Great question! A tax rate is the percentage at which a sum of money – for example, your income, or the price of a good or service – is taxed. In simple terms, it’s the ratio between a sum of money and the tax owed on it, expressed as a percentage.

For example, if you spent $100 and paid $10 in tax, your tax rate would be 10%. Simple enough, right?

Flat taxes vs. progressive taxes

Some taxes use a flat rate, meaning the percentage stays the same no matter what. GST is a good example – it’s a flat 15% on most goods and services, regardless of what they cost or who’s buying them.

Income tax in New Zealand works differently. It’s a progressive tax, which means different portions of your income are taxed at different rates depending on how much you earn. Your income is split into bands, or brackets, each with its own rate.

Here’s how that looks for the 2025/26 financial year:

| Income | Tax rate |

|---|---|

| Up to $15,600 | 10\.5% |

| $15,601 – $53,500 | 17\.5% |

| $53,501 – $78,100 | 30% |

| $78,101 – $180,000 | 33% |

| $180,001+ | 39% |

What’s an effective tax rate?

Because not every dollar you earn is taxed at the same rate, your effective tax rate – the actual percentage of your total income that you pay as tax to IRD – will be lower than your highest bracket rate.

If you earn $55,000, for instance, you don’t pay 30% on all of it. You pay 10.5% on the first $15,600, 17.5% on the next chunk, and 30% only on the small slice above $53,500. Your effective tax rate ends up being around 15.9% – quite a bit less than 30%!

💡 For more on how income tax rates work, check out our guide to tax rates for sole traders.

Can sole traders lower their effective tax rate?

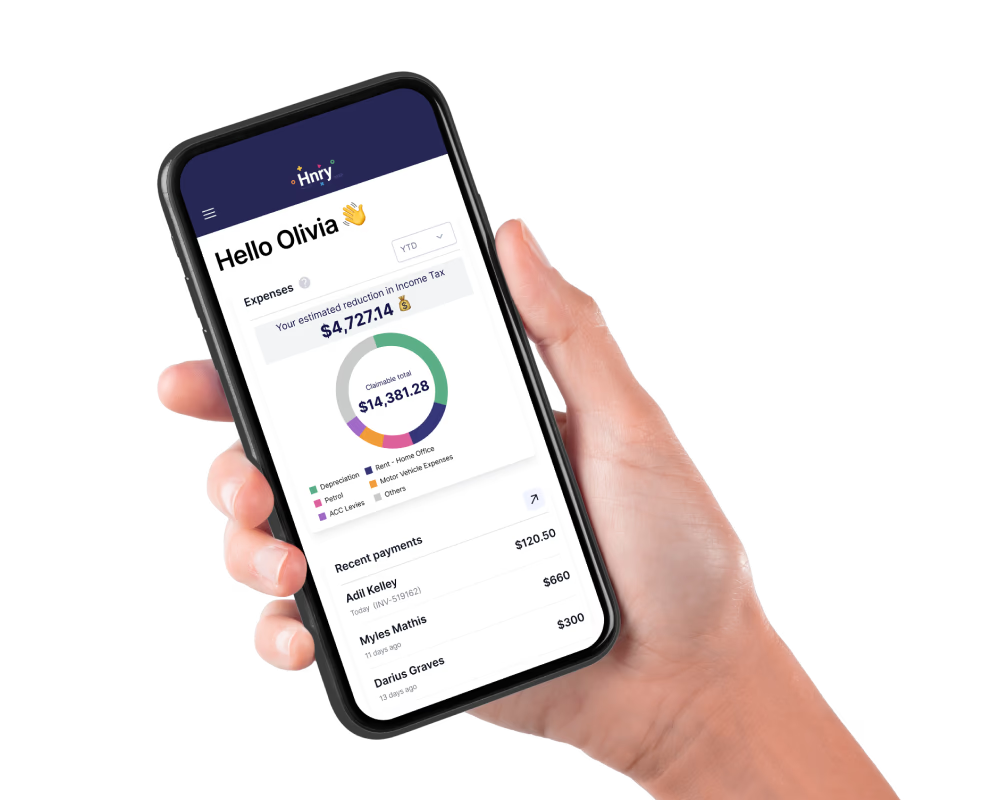

Yes – and this is one of the genuine perks of being self-employed. By claiming eligible business expenses, you can reduce your taxable income, which in turn lowers your effective tax rate.

💡 We explain how this works and more in our guide to claiming expenses.

We may be biased, but we reckon the easiest way to do this is to use Hnry. You can raise expenses in the Hnry App throughout the year, and we’ll factor these into our tax calculations so you get the tax relief as you go. Easy! Join Hnry today.