Ready to switch to Hnry from Xero? We’re excited to have you on board.

The good news is the process is so simple, you barely have to think about it (just like your taxes, after you join Hnry). You can also join at any point throughout the financial year. Honestly, there’s no bad news.

To make the switch, all you have to do is:

- Sign up for Hnry (duh) and complete your profile

- Upload your pre-Hnry expenses

- Upload your clients and services (optional)

- Get paid (whoo!)

That’s it, that’s literally everything. From there, you’re all set to continue growing your business – without ever thinking about tax again.

Welcome to Hnry. You’re going to love it.

Step 1: Sign up for Hnry, and complete your profile

Signing up to Hnry only takes a few minutes!

First, you’ll need to enter your email address and create a password for your account. Then, we’ll gather a few details about your business. Next, we’ll need to verify your identity. Finally, we’ll pay you a dollar (no, really!) to show you how the service works.

Tell us about your business

To calculate your tax rate accurately, we’ll need to know:,

- Your estimated annual earnings (from all sources of income),

- Your work type,

- If you’re GST registered, and

- If you have a student loan.

💡 Note: If you’ve sent invoices using invoicing software prior to joining Hnry, you don’t need these invoices to be loaded into the Hnry system in order to use our service! All we need is your projected earnings for the year.

Verify your identity

We trust you, but we still need to know that you are who you say you are!

You’ll need to provide us with proof of your identity. To do this, you can use either:

- An Australian or New Zealand passport,

- An Australian or New Zealand driver’s license.

If you don’t have any of the above, no worries! We also accept these other documents.

Once your scans have come through, our team will contact you to let you know your account is up and running.

Easy!

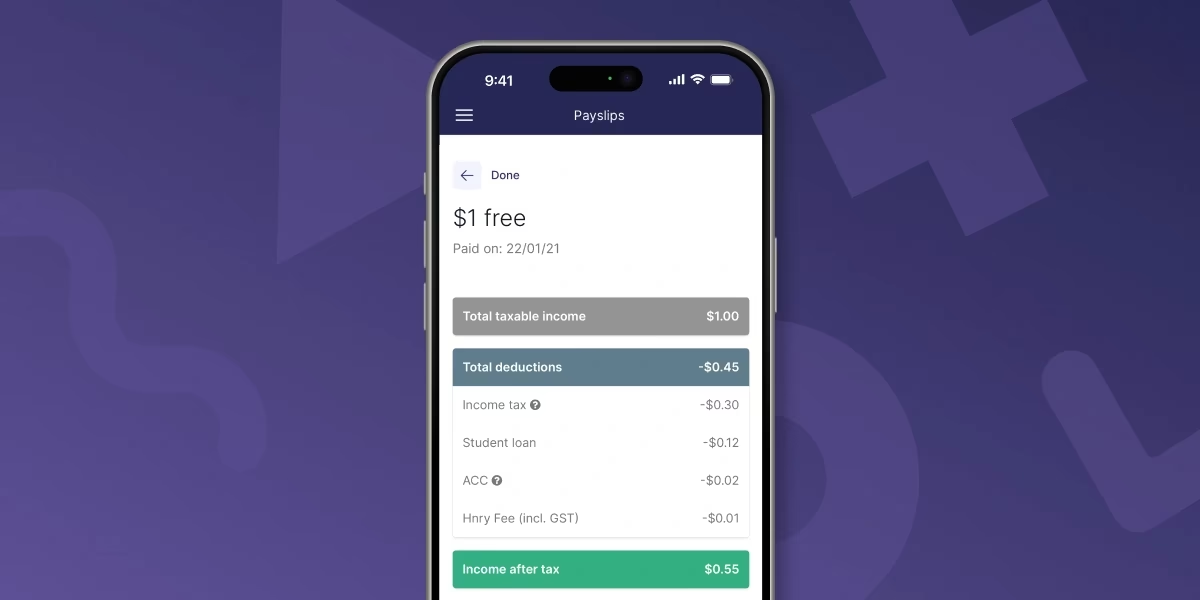

Earn a dollar

Now you’ll all signed up, we’ll even throw in a freebie – a single dollar that we pay to you, so you can see how the service works.

If you click through on the payment, you’ll be able to see the deductions we’ve made on your behalf.

It’s a wee taster of what’s to come – self-employed income without having to do your own calculations and set money aside. Everything that lands in your personal bank account is yours to spend.

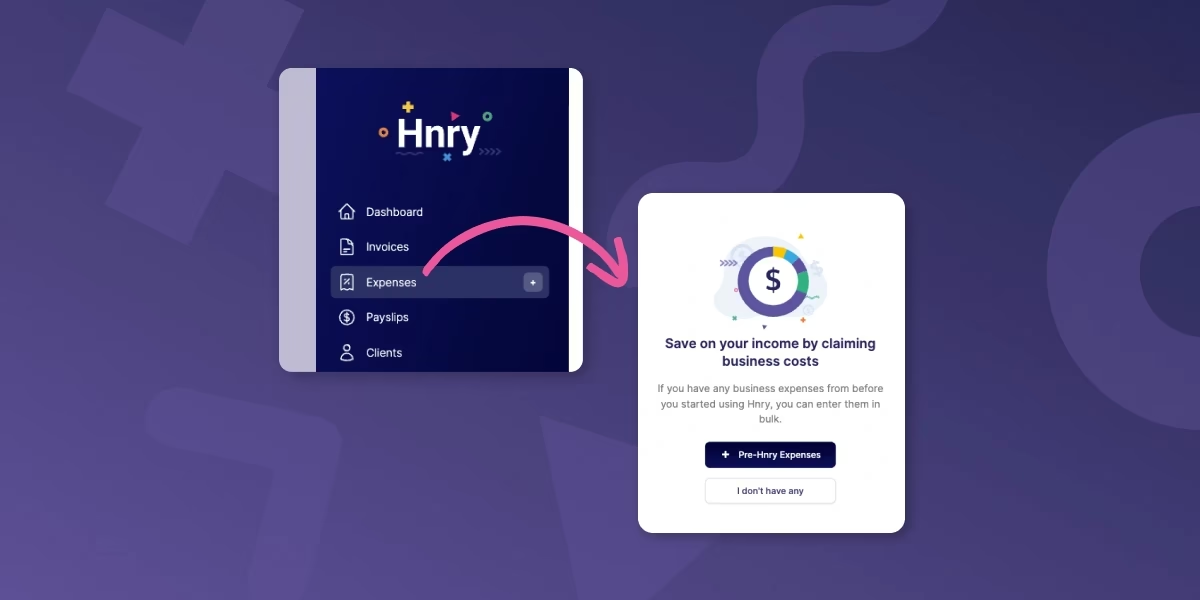

Step 2: Upload your pre-Hnry expenses

In order to maximise your tax savings, we need to be across any business expenses purchased before you join Hnry. You can do this in the Expenses tab of the app, by clicking the “Pre-Hnry Expenses” button when you first visit the page.

From there, all we need is the total amount you’re claiming for each expense category. If you’re not sure how to find this in Xero, that’s all good – we have helpful in-app content that will take you through the process.

Step 3: Upload your clients and services

This step is actually optional – you fully use Hnry without preemptively uploading your clients and services.

But if you’re after the smoothest invoicing process possible, this little step could save some serious time down the line!

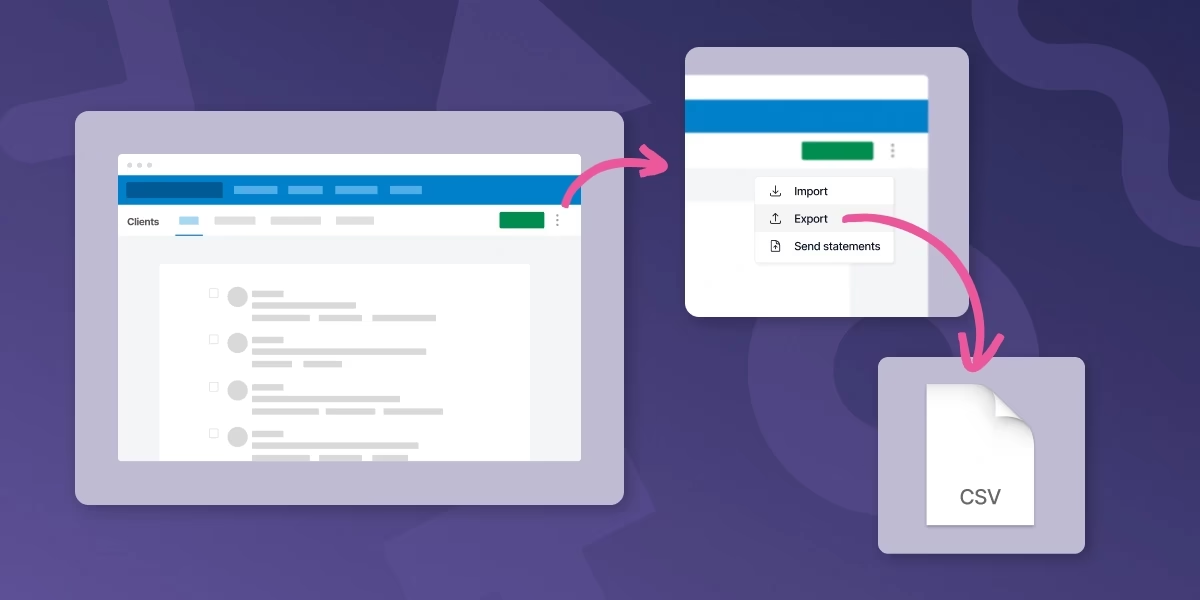

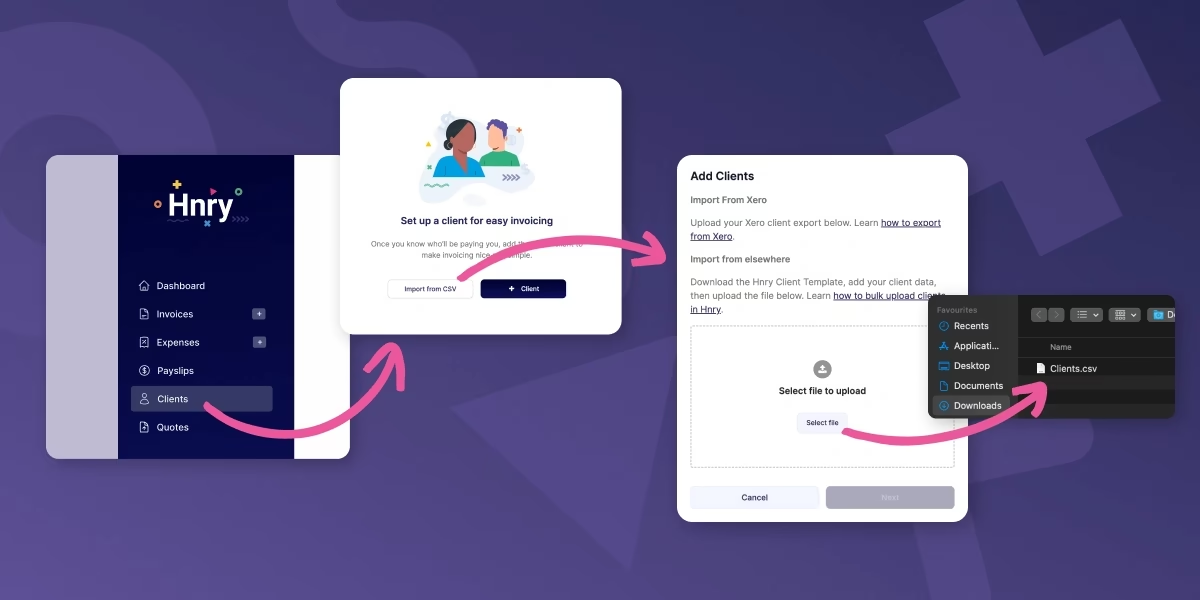

First, you’ll need to export your clients and services out of Xero in separate CSV files.

From there, you can download and use our simple CSV template to make sure you have the right formatting.

Upload this CSV file under the “Clients” or “Services” tab, double check everything looks right, and hit “Next”.

And voila! French!

Step 4: Get paid into your Hnry Account

This part’s the real magic.

Make sure you’re paid into your Hnry Account by updating your payment details with your clients, or invoicing through our app. As soon as payment comes through, we’ll calculate and deduct your taxes, levies, and whatnot, and send it to the IRD on your behalf.

Everything else that lands in your personal bank account is yours to spend.

Forget a separate bank account for taxes, forget the surprise massive tax bill – our service has you covered for all that.

That’s it! You’re all set up and ready to go.

Hnry is for sole traders

Hnry is an award-winning app and service that’s designed specifically for the needs of sole traders. And we mean all your needs. If you get stuck during the switching process, you can call our team – we’re happy to help!

Share on: