Research shows that a whopping 46% of sole traders with business expenses don’t claim all the tax deductions they’re entitled to. That’s an average of $5,611 in unclaimed deductions per sole trader, per financial year – which is straight up mind-blowing.

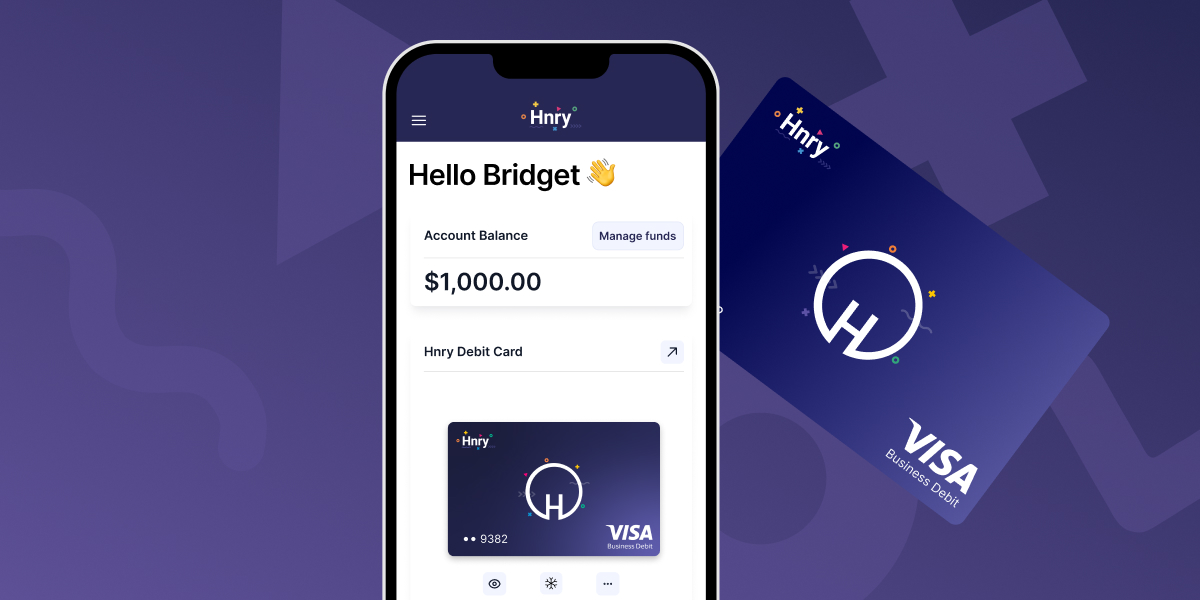

So we’re pretty excited to announce the launch of Hnry Debit Cards – a neat little tool to help capture and claim every business expense, and get you that sweet, sweet tax relief as you go.

Hnry Debit Cards work like a normal virtual Visa debit card, only they’re directly connected to your Hnry Account. Every time you use your card to purchase a business expense, a new expense is raised under the “Expenses” tab. Once you upload your purchase receipt and add a few details, the expense will be managed and claimed.

Easy as!

Best of all, Hnry Debit Cards are included as part of the 1% +GST Hnry fee (capped at $1,500 +GST) – no sign-up costs, no extra bank fees.

With Hnry Debit Cards, it’s now easier than ever to keep track of and claim business expenses. Never miss an expense claim again!

Why use a Hnry Debit Card?

Great question! You know how when you make a business purchase, you have to keep the receipt? For seven years (as required by the IRD)?

And then at the end of the financial year, you have to dig out all these receipts again and figure out what you’re claiming, when you bought it, and for how much? And add all these details to your tax return? Before calculating the final amount of tax you owe?

Yeah, not fun. Enter Hnry Debit Cards.

With Hnry Debit Cards:

- All your business transactions will be recorded in one place

- Expense claims are raised automatically with each purchase, ready for you to upload the receipt and add a few last details

- You can then forget about that receipt – we store it for you for the required seven years. No receipt-box-of-sadness necessary.

- All your raised expenses get managed and claimed for you by the brilliant and devastatingly attractive Hnry team. We’ll file it all with your tax return, and you’ll get the tax relief in real time.

If you’re already an avid Hnry User who doesn’t have to worry about doing their own taxes, a Hnry Debit Card still makes it easier to get all the tax deductions you’re eligible for.

It’s like becoming a Pokémon master – gotta claim ‘em all!

💡 If it’s getting close to the end of the financial year, you can still sign up for and use your Hnry Debit Card at any point. Just remember to add photos of your receipts to expenses raised in the app, and we will manage and review them like any other expense!

How Hnry Debit Cards work

Hnry Debit Cards are powered by Visa, and are currently virtual cards only. You can use your Hnry Debit Card details to shop online, or add them to Apple Wallet or Google Wallet to complete your transactions in store.

To get started using Hnry Debit Cards, you’ll need to:

- Access your card details

- Add your card to Apple Wallet or Google Wallet

- Add funds to your Hnry Debit Card (via your Hnry Account)

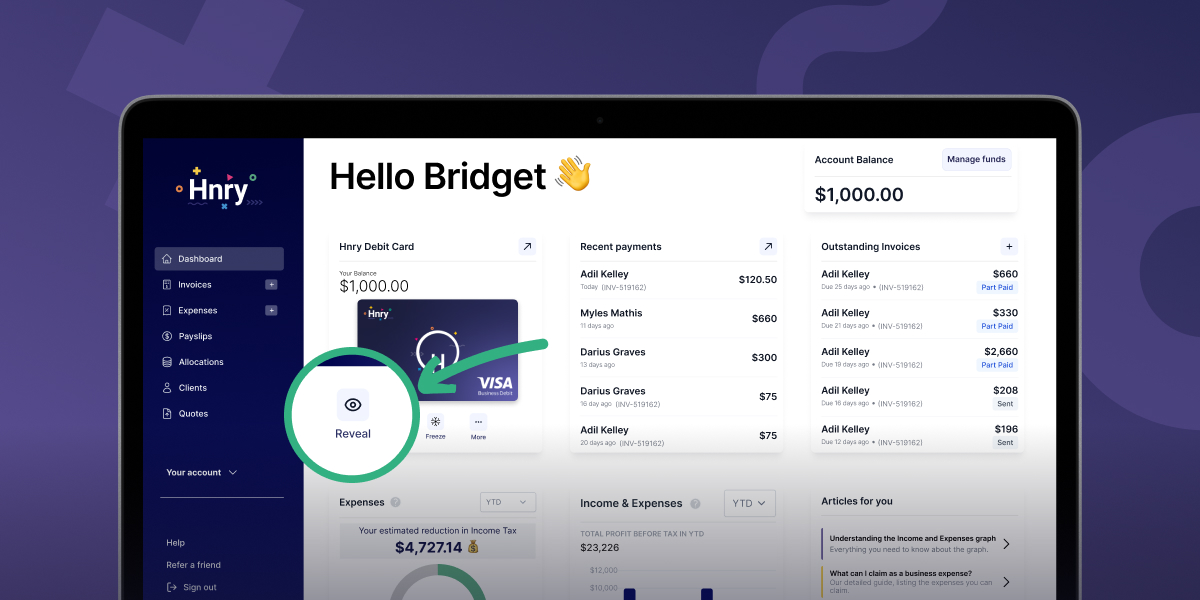

1. Accessing your Hnry Debit Card details

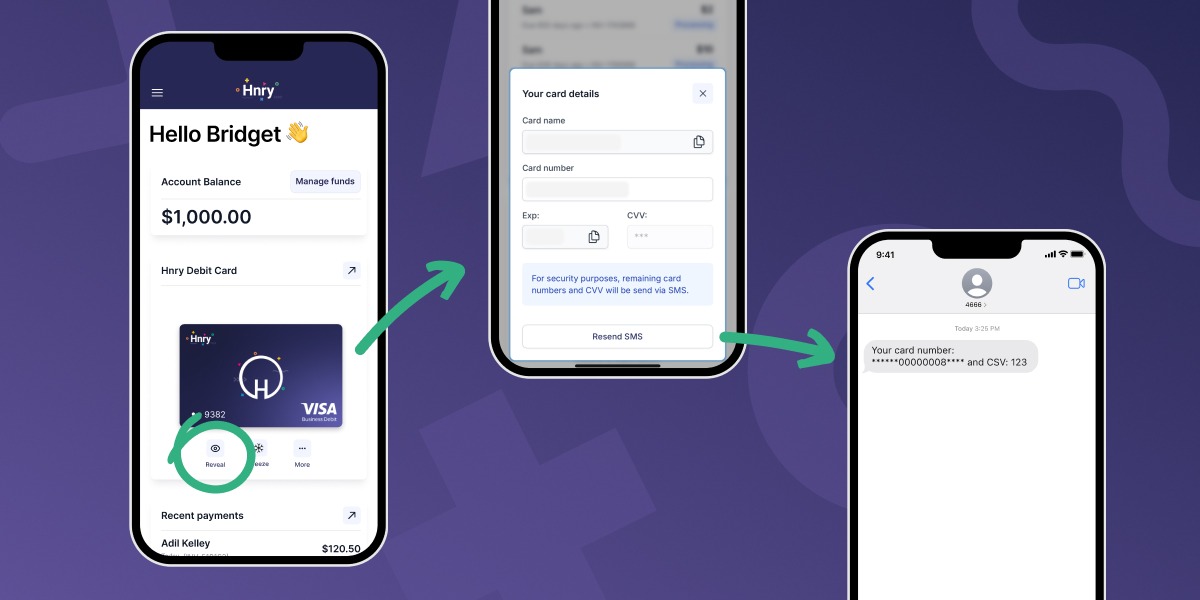

Your card details can be accessed from your Hnry Dashboard. In the “Hnry Debit Card” module, click on “Reveal”.

You’ll then be able to see most, but not all, of your card details in the app. For security reasons, the middle section of your card number and the CVV code are sent to you via SMS.

💡 To help keep your account secure, the Hnry team can’t access your card details. We’ll also never ask for them.

If you’re going to be using your card details a lot, you can add them to your Google Wallet, or Apple Wallet, or keep them somewhere else that’s secure – just remember to guard it with your life! Or at the very least, your dog. Definitely not a goldfish.

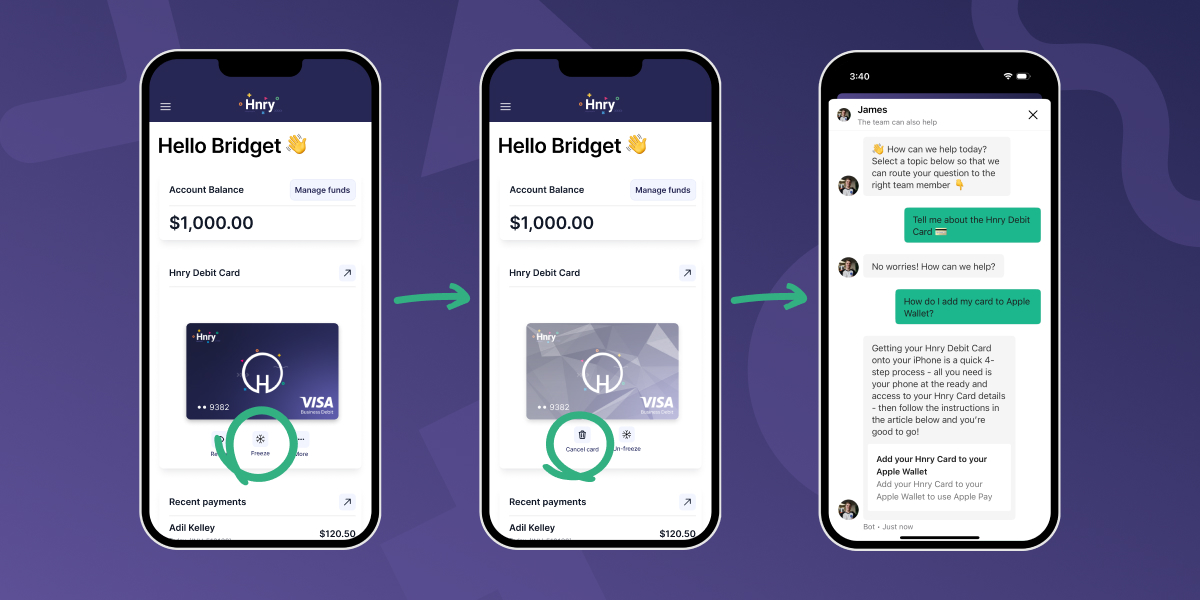

2. Add your card to Apple Wallet or Google Wallet

Once you have your details in hand, you can add your virtual card to your Apple Wallet or Google Wallet on your phone.

For more information on how to do this, check out this Apple Wallet tutorial, or this Google Wallet tutorial.

3. Add funds to your card

Hnry Debit Cards draw funds from your Hnry Account, not your personal bank account. This means that you have to add funds to your Hnry Debit Card before using it to make a purchase.

Usually, every time you get paid, we automatically calculate, deduct, and pay your taxes, and pass on the rest straight to your personal bank account. But if you want to use a Hnry Debit Card, you’ll need to make sure that there are funds left in your Hnry Account available for you to use.

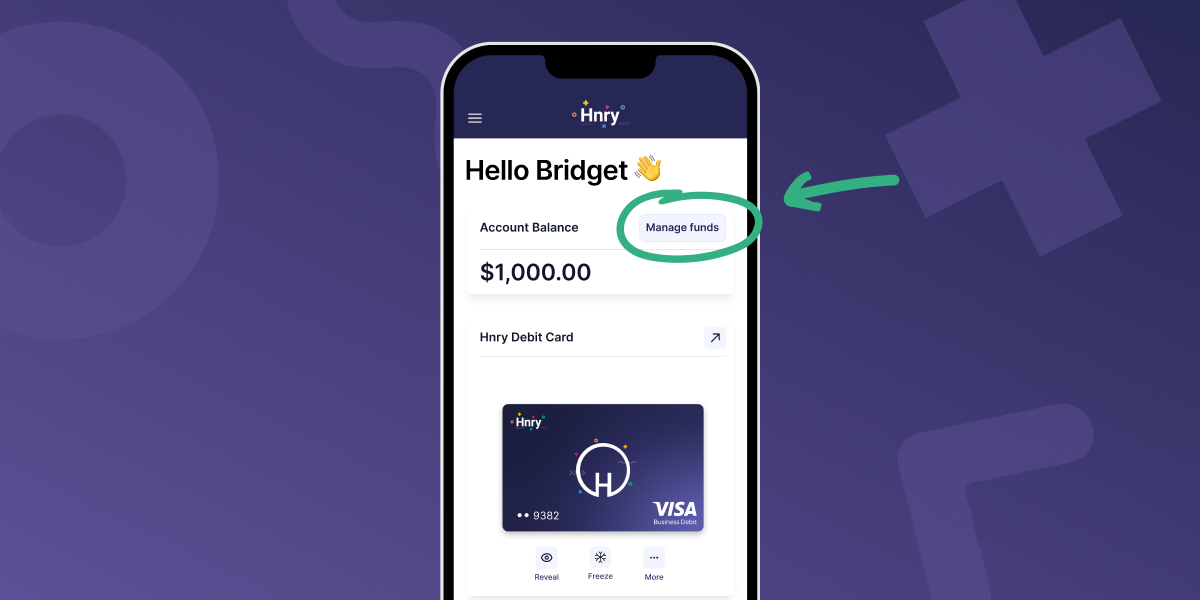

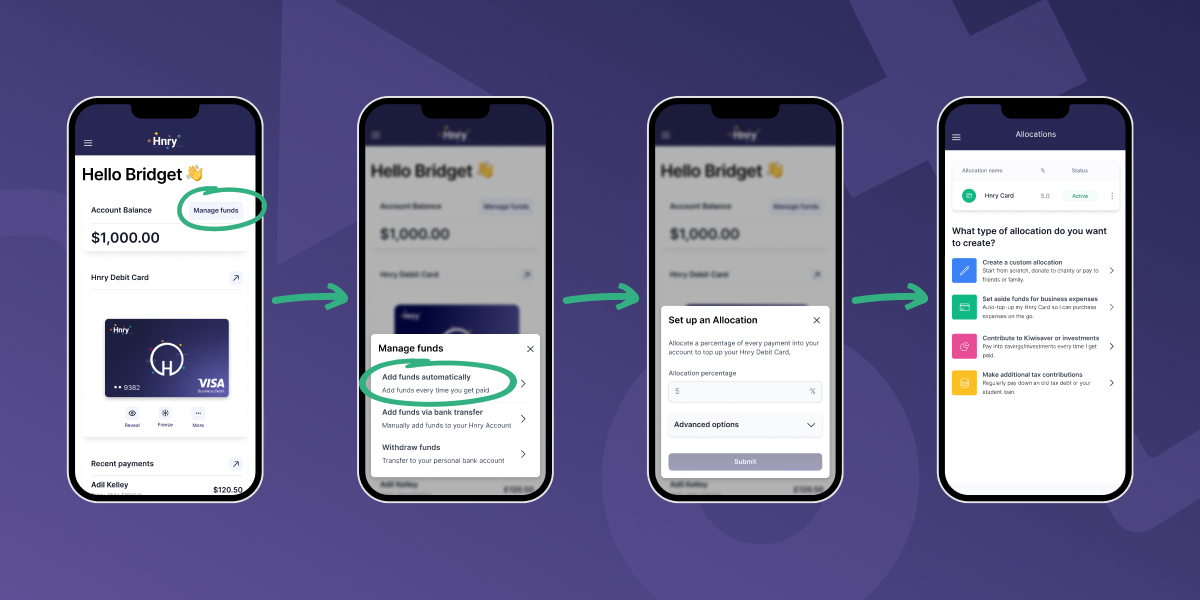

There are two main ways to do this (both accessed via the “Manage funds” button in the Account Balance module).

1. Add funds via bank transfer

To add funds by bank transfer, you’ll need to transfer funds from your personal bank account to your Hnry Account.

💡 Funds need to be transferred from the personal bank account registered to your Hnry Account. Otherwise, transferred funds may be processed as a client payment!

You’ll need to:

- Include the reference “Add funds”

- Make the payee name

- your first initial

- your last name

- and include “(via Hnry)” at the end

- Use your Hnry Account number as the bank account number

… and you’re done!

💡 Make this easier by saving these details as a payee in your banking app (including the reference, if you can). For extra points, you can set up an automatic payment so you’ll never be caught short!

2. Add funds every time you get paid

You can also add funds every time you get paid by creating an Allocation.

To create an Allocation, hit the “manage funds” button on the module. Select add funds automatically and enter the percentage of each pay you want add.

For example, if you enter 5%, we will automatically send 5% of each pay you receive through your Hnry Account to your Hnry Debit Card.

Using your Hnry Debit Card

Using your Hnry Debit Card is as simple as tap, snap, and confirm.

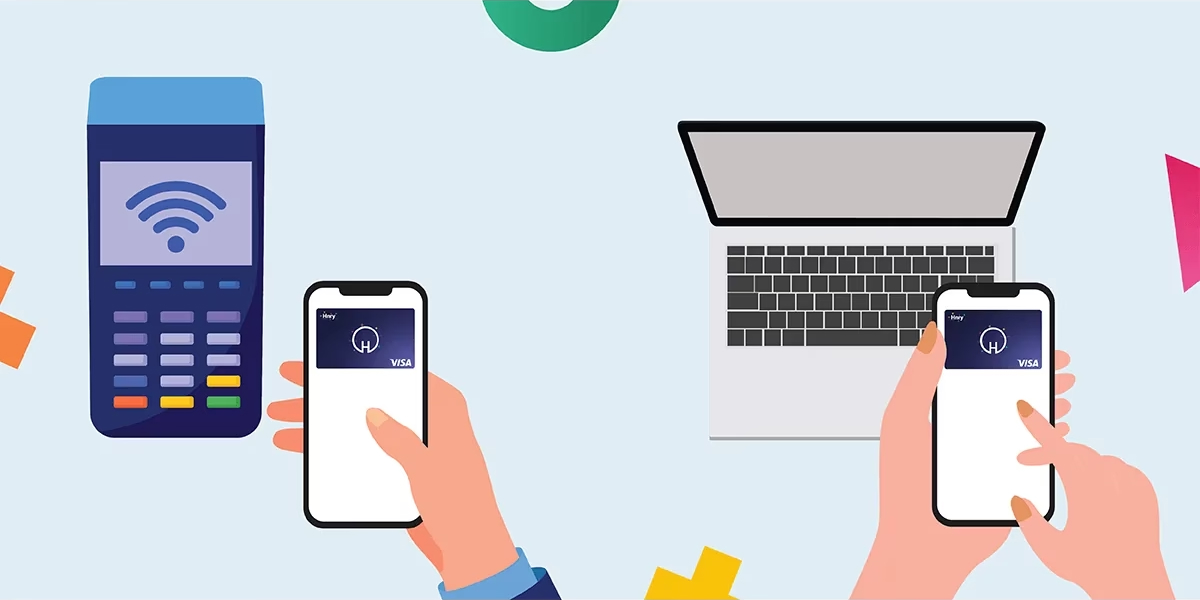

Tap

When making a business purchase, use your Hnry Debit Card to make purchases in store through your Apple Wallet or Google Wallet.

Simply tap your card against a PayWave terminal the way you would any other card, and you’re good to go!

(Or tap your card details into an online payment page – whatever floats your boat.)

Snap

Snap a quick pic of your receipt, and upload it to the new expense that’s just been raised for your purchase in the Hnry App (under the “Expenses” tab).

Then – and this is important – never think about that receipt again.

Confirm

Add the final few details – like the cost of the purchase, and if it’s GST inclusive – to your raised business expense, before hitting “Submit”.

That’s it. Expense raised. We’re all done here!

Other important Features

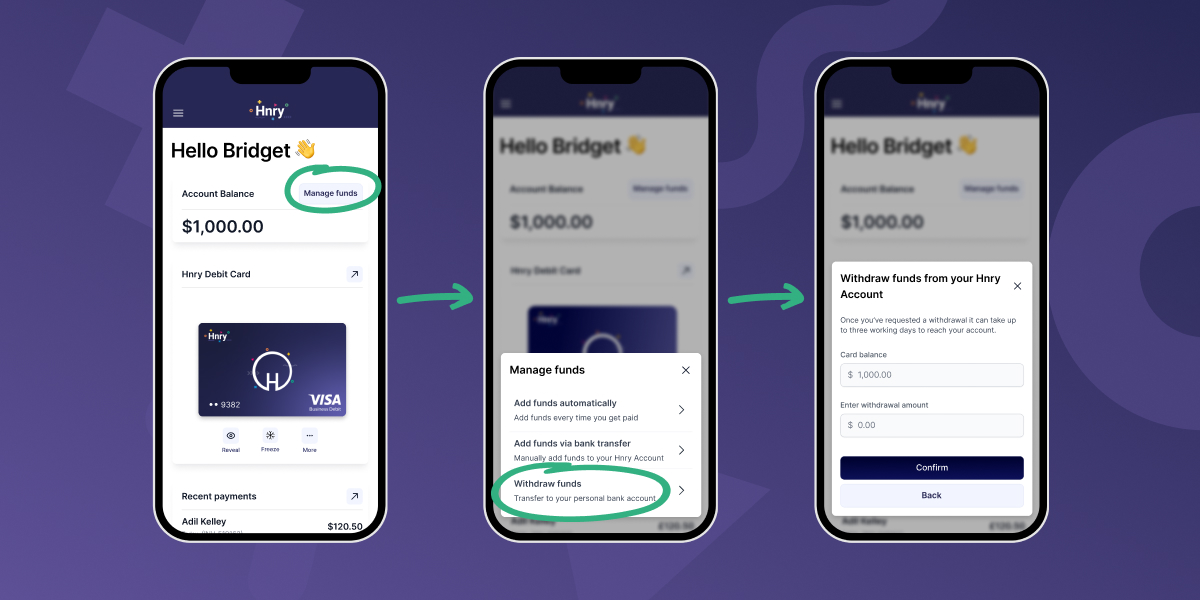

Withdraw Funds

If you need to access your Hnry Debit Card funds, for whatever reason, you can request to “Withdraw Funds” via the dashboard module.

First, click the “More” button in the Dashboard module.

Then select “Withdraw funds” from the options available. Enter the amount you want to withdraw, and it’ll be sent on its merry way to your personal account. Easy!

Freeze this card

If your card details are compromised, you can freeze your card to prevent it being used, just like any other debit card.

Simply click the “Freeze” button in the Hnry Debit Card module on the Dashboard.

Cancel card

And if it’s really not working out for you for whatever reason, you can cancel your Hnry Debit Card. This option becomes available once you’ve frozen your card.

Expense claims made easy with Hnry Debit Cards

We’re on a mission to make sure that sole traders never leave a tax deduction unclaimed again.

That’s why we created Hnry Debit Cards – to make purchasing, raising, and claiming business expenses easier than ever before.

With Hnry Debit Cards:

- Expenses are raised as you go

- Deductions are claimed as you go – so you get that sweet tax relief in real time

- No more pile of receipts stashed around the place

Best of all, there are no extra subscription/bank fees.

And don’t forget – on top of keeping track of all your business expenses, we automatically calculate, deduct, and pay your:

AND file your tax and GST returns – all for 1% +GST of your self-employed income, capped at $1,500 +GST annually.

So if you’re ready to give cards a whirl…

As with everything - conditions and exceptions apply. For more info, check out our Legal Page.