If you use your car/ute/motorcycle/scooter/starship (kidding) for work purposes, you’re probably already very familiar with the IRD’s tracking requirements.

From figuring out the right claiming method, to meticulously keeping a logbook, to forgetting about said logbook and spending hours on a Friday night trying to remember where you’ve driven this week – it can all be a real headache.

That’s why we decided to swoop in and make your life easier.

Introducing Mileage by Hnry – the ultimate mileage tracking app that automatically records and logs all your trips for you. You can use it to quickly sort the business miles from the personal, export your trips to the Hnry app, and claim the relevant expenses. You’re welcome!

Best of all, it’s all completely free for Hnry users who get paid regularly through their Hnry Account (with a minimal monthly subscription for non-Hnry users, which is claimable as a business expense).

So what are you waiting for? Ditch the physical logbook, and make your life easier with Mileage by Hnry. Here’s literally everything you need to know:

- Signing up for a Mileage account

- Choosing your claiming method

- Tracking permissions

- Reviewing your trips

- Exporting your trips

- Raising expenses in the Hnry app

- Setting up multiple vehicles and rates

- Hnry makes it so easy

Signing up for a Mileage account

It’s so simple to get started – all you need is your email address.

Then, once you hit the “Join/Sign-in” button, we’ll send a magic 6-digit code to the email address provided. This is just to prove you own that email address – we do trust you, but you can’t be too careful these days!

From there, you’ll need to select your country (pretty self-explanatory). You’ll also need to add details about your work vehicle including:

- The number plate

- The vehicle type (petrol, diesel, hybrid, etc)

- Your odometer unit (which should line up with your country’s mileage rates unit. So in New Zealand, kilometres)

💡 Don’t worry if you have more than one work vehicle – you can add more once you’re all signed up!

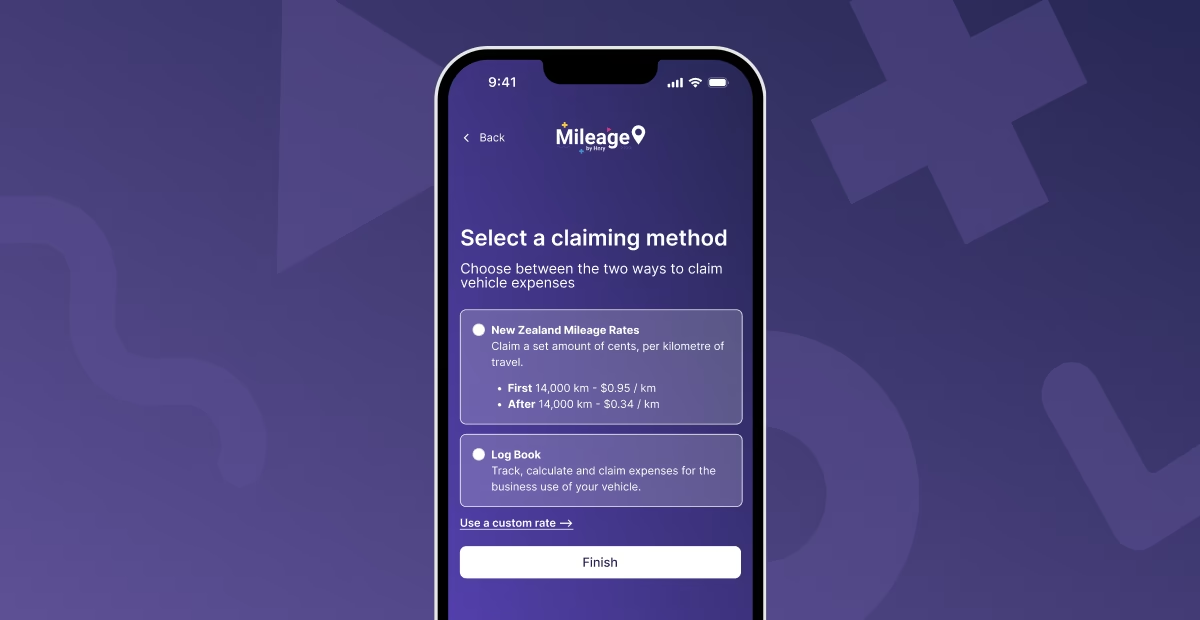

Choosing your claiming method

Now the fun bit! There are two methods for claiming vehicle expenses in Aotearoa: mileage and logbook.

The IRD categorises vehicles by the type of fuel they use:

- Petrol

- Diesel

- Hybrid

- Electric

How you claim vehicle expenses will depend on what your vehicle runs on:

- If your vehicle is petrol, diesel, hybrid or electric you can use either method.

- 💡 Different vehicle types are entitled to different mileage rates. Make sure you’re claiming the right rate!

- If your vehicle isn’t petrol, diesel, hybrid, or electric (???), then you must use the actual costs method.

💡 You can use different claiming methods for different vehicles – but once you’ve claimed expenses using one method, you can’t swap to the other for the same vehicle.

📖 For a more detailed explanation of vehicle types and claiming methods, read our ultimate guide to claiming vehicle expenses. It covers everything you need to know!

Mileage

The mileage method requires you to keep a logbook tracking all your work trips. Good news – that’s what this app is for!

From there, you can claim the IRD’s set amount per kilometre as a business expense for your work trips.

The first 14,000kms need to be claimed at their Tier 1 rate, and everything after that falls under their Tier 2 rate. Rates are split according to vehicle type.

📖Lost? No worries! We cover all this and more in our guide to motor vehicle expenses.

Logbook

Funnily enough, you’ll also need to keep a logbook (or use the Mileage app!) for 90 consecutive days, in order to claim using the logbook method.

Basically, a logbook tracks how often you use your vehicle for work purposes as opposed to personal trips, so you can figure out your business usage percentage. You can then claim this percentage of all the actual running costs for your vehicle, including:

- fuel,

- registration,

- insurance,

- lease payments,

- repairs,

- interest charges.

Once you’ve kept your logbook for the required 90 days, it’s valid for the next three years. Easy!

💡 Remember, you’ll need the receipts for all running costs in order to claim using this method. If you’re a Hnry user, you can upload and store photos of all receipts in the Hnry app. Then, you can throw them away.

Choosing a claiming method

Which method you choose depends on your vehicle type and your preferences. Although the IRD does actually have a bit of a say here – it classifies vehicles into four categories, based on fuel type, each with their own mileage rates:

- Petrol

- Diesel

- Hybrid

- Electric

If your vehicle falls into any of the above four categories, you can use either claiming method. But if your vehicle doesn’t run on any of the above (???), you’ll need to use the actual costs method.

Chosen a method? Sweet! Sorted.

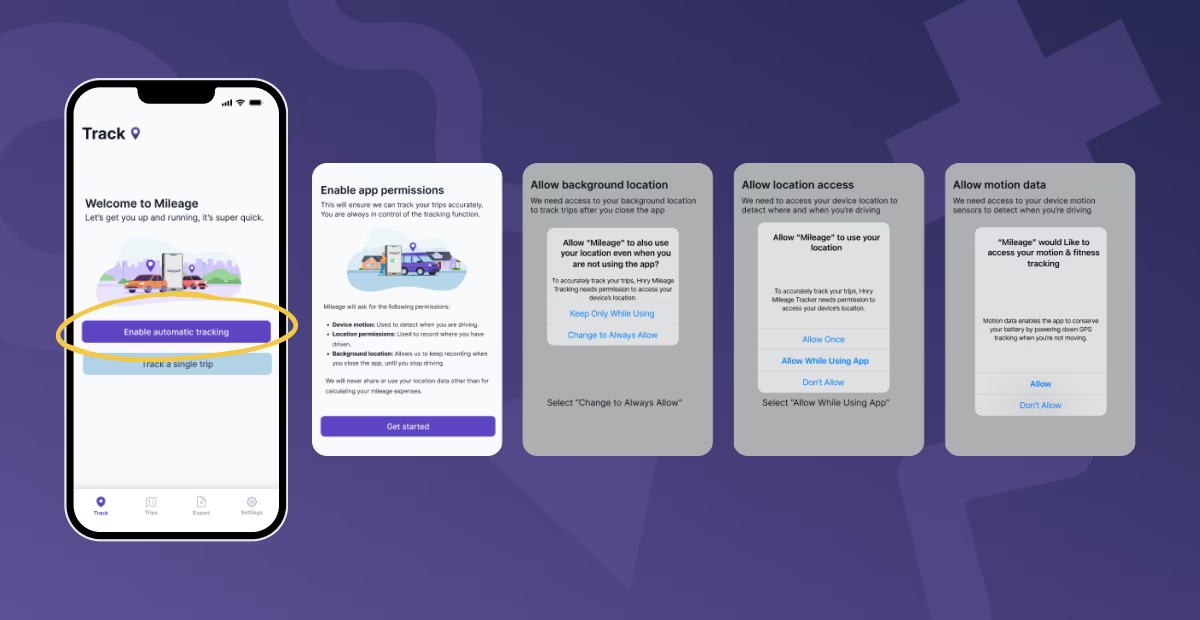

Tracking permissions

To actually start tracking trips, you’ll need to set up tracking permissions.

There are two ways to log trips in the Mileage app:

- Automatic tracking for all trips

- Manually entering trips into the app

You’re in complete control of how the app records your data. While we recommend you turn on the automatic tracking features for ease of use, you can absolutely choose a different route (mind the pun).

1. Automatic tracking

You can use this option to automatically track every trip you take in your car. No more trying to remember where you’ve been this week after the fact 🎉

You can also use filters to narrow down tracking to certain times, or between certain locations – for example, setting it up to only log trips on weekdays between 9am-5pm.

To set up automatic tracking, click the “Enable automatic tracking” button under the “Track” tab.

From there you’ll be prompted to allow the Mileage app access to your phone’s motion data, location access, and background location. You’ll need to allow all three for automatic tracking to work. If there isn’t an option on your phone to “Always allow”, you’ll need to allow the app to send you popup notifications, which will prompt you to allow tracking for each individual trip.

Once that’s all done, you’re all set! The Mileage app will automatically pick up when and where you start driving, and log trips as you go.

💡 If the app doesn’t have the required permissions to either automatically or manually track your trips, it’ll continue to prompt you to allow access.

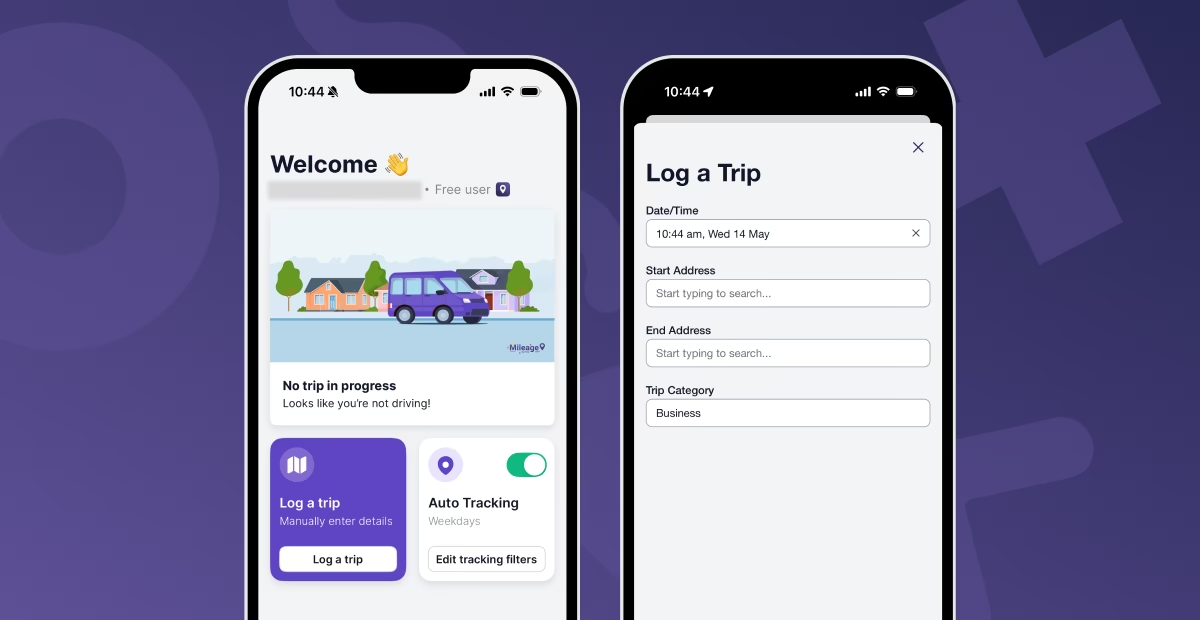

2. Manually enter trips into the app

If you’d prefer that the Mileage app doesn’t access your phone data, that’s totally cool! You’ll just need to manually log your trips within the app.

To do this, click the purple “Manually log a trip” button down the bottom of the “Track” page. From there, input the date and time, your start address, and your end address. Done!

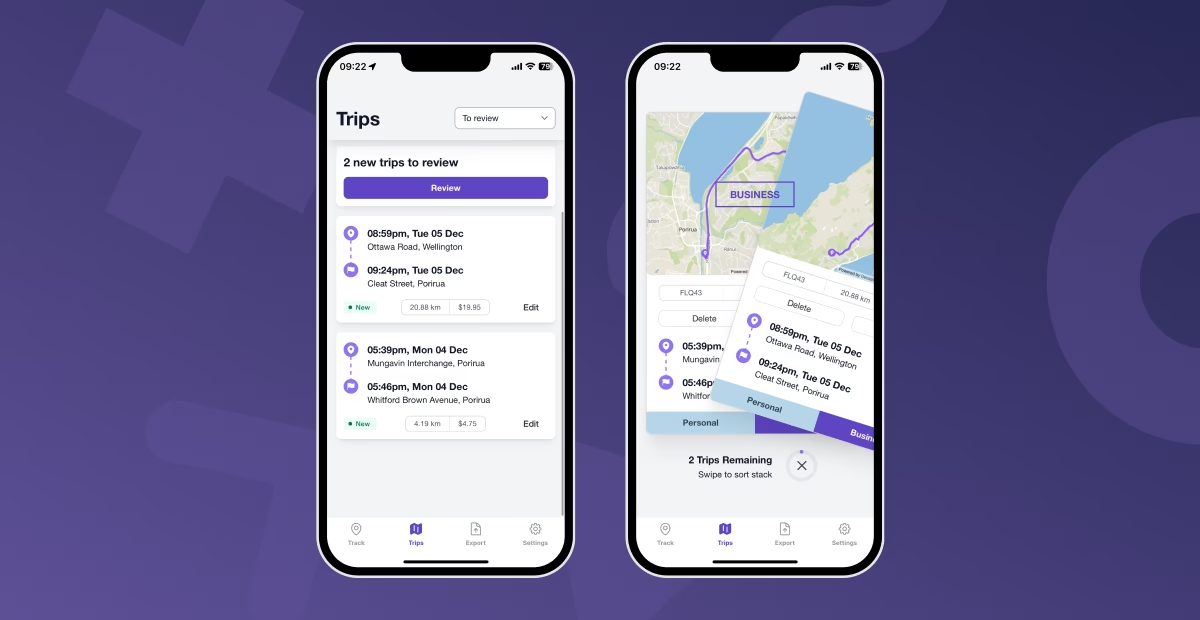

Reviewing your trips

Remember how you can only claim the business usage of your vehicle? Here’s where we make sure we’re capturing that accurately.

Once you’ve tracked or logged trips, you’ll need to review them in the “Trips” tab. Click through, and you’ll find a list of all your recent trips for you to categorise. You also have the option to edit a trip, if the details don’t look quite right.

Once you hit “Review”, you’ll be presented with each trip and asked to classify whether it was for business purposes, or a personal jaunt. Swipe right for “Business”, and the trip will be saved as eligible for an expense claim. Swipe left for “Personal”, and the trip will be deleted after seven days. It’s kind of like a dating app – only dinner and a movie aren’t required.

(If you make a mistake, you can retrieve the data for a trip classified as “Personal” – just do it before it’s gone for good!)

Exporting your trips

So, you’ve tracked, logged, reviewed – now it’s time to export!

When you click the “Export” tab for the first time, you’ll be prompted to connect your Hnry account if you haven’t already. It’s super simple to do, and you’ll need to complete this step in order to export trips to the Hnry app.

Once connected to Hnry, exporting business trips will be raised in the app as an expense. If you’re claiming using the mileage method, the raised expenses will include all info needed – nothing else needed from you!

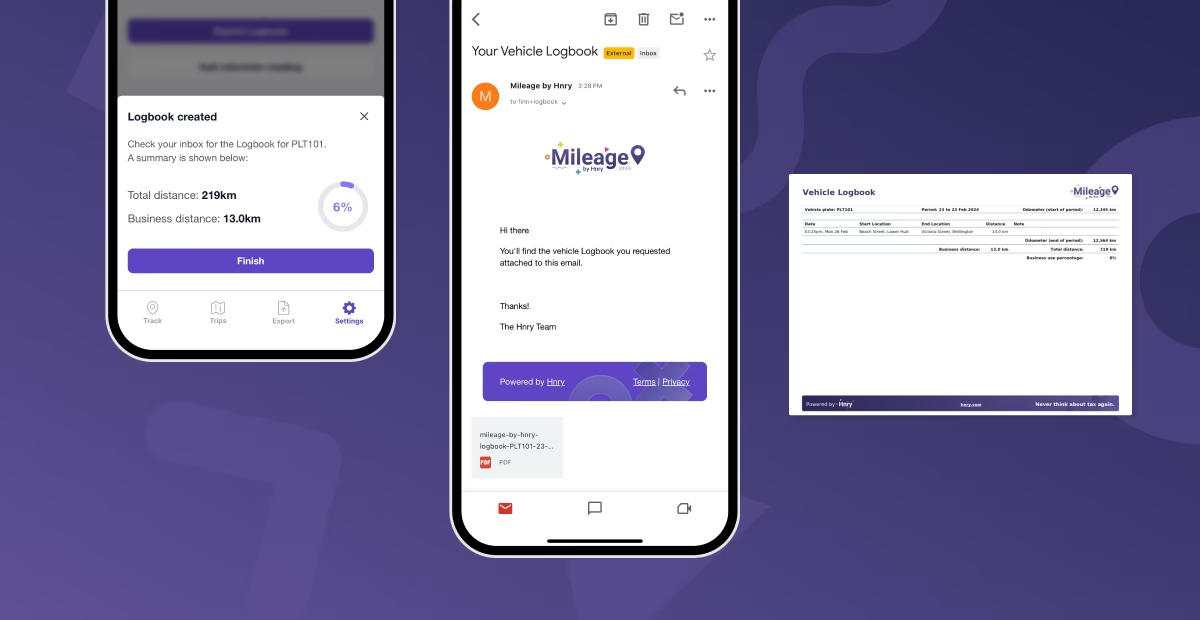

If you’re using the logbook method, you can export your logbook from the Mileage app, as evidence of your business usage of your vehicle, when claiming running costs. You’ll need to raise these expenses, including photos of receipts, within the Hnry app.

If you’re not a Hnry user (why not?), you’ll need to subscribe to the Mileage app in order to have export access. It’s either a monthly subscription of $4.99, or an annual subscription of $55 (slightly cheaper!).

You’ll then be able to export your data from the Mileage app, but it’s a slightly different process. Instead of raising expenses directly in the Hnry app, you’ll have to download it into a PDF or CSV report.

Exporting to Hnry (mileage method only)

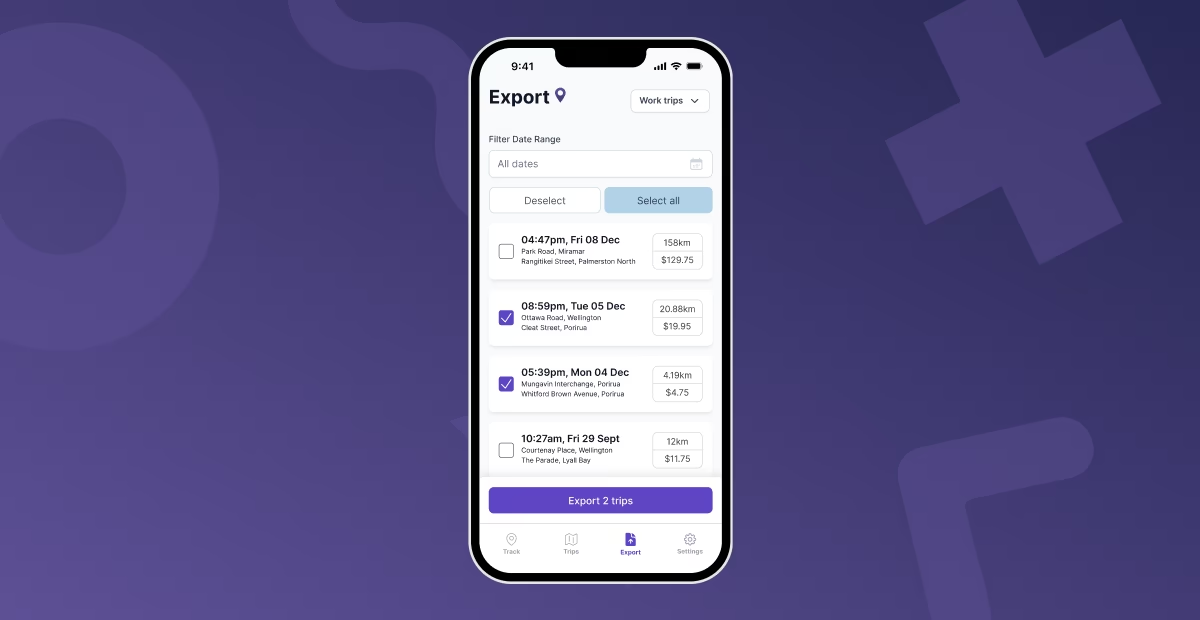

Head to the “Export” tab.

Once you have connected or subscribed, you can either “Select all”, or click individual trips to be exported. Then click “Export trips”.

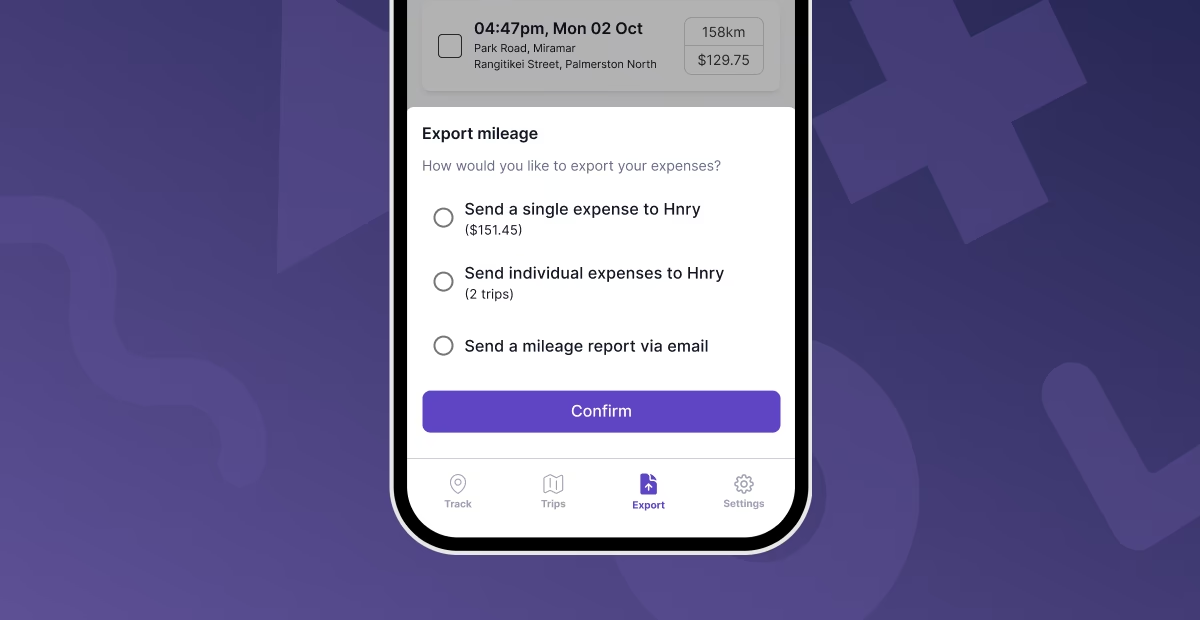

You’ll need to choose whether to:

- export trips as a single expense (eg. 10 trips in 1 expense in Hnry)

- export trips individually (10 trips in 10 individual expenses in Hnry), or

- create a PDF or CSV mileage report to send to your email (doesn’t export to Hnry).

That’s it! You’re all done!

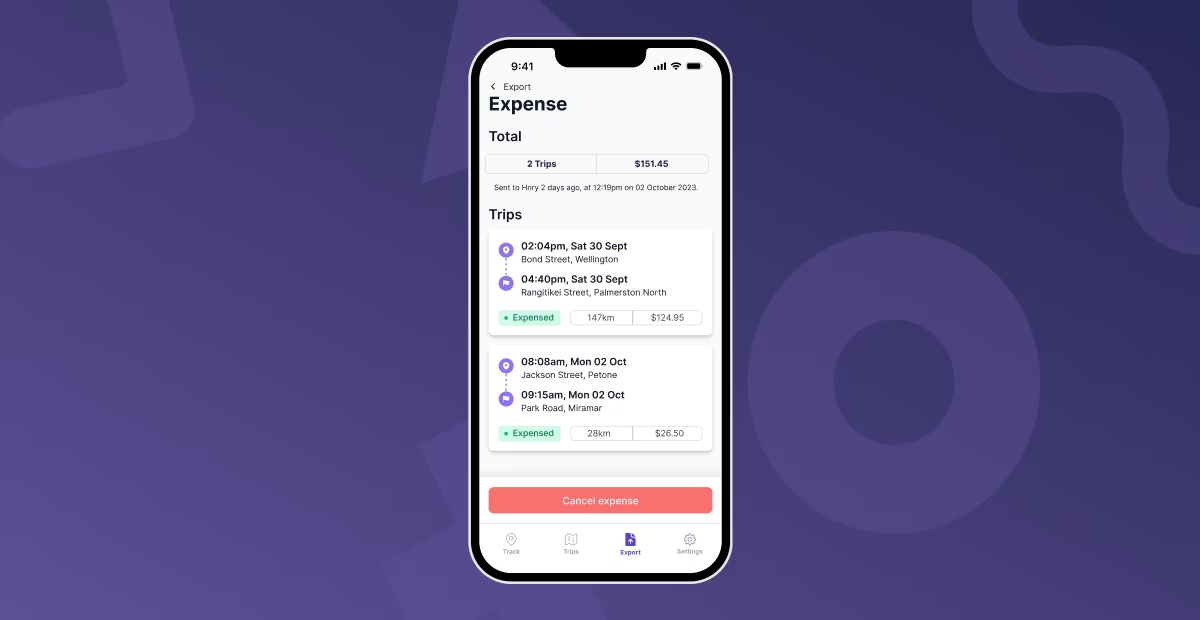

Exported trips will disappear from your “Work trips” view, just to keep things uncluttered. If you want to view your exported trips, you can switch to the “Exported” view in the top drop-down menu.

Cancelling a raised vehicle expense

If you want to delete an expense raise through a Mileage export, you can do this from the “Exported” view as well.

Simply click on an expense, and hit “Cancel expense” down the bottom. This will delete the expense raised in the Hnry app, and send the trips back to the “Trips” tab for review.

Exporting to not Hnry

If you’d like to have a report of your work trips outside raising an expense claim in the Hnry app, you can do that as well.

Follow the above steps until you get to the export options, then choose “Create mileage report”. A report will be created and sent to the email address associated with your account. You can choose between a PDF or CSV format.

In all seriousness though, we know we’re biased, but Hnry’s pretty great! We sort all your taxes for you every time you get paid, manage your expense claims (including your vehicle expenses), and complete and file your annual tax returns on your behalf – it’s all part of the service.

We’re basically an accountant in your pocket, helping you sort your financial and tax admin on the go. Plus, using the Mileage app alongside the Hnry service will basically make sure you never miss a vehicle expense claim, ever again. What’s not to love?

Raising expenses in the Hnry app

For those of you claiming vehicle expenses using the logbook method, you’ll still need to raise these expenses in the Hnry app.

Simply head to the “Expenses” tab, click “Create new”, enter the relevant details, upload a screenshot of your receipt, and you’re done!

Once your logbook in the Mileage app is complete (90 days, remember!), it’ll calculate your business-usage percentage for your motor vehicle. You’ll need to input this when raising a Motor Vehicle Expense in the Hnry app:

Sorted!

Setting up multiple vehicles and rates

If you have more than one vehicle, and need to claim using a different method or a different mileage rate, the Mileage app can absolutely do that for you. You just need to set up all your vehicles, and specify which one you’re using each trip.

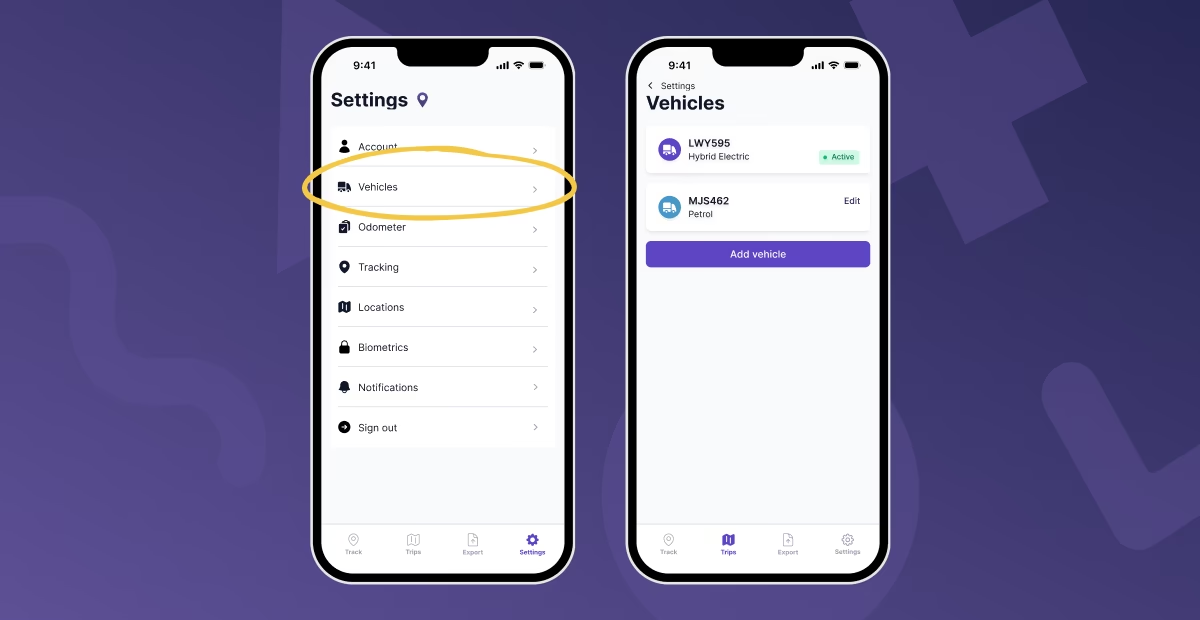

Head to the “Settings” tab, and click “Vehicles”. From there, hit “Add vehicle”.

You’ll be prompted to add in the same details for your second vehicle as you did for the first, namely:

- the number plate,

- the vehicle type,

- your odometer unit,

- claiming method,

- rates.

… And that’s it! You can swap between cars when reviewing trips under the “Trips” tab, by editing an individual trip and changing the vehicle used. Whooo!

Hnry makes it so easy

Hnry was designed to make sole trader taxes easier, so sole traders could be freed up to focus more on the important stuff – namely, their actual work.

So for us, creating the Mileage app was an absolute no-brainer. Mileage by Hnry automates the process of tracking, well, miles, meaning sole traders can spend less time on the admin and more time on the tools.

It’s completely free for all Hnry users, and for those yet to join Hnry, it’s a minimal monthly subscription of $4.99 monthly or $55 a year – which is totally worth it when you think about how much you could save on your final tax bill.

But using Mileage with Hnry is where the real magic happens. You’ll be able to raise vehicle expenses that are completely compliant with IRD requirements, in just a few clicks.

So, what are you waiting for? Try out Mileage by Hnry today!

Share on: