Before Hnry, I never knew exactly how much money my business was making.

I liked my PAYE job. The steady pay cheque, plus employer contributions to my KiwiSaver, were things I knew I could count on. But beyond this stability, I created a side hustle that I loved even more – a financial empowerment blog called The Happy Saver.

The only problem was, despite my best efforts at bookkeeping, there was no way to know in real time if my side hustle was financially viable enough for me to quit my day job. My self-employed income and expenses were both uncertain, which made financial planning difficult. I felt like I was making money, but with no real-time accounting system, it also felt like my side hustle was costing me more than I was earning.

The IRD tends to prefer a business run on something other than feelings. So do I, which is why I sought out and joined Hnry. I was looking for a solution that would help me stay on top of my taxes, but what actually happened was that Hnry gave me visibility over my income and expenses, my tax admin, and my actual take home pay.

Six months into using Hnry, I quit my day job forever. Here’s how Hnry made that happen:

Before I joined Hnry

I enjoyed my day job and the security it gave me – but I loved my side hustle a lot more, even though it came with less financial stability.

Once a year, I would hand my self-employed income information to my accountant, and many months later, they would tell me how much tax I had to pay and when. One year, I’d oversave for tax; the next, I would undersave. Expenses I tried to claim were unclaimable expenses, and out of the blue, I’d be hit by an ACC bill!

Both my income and expenses were unpredictable, which made planning difficult. I had no way of knowing when, or even if, I was making money, let alone whether I could grow The Happy Saver to the point where it was covering my cost of living.

I really wanted to back myself and my own business, but there was no way on earth I would give up the financial security of my day job and throw myself into an economic black hole. I had a family to look after, so quitting was far too risky.

That’s when I decided to let Hnry take over my tax and financial admin, in the hopes that I’d get some sort of peace of mind. Immediately, things started to change.

After joining Hnry

Visibility over my take-home pay

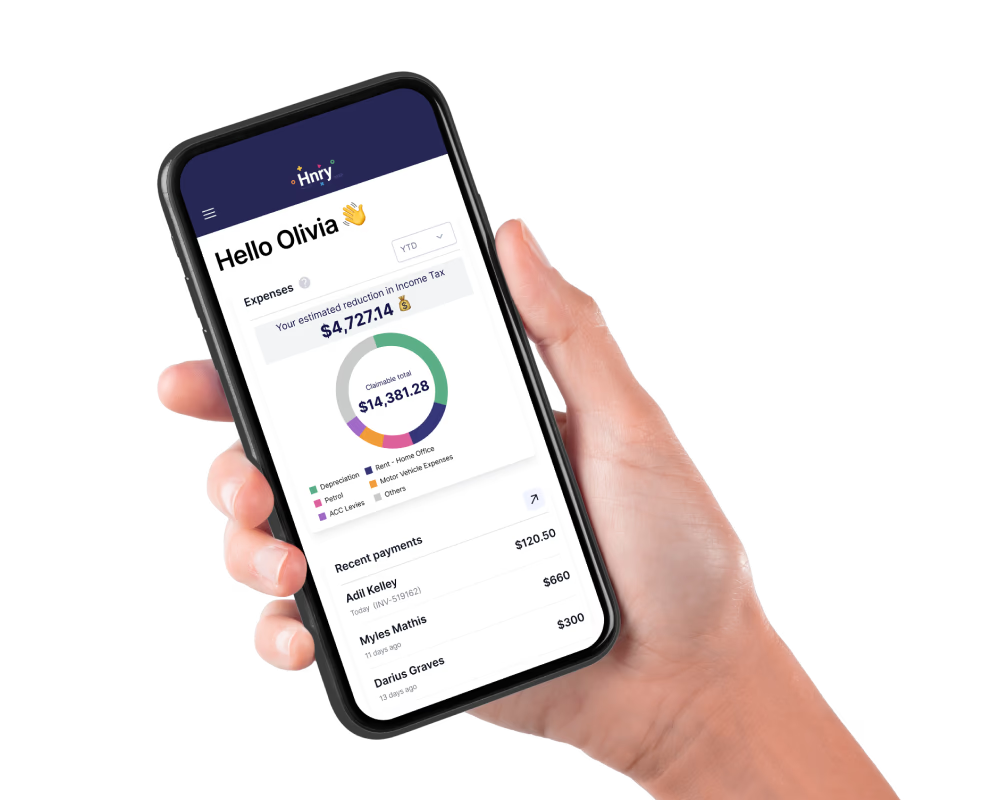

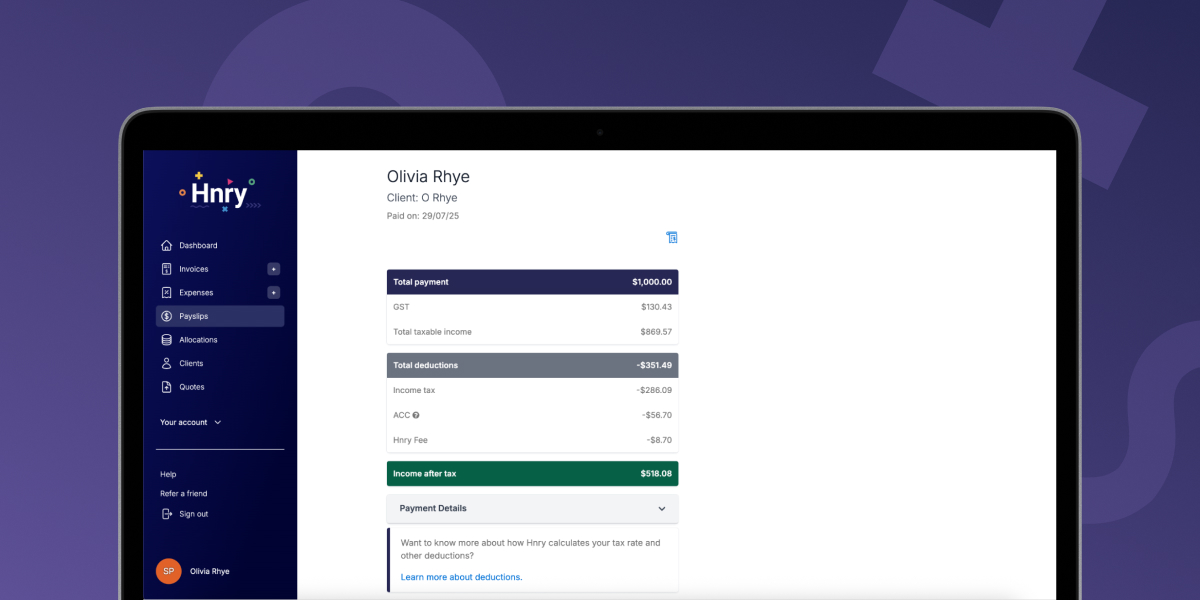

My primary issue was that I never knew the after-tax income of The Happy Saver in real time. As soon as the first invoice I issued through Hnry was paid, I knew I had found the solution I was searching for.

With that very first payment, I could clearly see my:

- Total taxable income

- Income tax and ACC deductions

- 1% +GST Hnry fee

- My income after tax

This was a game-changer – I knew my net profit on every invoice I issued. The benefits of using Hnry were instant. No more guessing how much money I needed to set aside to pay the IRD 12 months later! No more feeling like I’m at the mercy of my accountant! No more big accounting bills!

It turns out my side hustle was quite the viable business after all.

I instantly started to manage my after-tax income with certainty. I quickly set up two new bank accounts with automatic transfers, so I could build up:

- Annual leave – I could actually plan and enjoy a holiday.

- Savings – specifically to replace my tech and cover business expenses that would help me grow.

The best bit was that I no longer had to set money aside for taxes; every dollar hitting my bank account was mine to spend. Mind blowing.

Income and expenses data

I also quickly solved my biggest issue: dealing with irregular income as a self-employed person.

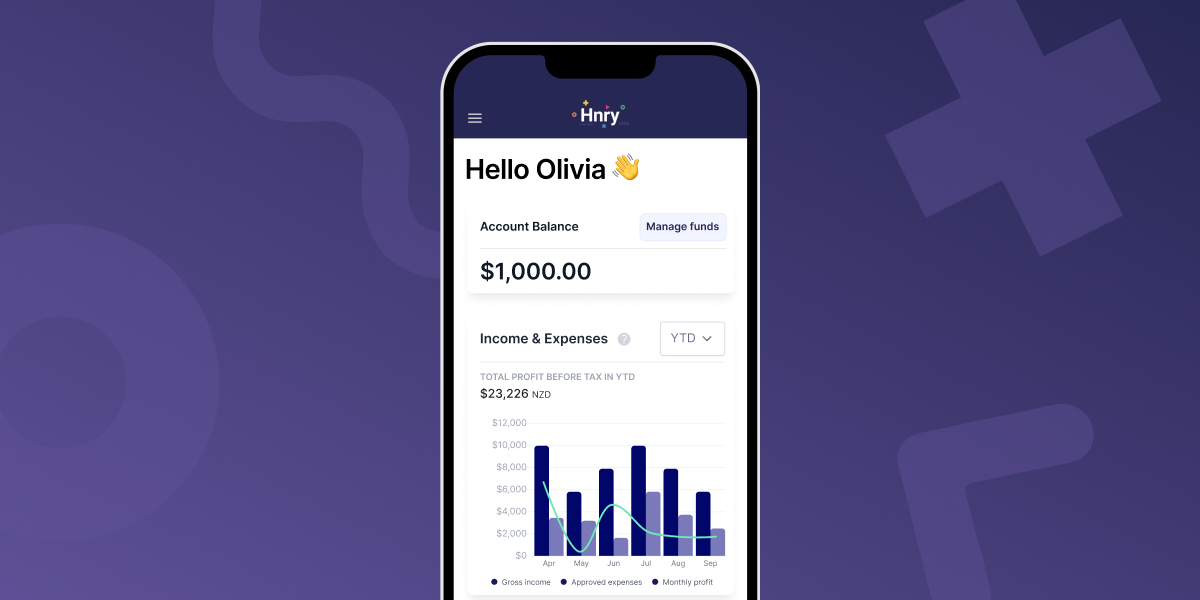

My business is unique because I don’t work full-time and have a sizeable unpaid volunteer component. Because of this, I needed to be mindful that I was paid appropriately for the work I invoiced. The Hnry Income and Expenses chart clearly shows me how much I’m making in comparison with running costs, meaning I can continue to volunteer my time while still making enough to cover expenses and pay myself.

The Hnry Dashboard also shows me my outstanding invoices, all in one place. It’s rare that someone doesn’t pay me, but if they do forget, Hnry notices before I do and sends my client a polite reminder. I’ve never not been paid.

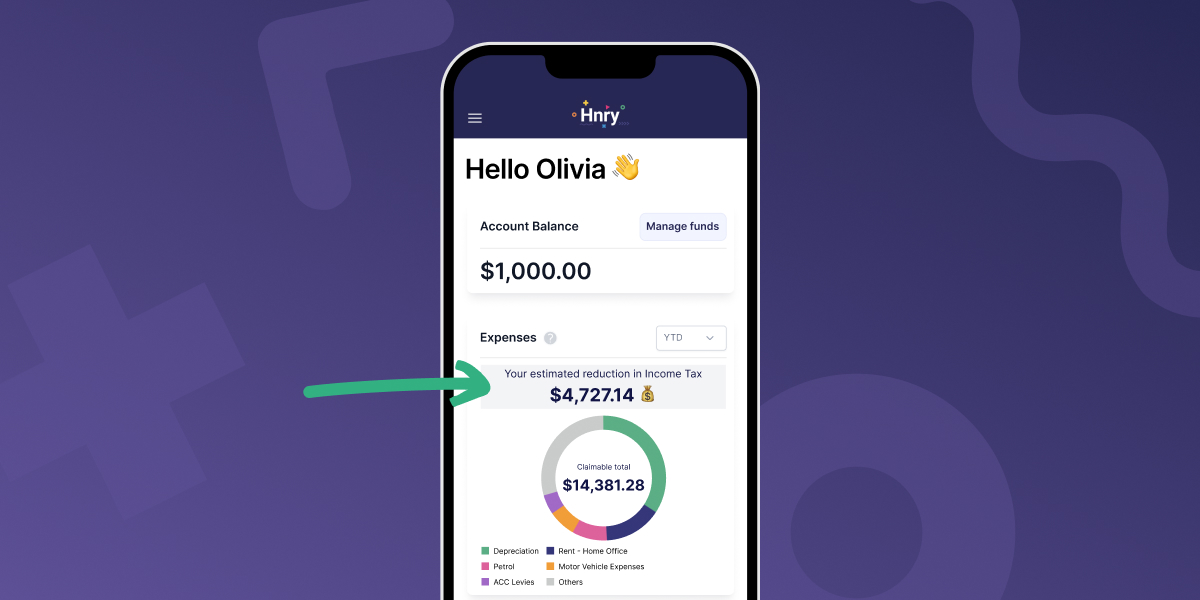

Finally, it took me some time to realise the actual value of submitting claimable expenses, but now the widget showing my Estimated Reduction In Income Tax is one of my favourite features. The ability to upload business expenses and have them assessed and approved or denied and explained by an accountant within 48 hours has been immensely beneficial.

All these features work together to make sure I’m paid on time, that I can see how much I’m spending on my business, and that I’m getting the tax relief I’m eligible for. Seeing it all in real time means I can make better decisions in the moment for me and my business. Data is power!

Covering all living expenses

The Income and Expenses chart and the Pay Summaries Hnry generates gave me the data I needed to calculate the minimum amount my side hustle could afford to pay me each week, while also topping up my annual leave and business savings accounts.

I set up a weekly payment of a set amount to my personal bank account, and resolved to use Hnry for six months before I made the decision to give up my PAYE job. During those six months, I stress-tested self-employment:

- I sought out new work, and let go of work I didn’t enjoy

- I juggled how much of my time I volunteered and how much I sought payment for

- I worked intensely on my business for a period, then deliberately took a quiet vacation, which tested my holiday pay allocation

I continually scanned the horizon for obstacles, including the arrival of an unexpected ACC bill for the previous financial year!

All the while, I watched my Hnry dashboard, specifically examining my income and expenses, the estimated reduction in income tax I would incur every time I uploaded a claimable expense, and the Current financial year-to-date reports, which gave me my net income YTD, or current profit.

I understood the minimum I needed to make to cover all my expenses, pay into a holiday pay account, set money aside for future costs, and, most importantly, pay myself a regular weekly income.

I quit my job when I knew all these bases were covered.

Why I really love using Hnry

Before using Hnry, I was sure I was close to spending more than I was earning due to surprise bills and incorrect tax estimations.

Initially, I used Hnry to tell me how much my small business cost to run and how much profit I made after tax. The results surprised me. As soon as my taxes were paid as I went along, and my expenses were applied to my total taxable income, I could clearly see that I had created an excellent and growing small business that provided enough income to give up my day job safely.

The unexpected outcome was that because I knew my exact position from month to month, I was no longer playing catch-up; I now used Hnry to plan ahead. I have time to work on growing my business, which is exciting.

I now feel the security I once had as an employee. I have a regular and reliable income that I can bank on. But unlike an employee who tends to be stuck on their pay rate, I can scale my business if I want to.

My success with Hnry spilled over to my husband, a PAYE employee who can do freelance work. Previously, he would turn this work down because it was too difficult, time-consuming, and not financially viable to set money aside for tax and pay an accountant to calculate his obligations. Now that he’s also a user of Hnry, he has readily accepted all sorts of interesting freelance work.

As a family, we have collectively replaced my missing PAYE income. I don’t doubt that over the next 12 months, we will increase our total household income even more.

I approached working with Hnry very methodically, and it paid off. What felt like a bold move (giving up my day job) now seems obvious, and I have Hnry to thank for helping me through the transition.

Share on: