Hnry for sole traders

Tax payments

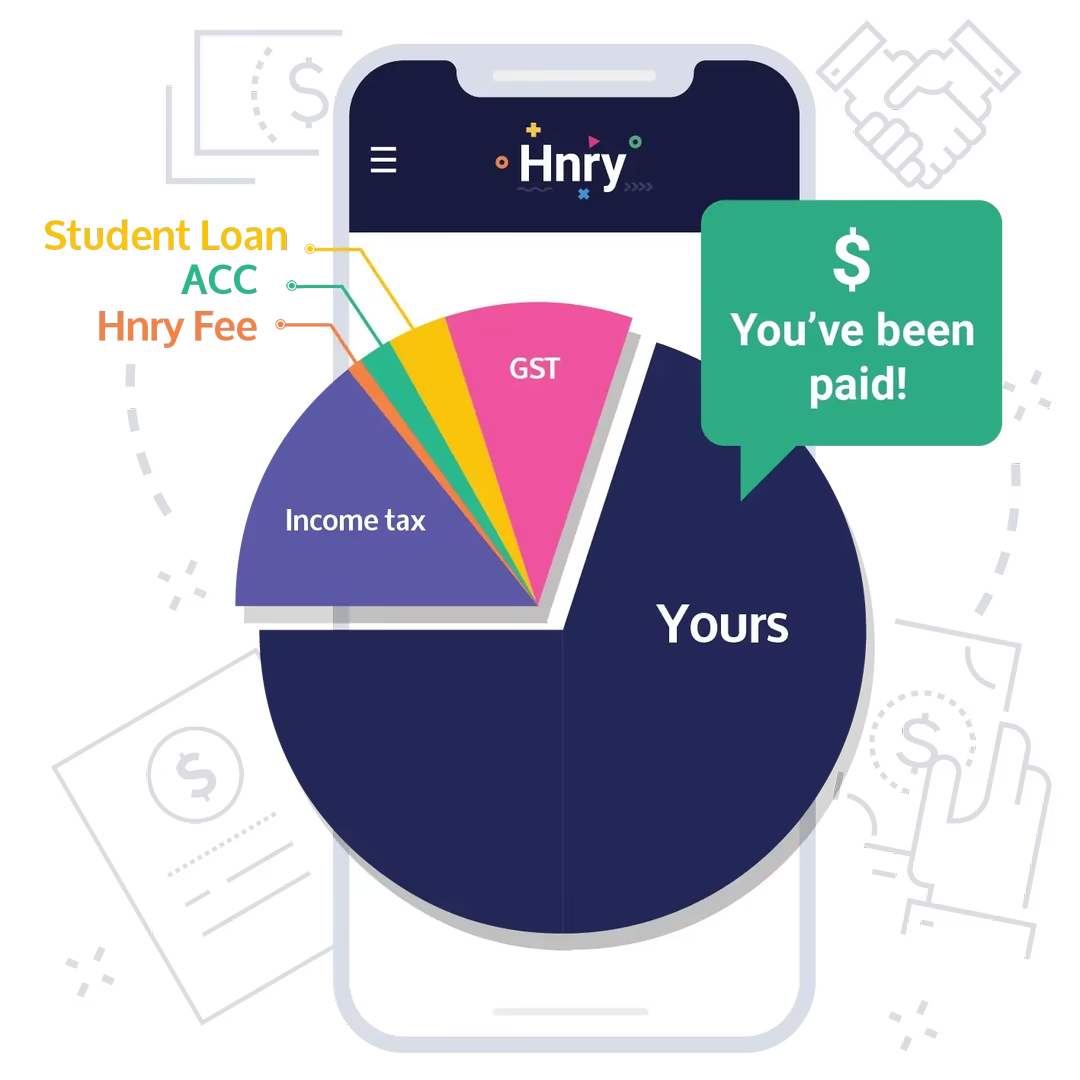

All your taxes (income tax, GST, ACC) automatically calculated and paid as you go.

Tax returns filed

As part of the service, our accountants file all your returns whenever they're due.

Raise expenses

Raise expenses easily - our team of expert accountants will manage them and get you the right tax relief.