We all love talking about profit – who doesn’t enjoy seeing those numbers climb? But there’s another financial concept that’s equally, if not more, critical to keeping your business afloat: cash flow.

Why is cash flow important? Imagine running a profitable venture, only to watch it sink because there’s no cash available to cover day-to-day expenses. Yes, that’s how vital positive business cash flow is. It’s the lifeblood of any sole trader business, ensuring you can pay your bills, buy supplies, and keep your business running. And, of course, pay yourself – after all, that’s why we’re here!

Let’s talk mastering your cash flow, and how to keep your business thriving.

What is cash flow?

Cash flow is literally the flow of cash through a business. Incoming cash includes sales of your products or services, as well as money from tax rebates, grants and any assets you may have sold, such as equipment. Outgoing cash could be things like the cost of goods sold, buying new equipment, or paying off loans.

Think of cash flow as a snapshot of your bank account in any given period, showing when money actually arrives and leaves (not when an invoice is sent or received). It’s different to profit which just shows if you’re earning more than you’re spending. Cash flow isn’t like a budget either where you allocate spending – it’s all about real-time cash in and out, and lets you know whether or not you have money in the bank when you need it.

Imagine your cash flow as a tide – money comes in waves and goes out in waves. Managing those tides effectively is what keeps your business afloat.

Positive and negative cash flow

Positive cash flow means you’ve got cash on hand to cover all your financial obligations, from paying for supplies to paying your taxes, as they arise.

Negative cash flow means the literal opposite. This might result from overspending, increased costs or clients not paying you. Without sufficient cash at your fingertips, you may be forced into taking out high-interest loans, which can drain your long-term profits. Oof.

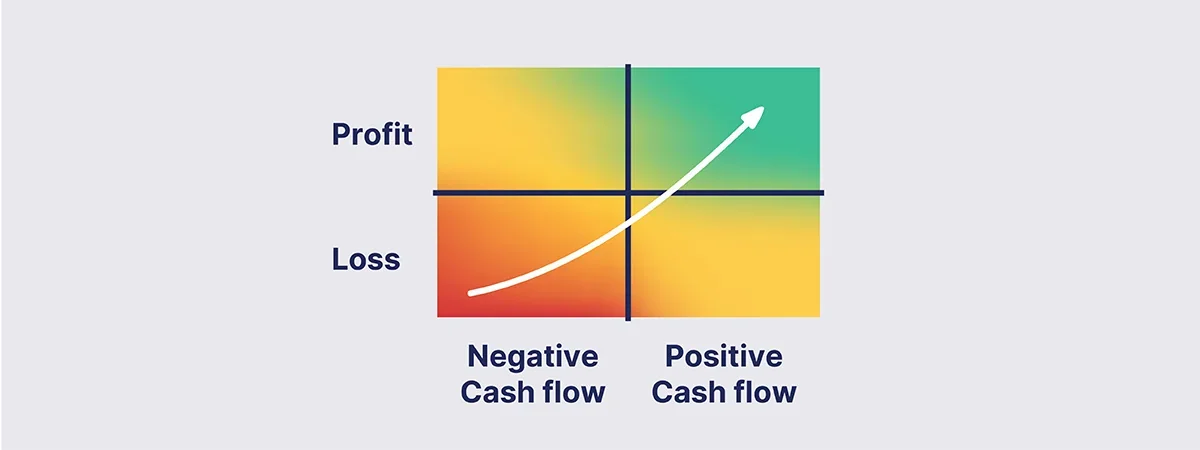

Here’s a handy visual to explain the impact of cash flow vs. profit and loss:

The sweet spot for any sole trader is when your business is turning a profit and you’re cash flow positive all year round (top right of the quadrant). That’s the dream!

On the flip side, the nightmare scenario is making a loss and being cash flow negative (bottom left). Yikes!

However, there’s a tricky middle ground where you can be profitable but still have negative cash flow (top left). Sounds confusing, right? Here’s the kicker: By the end of the financial year, you might see that you’re profitable because you’ve earned more than you’ve spent. But, if you didn’t have a steady stream of cash coming in throughout the year, you wouldn’t have money on hand to cover your daily expenses and buy supplies. This can put your business at serious risk of going under.

Picture this: You’re a furniture maker with a massive $10,000 order – great news! But then you need to spend $5,000 on materials. While waiting for that $10,000 to hit your account, you’re out $5,000 and sitting with no cash in the bank. Sure, you’ll eventually profit $5,000, but right now you’re cash-strapped. How will you keep things running? It’s tough to stay afloat with no cash flowing through your business.

Conversely, you might be making a loss but have positive cash flow (bottom right). This means your cash flow looks good during the financial year, but by year-end, unpaid invoices or being behind on loan repayments might tip you into a loss. Bit of a double-edged sword, right?

How to calculate net cash flow

Managing cash flow might sound like a chore, but trust us, it’s worth it. First, you’ll need to put together a cash flow statement.

What is a cash flow statement? It’s a summary showing money that’s come in and out of your business during a set time. We recommend monthly to keep things practicable.

While there are software solutions that can create this and produce a fancy cash flow report, as a sole trader you may not want the complexity or expense, so you can track your cash flow via these easy methods:

Calendar: Simply make a note of your incomings and outgoings on the relevant days. Eg on 20 May, you write ‘$10,000 expected income’, and on 10 June you write ‘bill for $5,000 due’.

Spreadsheets: You can create your own spreadsheet with a cash flow formula, or use a template, like this one from Business Victoria in Australia.

Subtract your outgoings from your incomings, and this will give you the amount of cash you have on hand during that set period.

Cash flow forecasting

Think of cash flow forecasting as your business’s crystal ball. It predicts future cash flow so you can plan smartly without any sorcery involved (unless you’ve got a magic wand hiding somewhere!).

For example, if you know May to July is usually your busiest period and you expect more cash to come in during this time, you might decide to ramp up your spending or save some money for slower months, depending on what your forecast reveals about your business’s financial future.

It’s true that predicting cash flow can get a bit tricky. If you run a seasonal business, like making Christmas decorations, you probably have a good sense of when sales will spike. But for those in the creative industries, it’s getting tougher to forecast income. Many clients are tightening their budgets due to inflation, and turning to AI instead of human workers (cue “The Terminator” theme!). In these situations, it’s crucial to stay updated on industry trends and adjust your income targets and expenses based on what’s happening around you.

A cash flow forecast allows you to be aware of your likely cash position, spot potential cash shortfalls, and plan for large expenses and taxes (which Hnry can help you with).

How to create a cash flow forecast statement:

- Choose a forecast period: Start with how much cash you currently have in your account (your opening balance).

- List your expected income during the period: Include all sources (sales, grants, GST refunds, tax rebates, proceeds from selling an asset). Tip: To estimate your sales, check out last year’s numbers and look for patterns. Did sales go up, down, or stay steady? Use this information to tweak your sales forecast accordingly. If you’re just starting your business and don’t have historical sales figures, start by estimating all your expenses first. This will give you a clear picture of how much cash you need to generate to cover them.

- List your expected outgoings: Cover both regular and irregular expenses (such as annual subscriptions or repairs).

- Calculate net cash flow: Subtract your outgoings from your incomings to find your closing cash balance for each period. This is the amount of cash you expect to have on hand at that time.

You can use that same template from Business Victoria for your cash flow forecast statement as for your cash flow statement – just add predicted figures into it.

How to improve cash flow so you stay positive

Save for slow months: Stash cash away during peak times to cover slower periods.

Get paid in advance: Try to get payments upfront. If this isn’t possible, make sure you clearly define payment terms and chase invoices to make sure you’re paid promptly (or let Hnry do it for you).

Short-term loans: If you need a quick cash injection, a short-term loan could be useful to tide you over. You could borrow money from a friend or family member, or a bank, or a short-term loan company. It’s important, however, to understand the terms upfront, like:

- How long you have to pay back the money before interest rates kick in

- What rate interest will be charged at

- What happens if you default on the loan

In general, short-term loans might be a last-resort situation – try to exhaust all other options if you can!

How Hnry can help

Miscalculating your tax bill at the end of the financial year can sting. But don’t worry, Hnry’s got you covered. Our award-winning app – created specifically for sole traders like you – takes care of your taxes, so whatever lands in your account is yours to spend.

For just 1% + GST of your sole trader income, capped at $1,500 +GST a year, we calculate, deduct, and pay all your taxes, levies, and whatnot for you, including:

… meaning you won’t have to think about any of that. Ever.

Being a sole trader is hard enough. Hnry has your back. Sign up today, and stay on top of your cash flow by never ending up with a hefty tax bill.