We take the fear out of doing your taxes

Tax payments

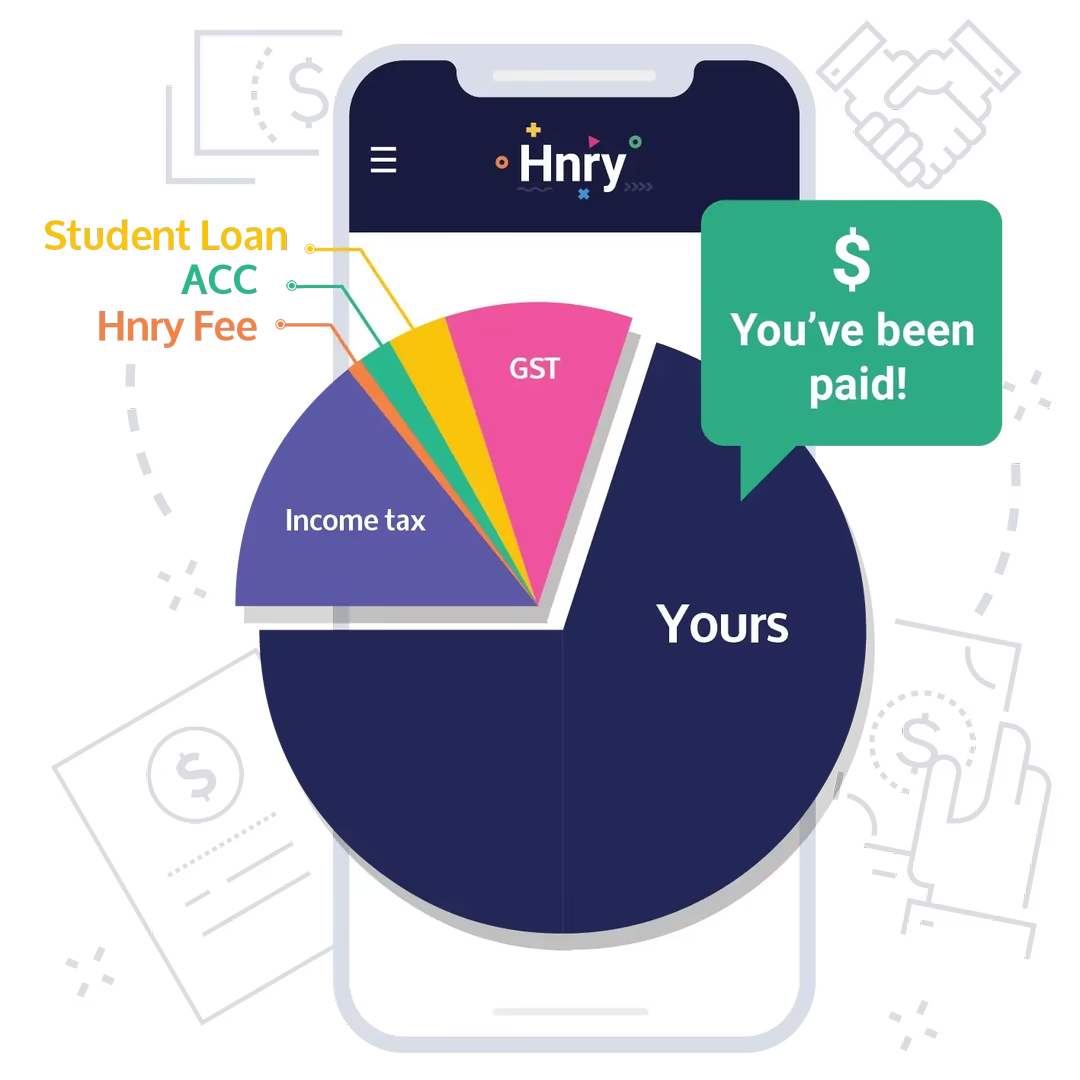

All your taxes (income tax, GST, ACC) automatically calculated and paid as you go.

Tax returns filed

As part of the service, our accountants will file all of your returns whenever they’re due.

Allocate your savings

Automatically send earnings to savings, Super, and investments accounts each time you get paid.