Gross income is the total amount of money you’ve earned once you add up all your income – whether through your sole trader business, a PAYE salary, a rental property, or shares and dividends – before you factor in business expenses and taxes.

Basically, gross income is everything that comes in, before taking into account any outgoings. Easy!

How to calculate your gross income

To calculate your gross income, you’ll need to add together all forms of income to get a single grand total. This includes things like your sole trader earnings, any dividends earned, and any bonus income you made selling knitted teddies on Etsy. It all counts!

- PAYE salary: $80,000

- Chocolate sales: $15,000

- Dividends from shares: $500

The key thing to remember is that all income streams count toward your gross income total – whether you’re employed, self-employed, or earning from investments. The IRD wants to know about every dollar coming your way (they’re thorough like that).

Why does gross income matter for sole traders?

Understanding your gross income is crucial because it’s the starting point for all your financial calculations. It’s like knowing how much flour you have before you start baking – you need to know what you’re working with before you can figure out what you’ll end up with.

(Don’t think too hard about that analogy.)

Your gross income helps you:

- Calculate how much tax you’ll owe across all income streams

- Work out your business expenses as a percentage of total income, for planning purposes

- Create budgets and set realistic financial goals

- Understand your overall earning potential

For sole traders like Louis, knowing his total gross income helps him see the bigger picture. While his chocolate business might seem small compared to his day job, that extra $15,000 could significantly increase his effective tax rate – something worth knowing when planning his finances.

💡 An effective tax rate is exactly what it says on the tin: the actual percentage of your total income that you pay in taxes.

Most importantly, understanding gross income gives you a better picture of your financial situation. It sure feels good to receive a payment for $2,000 from your biggest client – but that’s not necessarily all yours to spend.

Speaking of which –

How is gross income different from net income?

Here’s where things get interesting (and by interesting, we mean slightly less exciting for your bank balance). While gross income is your total earnings from all sources, net income is what you actually get to keep after all the necessary deductions.

Let’s return to Louis. His gross income of $95,500 looks pretty healthy, but after income tax, ACC levies, student loan repayments, and business expenses for his chocolate venture (ingredients, market stall fees, equipment), his actual take-home pay, his net income, will be significantly less.

Think of gross income as the money you earned on paper, and net income as the money you can actually spend on coffee and rent (priorities!).

The gap between gross and net income can be particularly eye-opening for sole traders who are used to PAYE employment. Employers generally handle most tax deductions automatically, meaning most employees don’t even think about their taxes. That’s not the case for the self-employed, who have to sort their sole trader taxes on their own.

(Although, they don’t actually have to, because –)

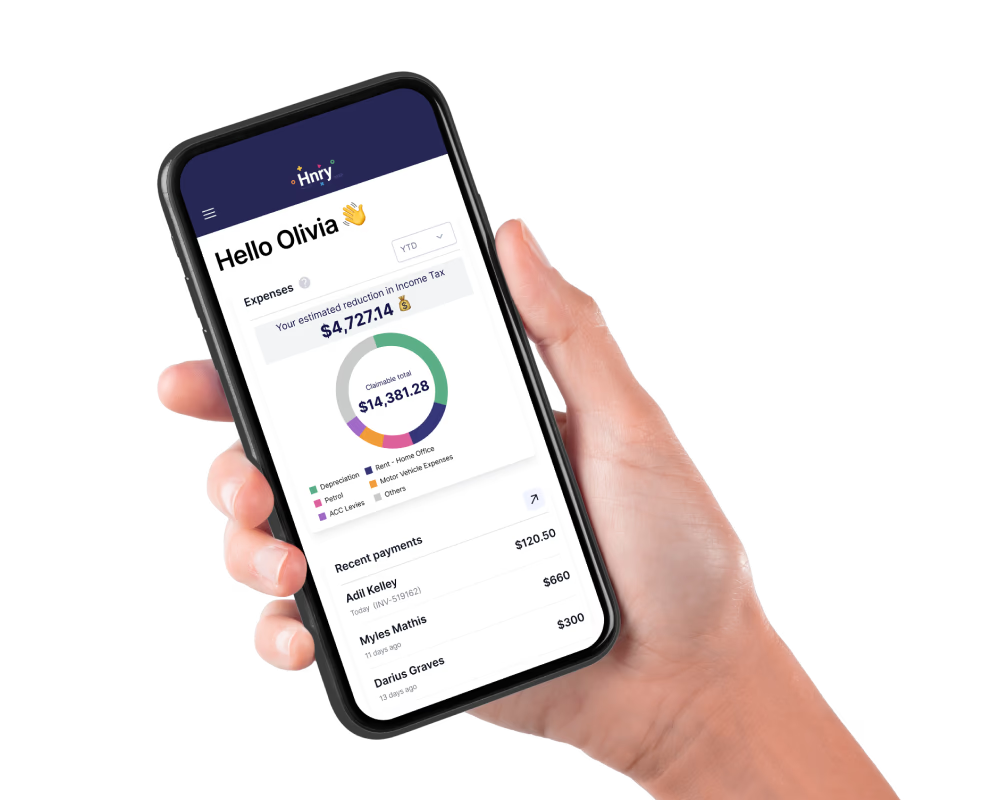

Hnry has your back

If juggling multiple income streams and calculating your total gross income sounds about as fun as doing taxes on a sunny weekend, you’re not alone. Managing finances across different income sources can feel overwhelming, especially when you’re trying to run a business and maintain other work commitments.

This is exactly why Hnry exists. For just 1% +GST of your self-employed income, capped at $1,500 +GST a year, we’ll automatically sort all your sole trader taxes for you. This includes calculating, deducting, and paying your:

…every time you get paid. Plus we file your tax returns for you – it’s all part of the service!

So why not give us a whirl? Join Hnry today and never think about tax again!