Getting up and running with Hnry is easy – we’ll do the heavy lifting!Just follow these three simple steps and you’ll never think about tax again.

Step 1: Sign up

(Takes about two minutes.)

Here’s what we’ll need from you:

- Your email address and a password

- Your estimated annual earnings (all sources of income)

- What type of work you do

- Whether or not you’re GST registered, and

- If you have a student loan.

Once we have all that, we’ll give you your Hnry Account - our magic tool for calculating and paying your taxes.

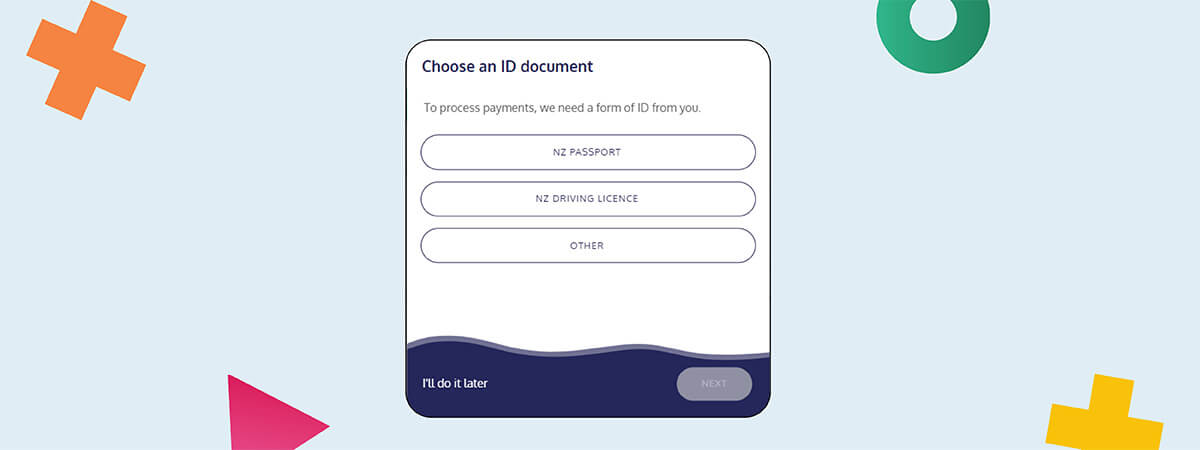

Step 2: Verify your identity

(Takes less than five minutes.)

Legally, we can’t process payments on your behalf unless we’ve verified that you’re a real human.

In most cases, our ID verification is a quick process. You’ll need one of the following:

- AU or NZ Passport

- AU or NZ Driving License

If you’re unable to provide one of these documents, no worries – you can find other options in this article.

We’ll pay $1 into your Hnry Account, deduct the taxes you owe on this $1 (based on the income you’ve told us about), then send the rest to your personal bank account. Boom. Easiest ~68 cents ever.

Step 3: Get paid

To make this relationship official, we need you to start using your Hnry Account.

How you do that depends on how you get paid by your clients.

When your first payment comes through your Hnry Account, two things will happen:

- We’ll calculate your taxes on that amount, then deduct them and send them to the IRD before firing the rest into your personal bank account. This all happens instantly, and we’ll do this every time you get paid.

- We officially become your accountant. This means we’ll take charge of:

- Managing your expenses

- Adjusting your tax rate (taking into account your income and deductions)

- Filing all your tax returns (income tax and GST), and

- Answering your gnarly tax questions. Just hop into the app and send us a chat message to get started!

You’re done! Mostly!

In most cases, you can sit back, relax, and let us manage your taxes from here. As long as all your self-employed income is paid into your Hnry Account, we’ve got you.

There are a couple things you may need to do, such as:

- Let us know about your other income sources. Basically, to calculate the right tax rate for you, we need to know about all of your income - this includes income from permanent employment, income earned prior to joining Hnry, etc. Just hop in the chat and let us know!

- Tell us about business expenses from before you joined Hnry. Once again, this is all about getting the right tax rate for you. If you’ve loaded expenses into your old accounting software, no worries – just get in touch with the team and we’ll help get you sorted.