed, if nothing changed.

Try the 2023/24 Tax Calculator →

💡 Note: These calculators are based on information released by the government. Rates and thresholds are subject to change.

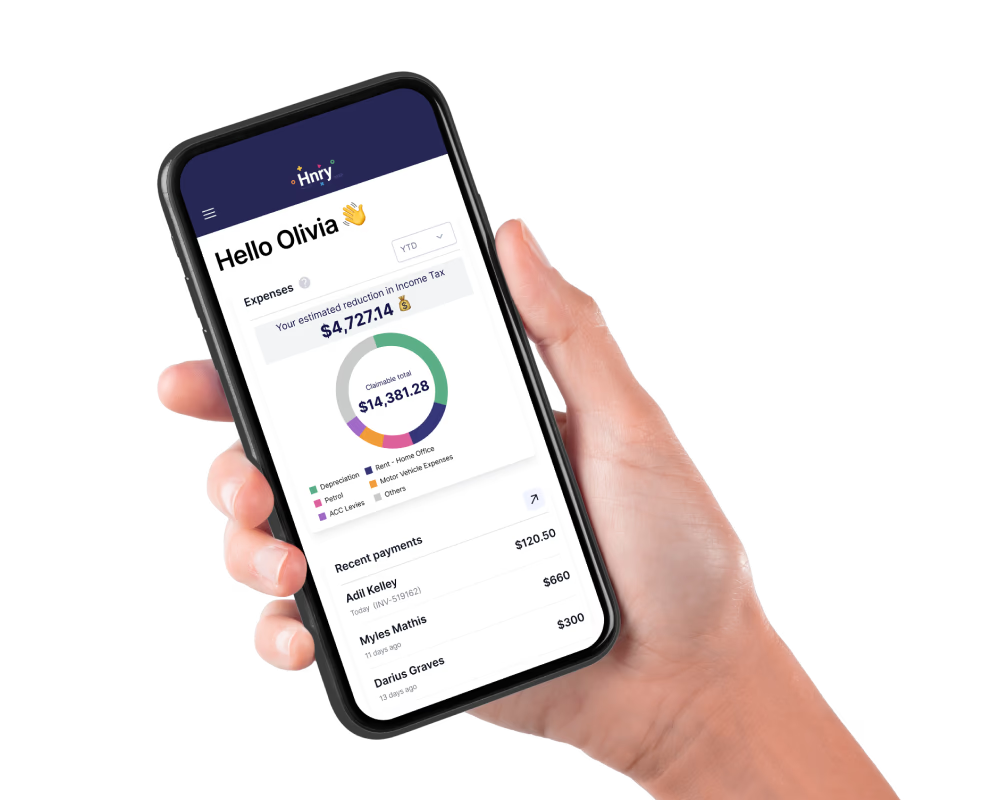

Lost in the maths? Hnry can help

You can get your calculator out, start messing around with decimals and percentages and whatnot – or you could ditch the lot and just use Hnry instead. We’re already all over these changes, and we’ve got you covered.

Plus, we don’t just calculate your tax – we set it aside and send it to the IRD on your behalf. Everything that ends up in your personal bank account is yours to spend.

For just 1% + GST of your self-employed income, capped at $1500 a year, Hnry will calculate and pay all your taxes, levies and whatnot for you, including:

We also file your annual tax return – it’s all part of the service! You also get access to unlimited quotes and invoices through the Hnry tab, and we manage your expenses for you, giving you tax relief in real-time. Using the Hnry platform costs less than using a traditional accountant, and is entirely tax deductible.

So what are you waiting for? Ditch the maths, join Hnry today and never think about tax again!

Share on: