Looking for a self-employed tax calculator for FY 2025/26? We’ve got you covered!

As a sole trader, it can be tricky to figure out how much to set aside for your annual tax bill.

That’s why we decided to create a tax calculator that’s specifically for the self-employed.

Enter your:

- sole trader income,

- PAYE income (if applicable),

- tax deductions claimed,

- student loan status,

- KiwiSaver contributions (optional)

and get a rough estimate of what you’ll owe at the end of the financial year (EOFY). Easy! 👇

Sole trader tax calculator FY 2025/26

*Assuming an average ACC work levy rate. For more information, check out our guide to ACC levies.

This calculator reflects IRD rates and thresholds for the 2025/26 tax year and was last reviewed in February 2026.

Disclaimer: Please note the numbers shown above are an estimate based on the figures you have provided. If you have any questions, please reach out to the team.

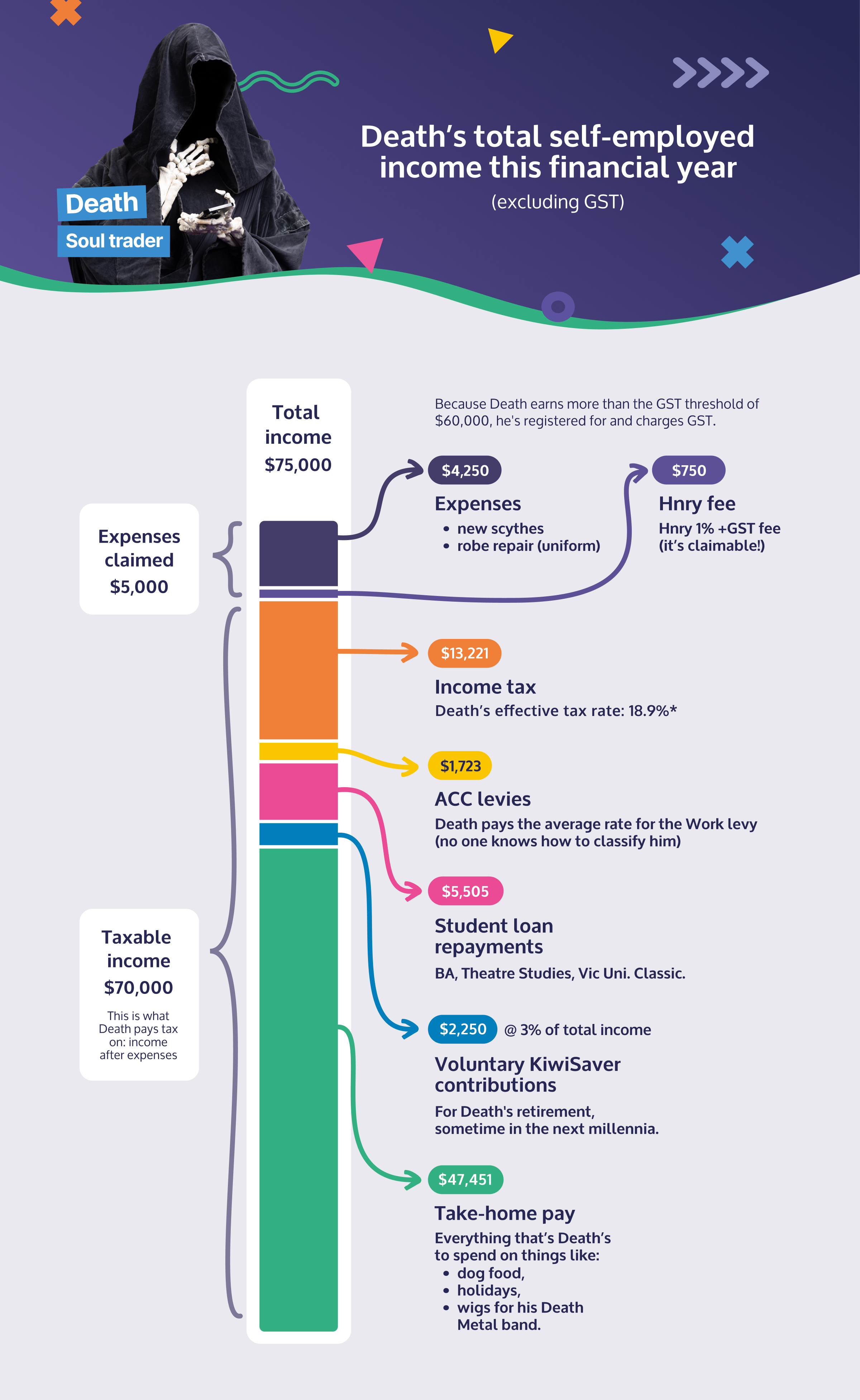

Breakdown of taxes and levies

*An effective tax rate is exactly what it says on the tin: the actual percentage of your total income that you pay in taxes. For more information, check out our guide to tax rates for sole traders.

Key Taxes for the Self-Employed

Income tax

You’re required to pay tax on all your income, whether it comes from a full time job or a self-employed gig. Unlike in other countries, there’s no ‘tax free’ threshold in New Zealand, so you’ll owe income tax from the first dollar you earn.

The IRD calculates your income tax rate by adding up your earnings from all your sources of income (PAYE/salary jobs, self-employed income, investment income etc) and deducting tax according to our progressive tax rate system.

There’s sometimes confusion around tax codes for secondary income, and the amount of tax owed on self-employed earnings – but rest assured, the income tax rates for salaried earners and self-employed individuals are exactly the same.

📖 Still not making sense? We explain in more detail in our guide to tax rates.

| New threshold | Tax rate |

|---|---|

| <$15,600 | 10.5% |

| $15,601 - $53,500 | 17.5% |

| $53,501 - $78,000 | 30% |

| $78,101 - $180,000 | 33% |

| $180,001 and over | 39% |

Source: IRD

GST

If you earn over $60,000 in a 12-month period in just self-employed income (i.e. not including any PAYE income), you’ll be required to register for and charge GST.

What this means is that you’ll need to charge customers an additional 15% GST on top of your regular prices. This 15% is then payable to IRD whenever you file your GST returns.

If you make business purchases, the GST on any business purchase will reduce the amount of the GST you’ve collected that will be payable to IRD.

📖 For more information, check out our sole trader guide to GST.

ACC levies

On top of income tax, you’ll also need to pay ACC levies on your self-employed income. The exact cost of your ACC levies will depend on the type of work you do.

If you also earn income from a PAYE job, then you’ll already be making ACC contributions as part of your PAYE taxes, and any ACC levies on your self-employed income will be in addition to that.

It’s worth noting that there are annual limits for ACC levies, over which you won’t be required to make any further payments.

💡 For our tax calculator, we’ve assumed an average ACC levy rate. But you may need to set aside more, depending on the type of work you do, and the associated risk.

Student loan

If you currently have a student loan, and you’re earning over the annual threshold of $24,128, you’ll be required to make repayments on that loan at the standard IRD rate of 12%.

This applies to your sole trader income, in addition to any repayments you make from a PAYE salary. There’s no way around it, sorry!

📖 Check out our handy guide to paying off your student loan as a sole trader.

FAQs

What taxes and levies do sole traders pay?

Sole traders need to sort income tax, ACC levies, and their student loan repayments for their self-employed income.

If they earn over $60,000 in a 12-month period, they’ll also need to register for and pay GST.

When do sole traders pay their taxes?

Great question!

If you’re a sole trader filing your own taxes, your individual tax return (IR3) will be due on 7 July. Any tax owing will need to be paid before 7 February the following year.

For example, your FY 2025/26 tax return will be due on 7 July 2026, and any tax owing will need to be paid by 7 February 2027.

If you’re filing through a tax agent (like Hnry!), your tax return will be due on 31 March the following year, and any tax owing will be due on 7 April.

In this situation, your FY 2025/26 tax return will be due on 31 March 2027, and any tax owing will be due by 7 April 2027.

📖 For more information, check out our ultimate guide to the End of the Financial Year (EOFY).

How do I save on my tax bill?

Sole traders can lower their tax bill by claiming valid business expenses. This lowers their taxable income, and therefore the amount of tax they owe.

📖 Good news! We have a full guide to claiming expenses. Whoo!

How Hnry Helps

Hnry is an award winning app and tax service, designed specifically for sole traders. For just 1% + GST of your self-employed income, capped at $1500 a year, Hnry will calculate and pay all your taxes, levies and whatnot for you, including:

We also file your annual tax return for you – it’s all part of the service! Better still, using the Hnry platform costs less than using a traditional accountant, and is entirely tax deductible.

If that sounds good to you, join Hnry today and never think about tax again!