To put it bluntly, income tax is tax that’s levied on your income. Tada!

But hang on, it’s actually slightly more complicated than that. For starters, you don’t pay income tax at the same rate across your whole income. Our progressive tax system means that different dollars are taxed at different amounts, depending which tax bracket they fall into.

Income tax also only applies to certain kinds of income. For example, if your mum gives you $50 for your birthday, that’s technically income – but you sure as heck won’t be paying tax on it!

That’s a lot of info to throw at you in one go. Let’s break it all down.

What is income?

Great question.

Intuitively, you could say that income is any money that comes in (to you). But from a tax perspective, this definition isn’t really accurate. For example, if a friend pays you back for shouting them Burger King last weekend, this money would count as “income” under this definition – but you didn’t “earn” it, and you certainly won’t be taxed on it!

So for our purposes, a better definition is that income is money received in exchange for labour, products, or through investments. In other words, income is money you earn for your work, for things you sell, or through investments.

But income that’s subject to income tax can also include things like pensions, benefits, and certain government payments. You technically don’t receive these in exchange for anything, but they count as income all the same.

What is income tax?

Income tax is a tax levied on income earned. It’s charged at different rates applied progressively, meaning that in general, the more you earn, the more income tax you pay.

Tax rates and thresholds for Financial Year 2025/26

| New threshold | Tax rate |

|---|---|

| <$15,600 | 10.5% |

| $15,601 - $53,500 | 17.5% |

| $53,501 - $78,100 | 30% |

| $78,101 - $180,000 | 33% |

| $180,001 and over | 39% |

Source: IRD

How to calculate income tax

To calculate how much income tax you’ll owe at the end of the financial year, you’ll need to calculate how much tax you’ll owe per bracket.

For example, if you make $55,000 annually, you’ll owe:

- 10.5% on your earnings up to $15,600,

- 17.5% on your earnings from $15,601 to $53,500, and

- 30% on anything over $53,501 (and under $78.1k)

So if you do the calculations:

- 10.5% of $15,600 = $1,638

- 17.5% of $37,900 = $6,632

- 30% of $1,500 = $450

Total income tax bill: $8,720

📖 For more information on how income tax works, check out our guide to tax rates for sole traders.

💡 Remember, you may have other payments to make like student loan repayments and ACC levies – the above information doesn’t take this into account.

How claiming business expenses reduces your tax bill

The IRD allows you to claim eligible business expenses, which reduces the income that you pay tax on – as in, they lower your taxable income. A good way to save on your final tax bill is to claim as many eligible business expenses as you can.

📖 For more information on how tax deductions work, check out our guide to claiming expenses.

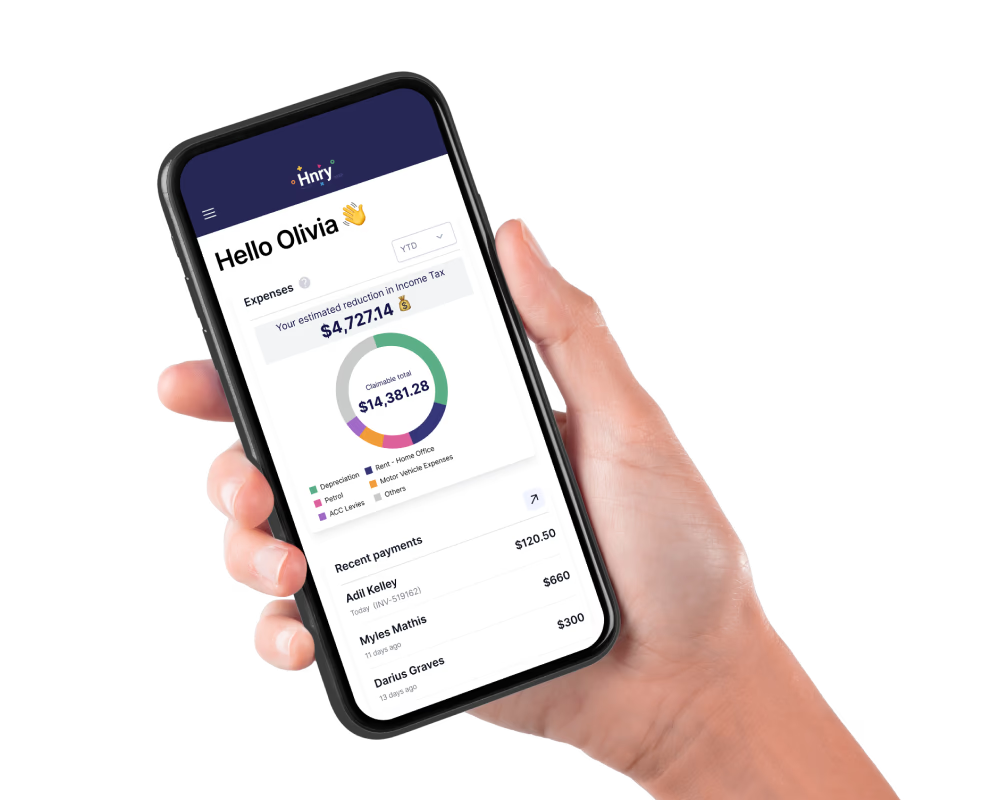

💡 The Hnry Debit Card is the easiest way to claim expenses, and get tax relief in real time. It’s as easy as tap, snap, confirm!

Alternatively, you could skip the maths and just use Hnry (hi, that’s us!).

Hnry is an award-winning app and accounting service for sole traders that automatically calculates, deducts, and pays taxes for your sole trader income throughout the financial year. We do all the maths for you, so you don’t need to worry about any of this, we promise.