As a sole trader, your business finances and personal finances are connected. Your earnings need to cover business overheads and expenses as well as personal essentials like rent and groceries. So how do you decide what to spend and what to save? That’s where budgeting comes in.

A budget is a spending plan that assigns your money to different purposes – paying bills, building savings, or reinvesting in your business. Unlike a cash flow forecast that predicts when money arrives and leaves, a budget tells every dollar exactly what to do.

Why you need two budgets

Managing your finances means handling two budgets: personal and business.

Your personal budget covers basics like housing, groceries, utilities, and everyday essentials. It should also include funds for sick leave, holidays, fun money for treats, and savings for the future or retirement.

Your business budget includes what you need to hit your goals – supplies, marketing, expansion plans – plus overheads like rent, utilities, and software subscriptions.

If your business has seasonal fluctuations, budgeting becomes crucial. You can aim to set aside earnings from busy periods to cover quieter months when demand drops. That way, no matter what the year throws at you, you’re always covered!

How to build your budget

Creating a budget takes just a few simple steps using a spreadsheet, notebook, or even scrap paper!

Start by listing all your income. Record how much comes in, where it’s from, and when it arrives (weekly, monthly, annually). If income varies, you can calculate an average. Include everything: sole trader earnings, PAYE income, government benefits, and investment earnings. Use two columns – one for estimated income, one for actual.

Next, list all your expenses. Include regular essentials like rent or mortgage, utilities, council and water rates, household needs, transport, and insurance. Add debts like personal loans, student loans, and credit card repayments. Don’t forget unexpected expenses like car repairs or medical bills. You can check recent bills or bank statements to avoid missing anything. Again, create estimated and actual columns.

Then allocate funds to each expense category, prioritizing what’s most important for your business and personal goals. For example, if you want to improve your online presence, allocate more to website development or marketing. If you’re expanding services, invest in training or new tools.

Keep adjusting as you go

Your budget should fit your current situation, so you’ll need to adjust it as life changes. If expenses spike, you could decide to reduce spending elsewhere or adjust your savings target. If you clear a debt, you can reallocate that money you were setting aside to pay it off to other goals.

Top tip: Peek at your recent bills or statements to spot what expenses you’ve had, how much they cost, and when they were due. Use this as a basis for future budgeting.

Smart budgeting strategies

There’s no one-size-fits-all approach. What works for someone else may not suit your lifestyle or goals, and that’s fine. You’ll need to find what matches your circumstances.

For example, consider separating money into different accounts. Beyond having separate business and personal accounts, you could create specific accounts for everyday shopping, bills, health costs, holidays, and savings. For bonus points: use a high-interest savings account for long-term goals.

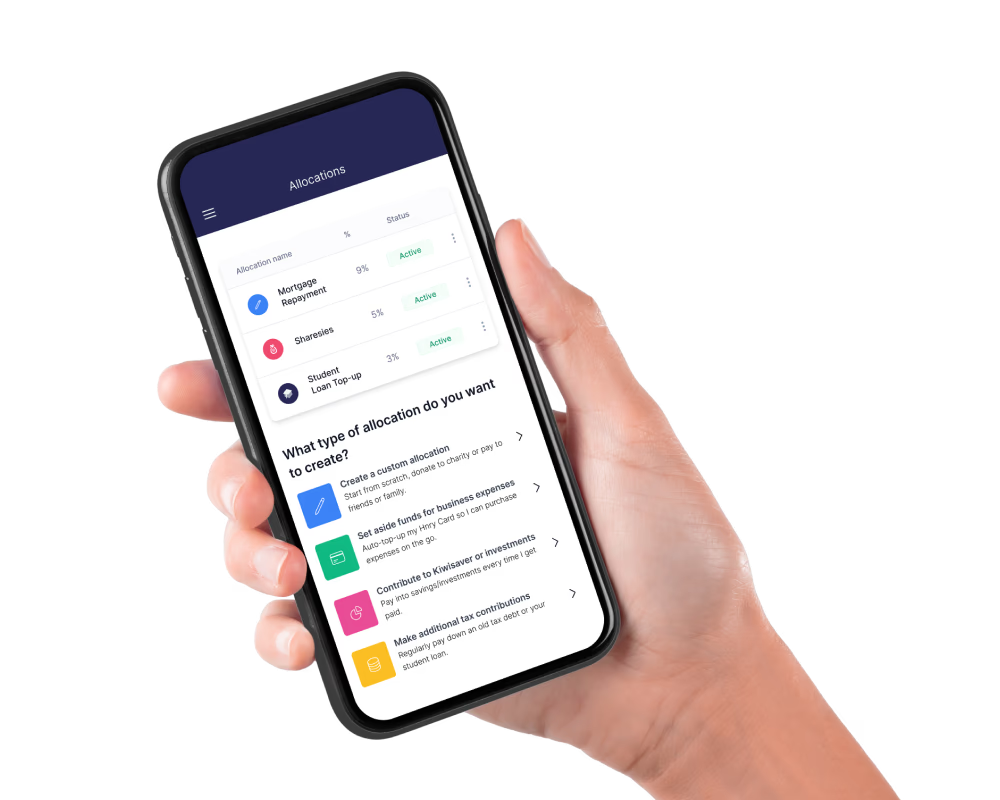

Set up automation with routine transfers to savings or direct debits for bills. Hnry’s Allocations feature makes this easy, keeping your money management on autopilot.

Not a fan of spreadsheets? Budgeting apps can help you track spending, set goals, and stay on target from your phone. Do your research to find one that fits your needs.

Hnry does your taxes

Hnry takes care of all your tax admin automatically. For just 1% + GST of your sole trader income, capped at $1,500 +GST a year, we calculate, deduct, and pay income tax, GST, ACC levies, student loan repayments, and optional KiwiSaver contributions.

Sign up today and make sure a hefty tax bill is something you never have to budget for.