If you’re a sole trader in New Zealand, there isn’t just one tax deadline to worry about – there are several. The dates that apply to you will depend on how you file, whether you’re GST registered, and whether you pay provisional or withholding tax.

Here’s a rundown of the key ones to know.

End of the financial year: 31st March

New Zealand’s financial year runs from 1st April to 31st March. This is the cut-off for the income you’ll be declaring in your tax return, so it’s the date everything else flows from.

Filing your tax return

Once the financial year ends, you have two main options:

If you’re self-filing, your IR3 tax return is due by 7th July. Your residual taxes (anything still owing) are then due by 7th February the following year.

For example, your tax return for the 2025/26 financial year will be due on the 7th of July 2026. Any residual tax you owe will be due by the 7th of February 2027.

If you’re filing through a tax agent, your return is due by 31st March of the next calendar year, with any residual taxes due by 7th April.

So for FY 2025/26, your return is due on the 31st of March 2027. Residual taxes would be due by 7th April 2027.

GST returns

If you’re registered for GST, you’ll have separate filing deadlines depending on your GST period (monthly, bimonthly, or six-monthly). The last GST due date each financial year is 7th May.

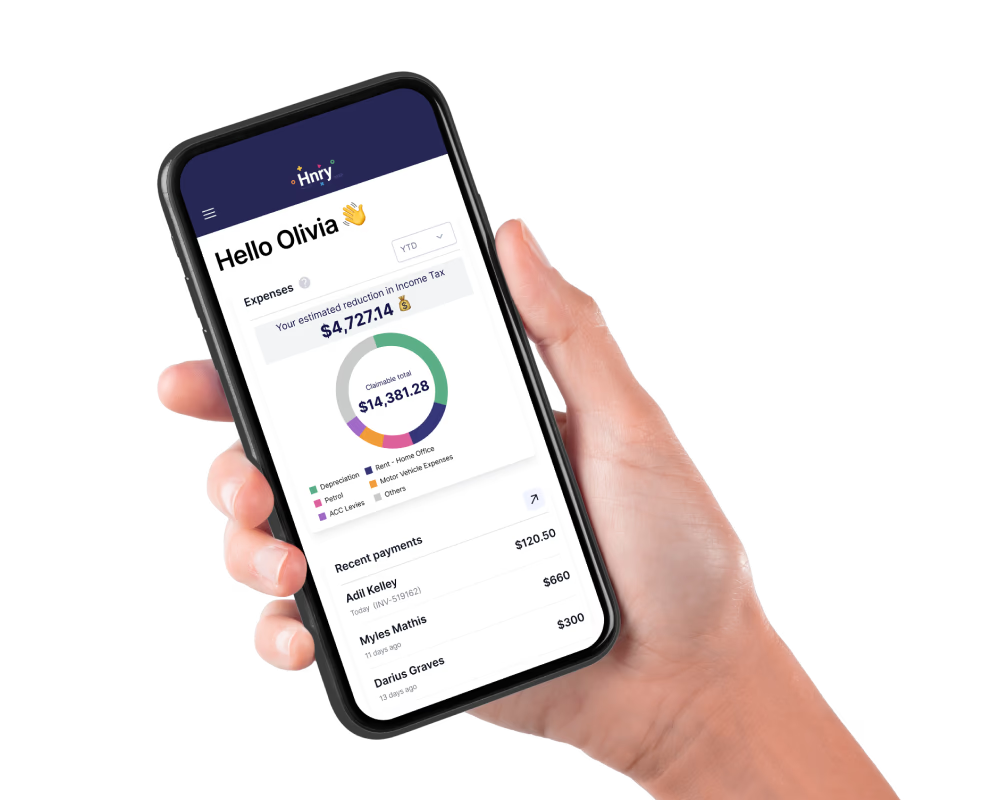

The easy way to stay on top of it all

Keeping track of multiple deadlines across the year is a lot to manage on top of actually running your business. Hnry calculates and pays your taxes throughout the year as you earn, and files your tax return for you — so when EOFY rolls around, there’s no scramble.