Alright then, let’s get down to business.

You’re probably well aware that if you’re GST registered, you’re required to charge, collect, and pay GST to the IRD. You’ll also need to file GST returns.

Where it gets slightly tricky is that GST returns are generally due on the 28th of the month after your GST period ends (with a few exceptions). Basically, your GST return due dates all depend on which period you’ve registered for.

So, what are the options for GST periods? And what are the corresponding due dates? Don’t worry, we’ve got you covered.

- The three types of GST periods

- GST due dates by period type

- Monthly due dates

- Bimonthly due dates

- 6-monthly due dates

💡You can’t apply for an extension for your GST returns – that’s why it’s super important that you file on time!

GST periods

When you register for GST, you’ll need to decide how long you’d like your GST periods to be. There are three options to choose from:

-

Monthly: Potentially slightly easier to keep track of GST obligations, but does involve the most paperwork.

-

Bimonthly: As in, every two months. It’s not as much paperwork as filing monthly, but is short enough that keeping records isn’t too tricky.

-

6-monthly: Basically, filing twice a year. Less paperwork, but you’ll need to stay on top of the GST flowing in and out of your business for a longer period of time. You’re only eligible for 6-monthly GST periods if your sales are $500,000 or less in any 12-month period.

💡 At this point, you’ll also need to decide whether or not you want to register for GST on a “payments” or “invoices” schedule. For more information, check out our monster guide to GST.

GST due dates by period

Right, so now that’s sorted, let’s discuss due dates.

Your GST returns and payments to the IRD are generally due on the 28th of the month following the end of your GST period. Simple!

There are two exceptions to this rule however – for the GST period ending 31st March, you’ll have until the 7th of May to file. Similarly for the GST period ending 30th November, you get until the 15th of January. It’s a little bit of leeway for the potentially busiest times of the financial year (cheers IRD!).

Because of this, we recommend noting down your due dates in a wall calendar or something – just so they never take you by surprise!

Monthly GST return due dates

If you’re filing your GST monthly, your GST return and payments will be due on the 28th of every month. So to spell that out:

- 28th May 2025 – for the April 2025 GST period

- 28th June 2025 – for the May 2025 GST period

- 28th July 2025 – for the June 2025 GST period

- 28th August 2025 – for the July 2025 GST period

- 28th September 2025 – for the August 2025 GST period

- 28th October 2025 – for the September 2025 GST period

- 28th November 2025 – for the October 2025 GST period

- 15th January 2026 – for the November 2025 GST period

- 28th January 2026 – for the December 2025 GST period

- 28th February 2026 – for the January 2026 GST period

- 28th March 2026 – for the February 2026 GST period

- 7th May 2026 – for the March 2026 GST period

Bimonthly GST return due dates

If you’re filing your GST every two months, your due dates will be:

- 28th June 2025 – for the April/May 2025 GST period

- 28th August 2025 – for the June/July 2025 GST period

- 28th October 2025 – for the August/September 2025 GST period

- 15th January 2026 – for the October/November 2025 GST period

- 28th February 2026 – for the December/January 2025/26 GST period

- 7th May 2026 – for the February/March 2026 GST period

6-monthly GST return due dates

For those with 6-monthly GST periods, you only have two GST return due dates to remember (lucky you!):

- 28th October 2025 – for the April-September 2025 GST period

- 7th May 2026 – for the October-March 2025/26 GST period

Tada!

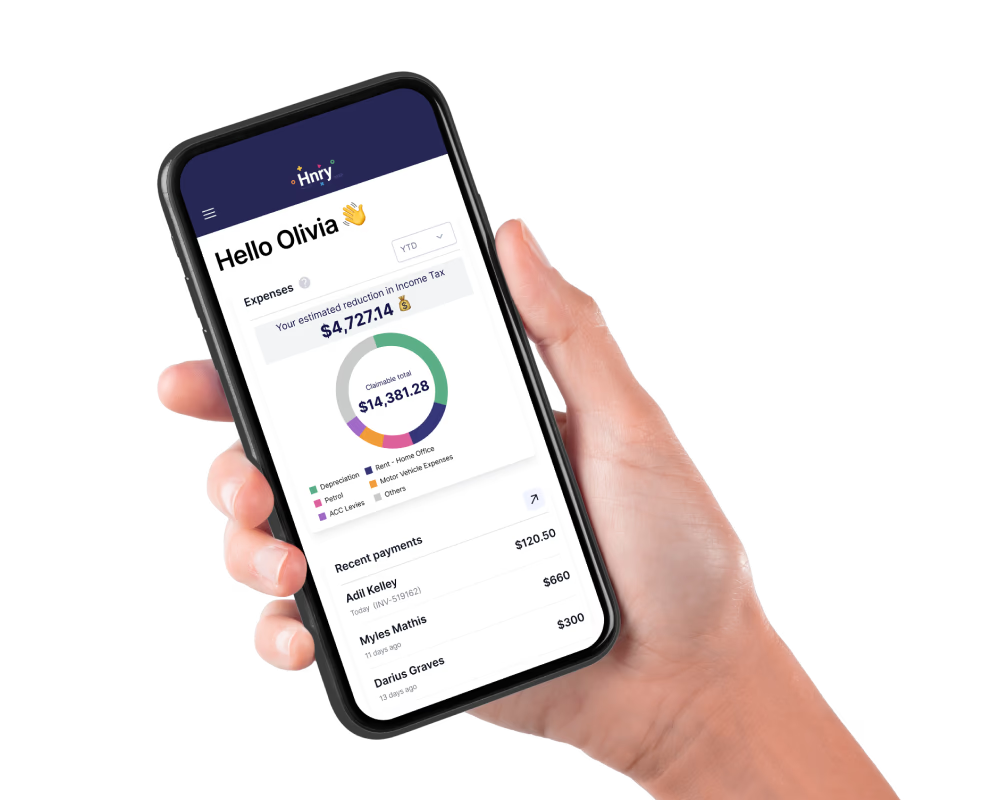

Let Hnry handle it all

That’s a lot of deadlines to remember! And this is just the tip of the iceberg – you still have to charge, collect, and calculate the GST owing every time you file. Not to mention all the records you’ll need to keep for the IRD. It’s a lot to be across!

So if you’re over it (we hear you), you can always join Hnry, and we’ll sort the lot. Yes, really. That includes automatically:

- Calculating and adding GST to your prices (if you invoice through our app),

- Deducting any GST paid from GST collected

- Setting aside GST owed

- Paying GST and filing your GST return every time they’re due

Basically, Hnry makes it so you never have to think about any of these deadlines ever again. Plus, there’s a whole bunch of other cool things we do for you, all as part of the cost (which is 1% +GST of self-employed income, capped at $1,500 +GST a year).

Sound good to you? Great! Join Hnry today.