We’re not going to sugarcoat it; inflation has been especially hard on sole traders.

If you’ve been feeling the cost-of-living pinch, you’re not alone. As of October 2022, 74% of sole traders say they’re eating into their savings, or saving less, and a whopping 85% are paying more for their supplies and services.

In more bad news, rates aren’t rising to keep up with increasing costs. Fewer sole traders raised their prices in the last few months than during the beginning half of this year, suggesting that we’re hitting a pricing ceiling. Worst of all half of all sole traders believe they’ve worked for less than minimum wage in the last six months.

We aren’t going to suggest that there’s a silver lining to all of this - it’s been a rough few years, and you don’t need to hear any more empty cliches/platitudes. What we have for you instead are five practical suggestions to help ease the strain of inflation on your sole trader business.

1. Automate everything you can

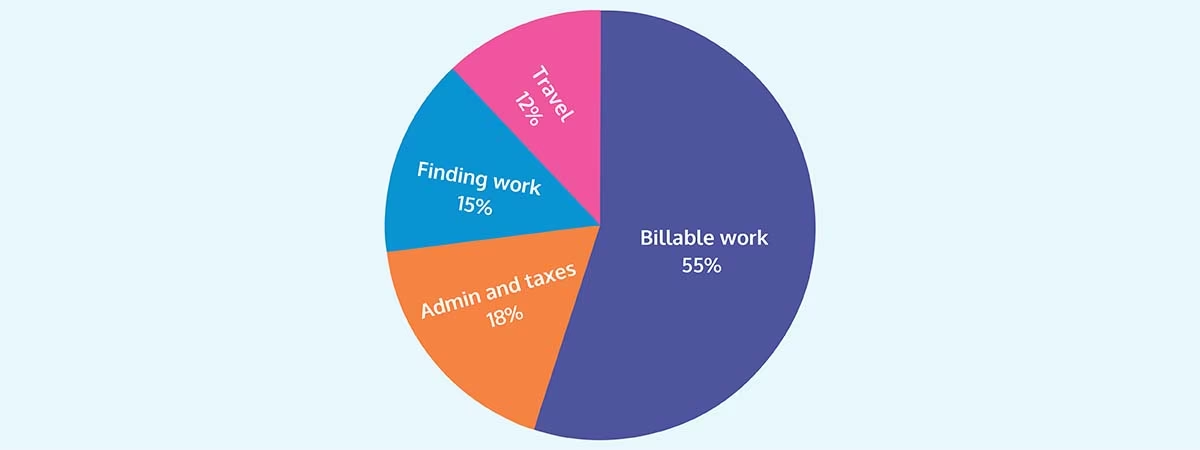

Research shows that sole traders are only spending around half of their working week (55%) on actual work - the rest gets taken up with admin and taxes (18%), finding work (15%), and things like travel (12%). Freeing up some of this time could mean taking on more projects, or working bigger contracts, resulting in a boost to your bottom line.

Start by identifying the boring, repetitive tasks that drain your soul. For example, is chasing invoices taking up a lot of your time? Are you struggling to find new clients? At the risk of sounding like an infomercial, are taxes getting you down? Good news - there’ll be a way to either streamline that task, or automate it completely!

Once you know what you don’t want to deal with anymore, you can start finding the right solution for your needs. That could mean anything from creating a booking form on your website, to building an automatic sales pipeline in excel, to letting Hnry automatically chase clients who are late paying their invoices (politely, of course).

Automating now can mean huge time savings down the line. If you can free up just two extra hours a week, you’ll save 104 hours per year – that’s the equivalent of creating an extra two and a half working weeks a year. What could you do with that extra time?

- No more reconciling transactions - we do it all for you every time you're paid into your Hnry Account

- No more chasing invoices - if a client is late paying, we'll send them a reminder email. People who use this feature get paid an average of 5x faster!

- No more saving expense receipts - simply take a photo, upload it to the app, and we'll manage your expenses and store your receipts for you

- No more calculating and deducting your own taxes - we calculate, deduct, and pay all your taxes every time you get paid.

2. Claim all the deductions you’re entitled to

We can’t stress this one enough: Claiming business expenses can save you thousands of dollars each year. If you’re not claiming everything you’re entitled to, that’s significant savings left on the table.

The problem is, the IRD doesn’t automatically accept every business expense as a tax deduction.

As a general rule, you can claim a tax deduction for a business expense as long as:

- the expense relates directly to earning income,

- or running your business.

This, however, is just a starting point. You should also know that:

- Not every business expense will be a valid tax deduction

- Not every tax deduction is a business expense

- Some tax deductions are industry specific. A tradie won’t be able to claim everything a clown can for example, and vice versa.

We know, it’s as clear as mud. So how do you know that you’re claiming everything you should claim?

- The IRD website and business.govt.nz are good starting points for learning about expenses

- Beyond that, it’s always a good idea to talk through your expenses with an accountant (or Hnry tax specialist in the chat box below!). They might spot something you’ve missed.

💡Confused about what expenses are, what tax deductions are, and how to make the most of both? Check out our mammoth guide to tax deductions.

3. Review your cash flow

If you haven’t come across this term before, it does what it says on the tin: cash flow refers to the flow of cash through your business. Unlike profit, which is a single number calculated at the end of the financial year (usually), cash flow factors in the timing of incoming and outgoing funds. Very simply, positive cash flow means you have more coming into your bank account than going out at any given time; negative cash flow means the opposite.

Take a look at your business’ income and expenditure for a single month. Do the numbers balance, or do you need to make some changes? Do you need to start chasing invoices earlier? Could you renegotiate payment terms with your suppliers? If you can’t avoid negative cash flow, could your business benefit from a loan?

A higher cost of living makes tight margins even tighter. Do anything and everything you can to stay cash flow positive, and give yourself some breathing room.

4. Repackage your services

As the economy contracts, raising your rates might become harder and harder to do. Everyone is trying to get the most bang for their buck, and the fear of losing work due to high prices is a real one. So how do you maintain a fair hourly rate without scaring clients away?

One strategy is to rethink what you offer, and how you price your services.

- If you’re an efficient freelancer writer who charges by the hour, your hourly rate could go up if you charge per project.

- If you’re a tradie, you could bundle small services together into a more cost-effective package.

- If you bake intricate cakes, you could subsidise larger, time-intensive order with quick and high-profit cupcake runs.

- If you’re a makeup artist, you could do drunk glow-up classes at bachelorette parties (we’d sign up).

- If you’re a clown at kids parties… uh… what about retirement homes…? (Sorry, we’re not fully up on the industry, but we’re rooting for you!)

The point is, all business strategies need tweaking from time to time. Now could be a good opportunity to introduce something new.

5. Take care of your mental health

We know that there’s already a lot out there on mental health, so we’re going to keep this short and sweet.

1. You are your business. Your business is you. If your mental health tanks, your business will struggle. From this perspective, taking care of your mental health isn’t just essential, it’s good business sense.

2. It’s tempting to bite off more than you can chew when times get tough, but it’s not a good long term strategy. If you have to put in extra hours, do your best to create time and space to recharge. Pay attention to your own warning signs; don’t push past your limits.

3. Being a sole trader can be hard, especially when you’re just starting out. Don’t be afraid to lean on your networks, and ask for help if you need it. There are a lot of kind people out there who will gladly give you a hand, and one day you’ll be able to do the same for someone else.

4. If possible, don’t neglect the basics. Good food, enough rest, fun exercise, time with friends and family. These four things are the pillars of good mental health, and can keep you steady when things get rough.

Despite all the challenges, being a sole trader is intensely rewarding. The autonomy, freedom, satisfaction, balance - there are so many reasons why more and more people go at it alone.

If you’re struggling right now, know that it won’t last, and you’re definitely not alone. We hope these suggestions have helped in some way, and we’re here to support you in whatever way we can.

🦋 Visit health.govt.nz for more information on ways to take care of your mental health.

🦋 For free mental health articles, apps, and more, you can visit depression.org.nz.

🦋 If you need immediate help, the Mental Health Foundation have a list of free helplines you can call throughout New Zealand.

About Hnry

Hnry is an award-winning service designed to help sole traders manage their tax and financial admin. For just 1% of your self-employed income (capped at $1500 annually), we’ll:

- Calculate and pay your taxes every time you get paid, including GST.

- File your income tax and GST returns whenever they’re due.

- Manage your expense claims - simply upload your receipts to our app and we’ll claim and store them for you.

- Provide any support you might need around your tax and financial admin.

We know how valuable your time is, and we want you to spend less time on financial admin, and more time on the important stuff. Save time, money, and energy with Hnry, and never think about tax again.