Whether or not you need to register for GST as a sole trader in New Zealand comes down to one main thing: how much you’re earning. Here’s what you need to know.

The $60,000 threshold

If you earn over $60,000 in self-employed income in any 12-month period, you’re required to register for GST – full stop. And it’s worth noting that this isn’t tied to the financial year. If you hit $60,000 between, say, June one year and July the next, you need to register immediately, even though that period spans two financial years.

If you’re an employee with a self-employed side hustle, only your sole trader income counts towards the threshold. Your combined income doesn’t factor in.

What if I earn under $60,000?

Under the threshold, registering for GST is entirely optional. Whether it makes sense for you depends on your situation.

The main perk of registering is that you can claim back the GST you pay on business expenses. If you’re regularly buying supplies or equipment for your work, that 15% adds up – being GST registered means you may be eligible for a GST refund, if you pay more in GST than you collect. It can also make dealing with GST-registered suppliers a bit more straightforward.

On the flip side, registering means more paperwork, and you’ll generally need to charge 15% GST on top of your regular prices. For sole traders with lower expenses and straightforward setups, the extra admin might not be worth it.

GST registration isn’t automatic

This is one of the most common misconceptions around GST – registering as a sole trader, filing a tax return, or getting an NZBN does not automatically register you for GST. If you haven’t specifically registered, you are not GST registered, and you can’t charge or claim GST unless you are.

The flip side is also true: if you have registered – even voluntarily, even if you’re under the threshold – you must collect and charge GST.

What happens once you’re registered?

Once you’re GST registered, you’ll generally need to add 15% GST on top of your fees and collect it from clients on behalf of the IRD. You’ll then file GST returns on a regular basis – either monthly, every two months, or every six months – and pay the IRD the difference between the GST you’ve collected and the GST you’ve paid on expenses.

If at any point your income drops back below $60,000, you do have the option to cancel your GST registration.

The easy way to handle GST

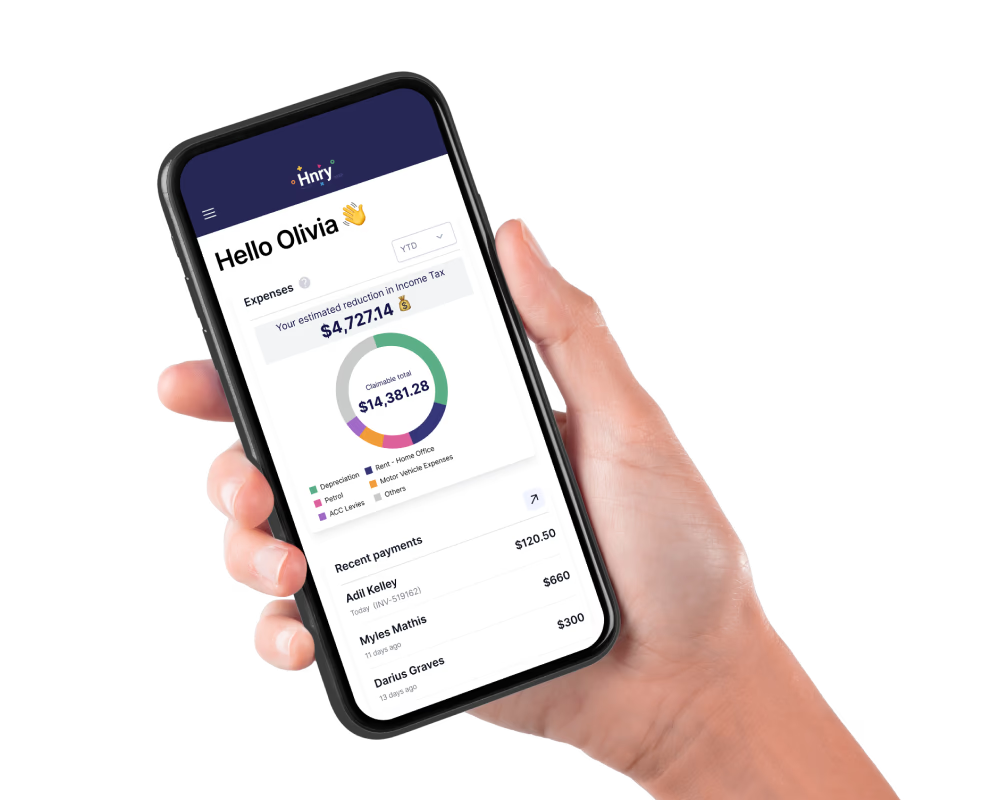

If keeping track of GST thresholds, returns, and filing deadlines sounds like a lot, well. It doesn’t have to be. Hnry automatically calculates and sorts your GST as you earn, and files all your GST returns for you. One less thing to think about.