If you’ve ever wondered why your tax bill doesn’t seem to match the tax rate you thought you were on, you’re not alone.

New Zealand’s tax system can feel a little counterintuitive at first – but once you understand how tax brackets work, it all starts to make sense.

Here’s what you need to know:

What’s a tax bracket?

In New Zealand, income tax is progressive. That means the more you earn, the higher your overall tax-to-income ratio – but crucially, not every dollar you earn gets taxed the same.

Your income is split into bands, or brackets, each taxed at a different rate. It’s a common misconception that your entire income gets taxed at the rate of your highest bracket – also known as your marginal tax rate.

In reality, you only pay that higher rate on the portion of income that falls within that bracket.

NZ tax brackets for 2025/26

| Income tax bracket | Tax rate |

|---|---|

| Up to $15,600 | 10\.5% |

| $15,601 – $53,500 | 17\.5% |

| $53,501 – $78,100 | 30% |

| $78,101 – $180,000 | 33% |

| $180,001+ | 39% |

How tax brackets work in practice

Say you earn $55,000. Although that falls within the 30% tax bracket, you don’t pay 30% on all your income.

Instead, you’d pay 10.5% on the first $15,600, 17.5% on earnings up to $53,500, and 30% on only the remaining $1,500. Your total tax bill would be around $8,720 – an effective tax rate of about 15.9%, not 30%.

What’s an effective tax rate?

Glad you asked!

Your effective tax rate is the actual percentage of your total income that you pay in taxes. It’s a much more useful number than your bracket rate, because it reflects what you’re really paying. The closer your income sits to the top of a bracket, the higher your effective tax rate will be.

How sole traders can lower their effective tax rate

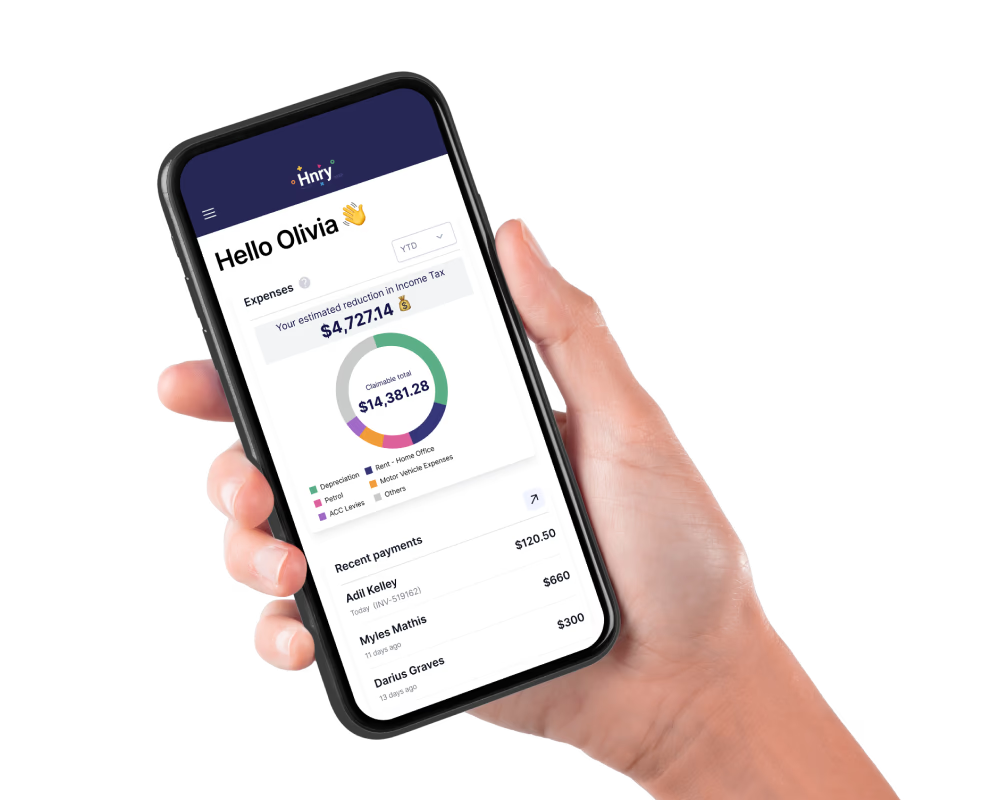

Here’s the good news: as a sole trader, you can reduce your taxable income by claiming eligible business expenses. This lowers your taxable income, which can make a meaningful difference to your final tax bill.

💡 For more info on how claiming expenses works, check out our guide to business expenses for sole traders.

If you’re not sure what you can and can’t claim, a tax specialist (like the Hnry Team!) can help point you in the right direction.