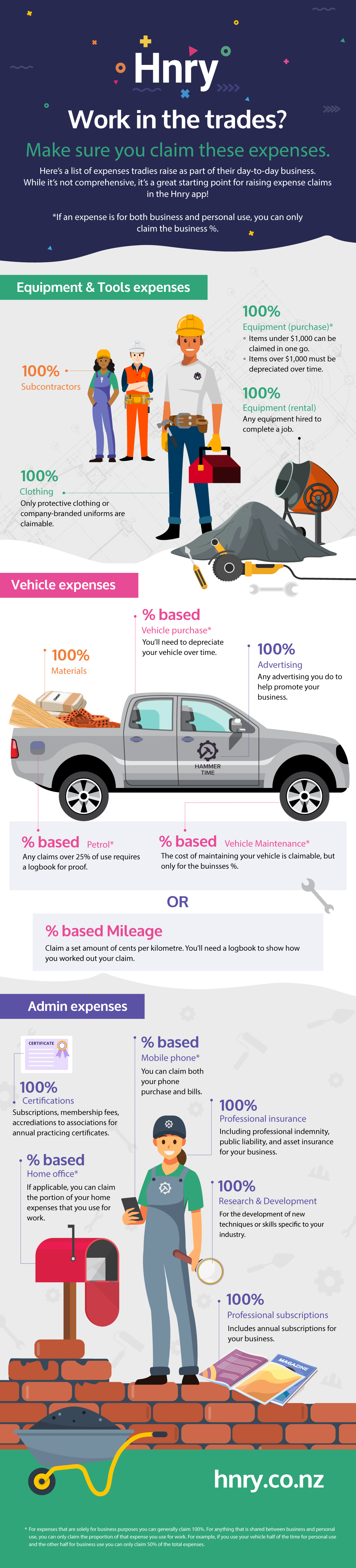

Here is a list of common expenses tradies can raise as part of their day-to-day business activity. While this list doesn’t have everything you can claim, it’s a great starting point for you to maximise your tax deductions.

What you get with Hnry

As a sole trader, Hnry will automate your tax obligations so you’ll never think about tax again.

Automatic tax calculations and payments

Whenever you get paid, Hnry automatically calculates, deducts and pays all of your taxes on your behalf, so you’re always up to date on your tax payments. Income tax, GST, ACC, and student loan - all calculated and paid as you earn!

All expenses managed by our expert team of accountants

Raise an expense in seconds - it’s as easy as snapping a photo. Our expert accountants manage all your expenses to get you the right tax relief and give you peace of mind on what you’re claiming!

All tax returns lodged by our accountants

As part of the service, our accountants will lodge all of your returns (income tax, GST and ACC) whenever they’re due.

As a sole trader, you get complete confidence that your taxes are done correctly - and on time!

![[Infographic] Expenses tradies should be claiming](/img/hero/tradies-expenses-hero.jpg?_cchid=4bfb31b1fc252ca8a8541c19b24b91f7)