Tired of Doing Your Own Taxes? You’re in the Right Place

Joining Hnry is so simple, you barely have to think about it. You can also join at any point throughout the financial year. Honestly, there’s no bad news.

To make the switch, all you have to do is:

- Sign up for Hnry (duh) and complete your profile

- Upload your pre-Hnry expenses

- Upload your clients and services (optional)

- Get paid (whoo!)

That’s it, that’s literally everything. From there, you’re all set to continue growing your business – without ever thinking about tax again.

Welcome to Hnry. You’re going to love it.

Step 1: Sign up for Hnry, and Complete Your Profile

Signing up to Hnry only takes a few minutes!

First, you’ll need to enter your email address and create a password for your account. Then, we’ll gather a few details about your business. Next, we’ll need to verify your identity. Finally, we’ll pay you a dollar (no, really!) to show you how the service works.

Tell Us About Your Business

To calculate your tax rate accurately, we’ll need to know:

- Your estimated annual earnings (from all sources of income)

- Your work type

- If you’re GST registered

- If you have a student loan

💡 Note: If you’ve sent invoices using invoicing software prior to joining Hnry, you don’t need these invoices to be loaded into the Hnry system in order to use our service! All we need is your projected earnings for the year.

Verify Your Identity

We trust you, but we still need to know that you are who you say you are!

You’ll need to provide us with proof of your identity. To do this, you can use either:

- An Australian or New Zealand passport

- An Australian or New Zealand driver’s license

If you don’t have any of the above, no worries! We also accept these other documents.

Once your scans have come through, our team will contact you to let you know your account is up and running.

Easy!

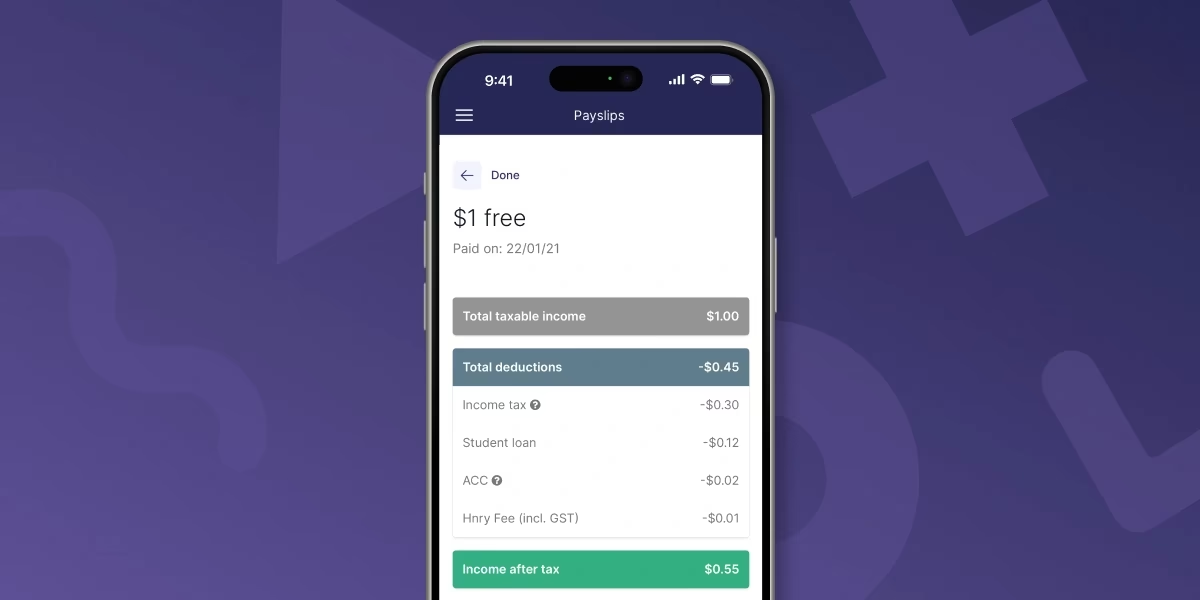

Earn a Dollar

Now you’re all signed up, we’ll even throw in a freebie – a single dollar that we pay to you, so you can see how the service works.

If you click through on the payment, you’ll be able to see the deductions we’ve made on your behalf.

It’s a wee taster of what’s to come – self-employed income without having to do your own calculations and set money aside. Everything that lands in your personal bank account is yours to spend.

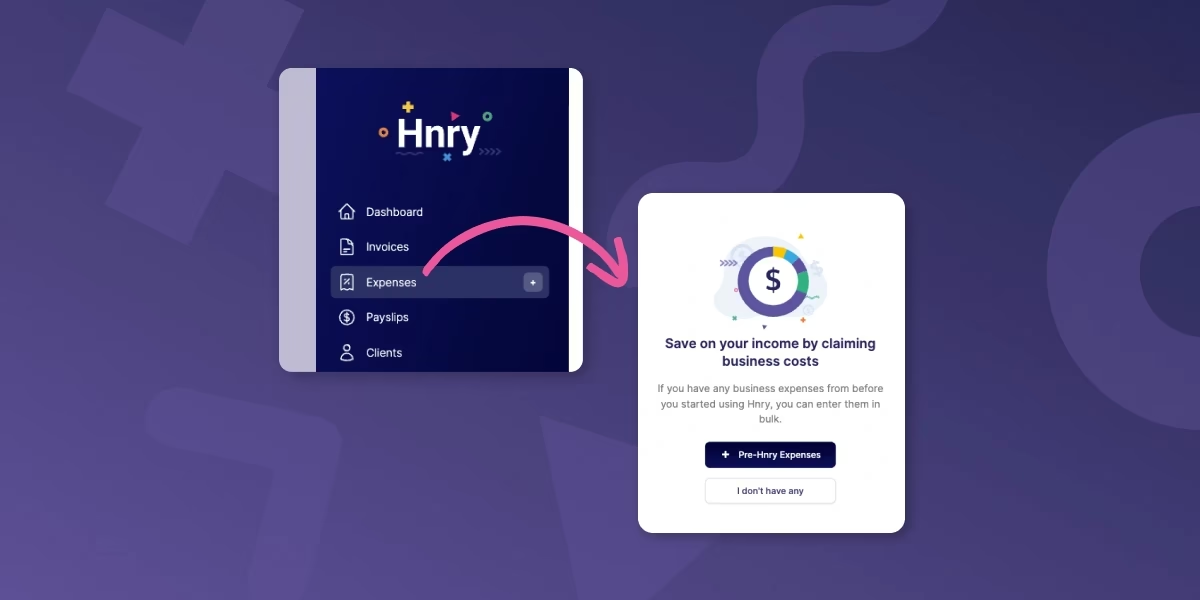

Step 2: Upload Your Pre-Hnry Expenses

In order to maximise your tax savings, we need to be across any business expenses purchased before you join Hnry. You can do this in the Expenses tab of the app, by clicking the “Pre-Hnry Expenses” button when you first visit the page.

From there, you can input all your pre-Hnry expenses for the relevant financial year. If you have a lot of expenses, don’t worry! We just need the total amount you’re claiming for each expense category, not each individual expense.

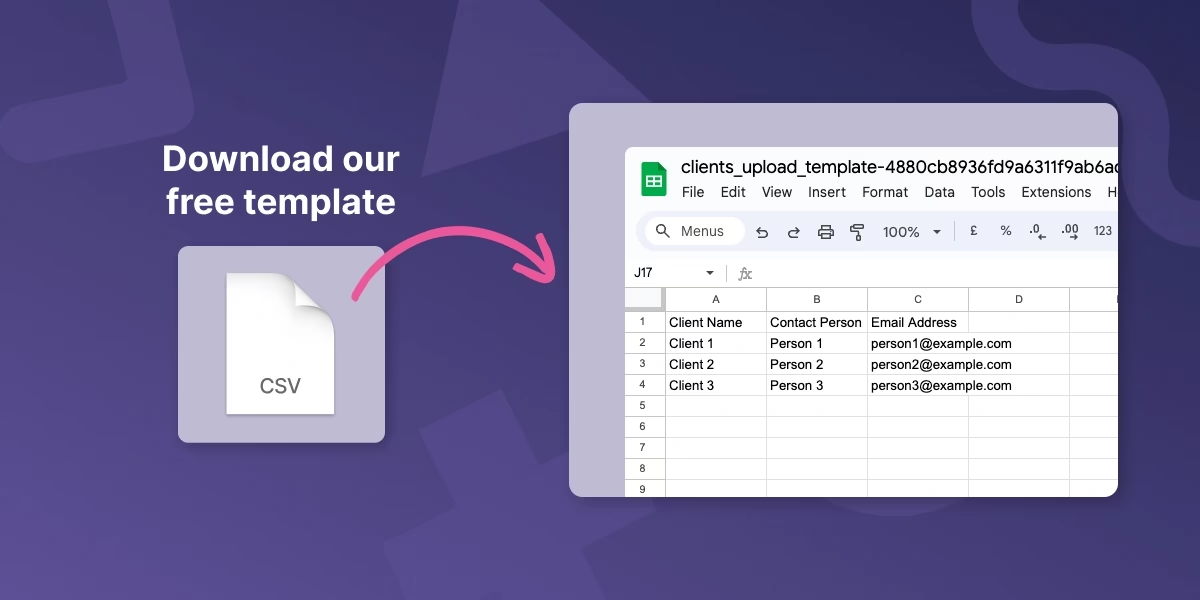

Step 3: Upload Your Clients and Services

This step is actually optional – you fully use Hnry without preemptively uploading your clients and services.

But if you’re after the smoothest invoicing process possible, this little step could save some serious time down the line!

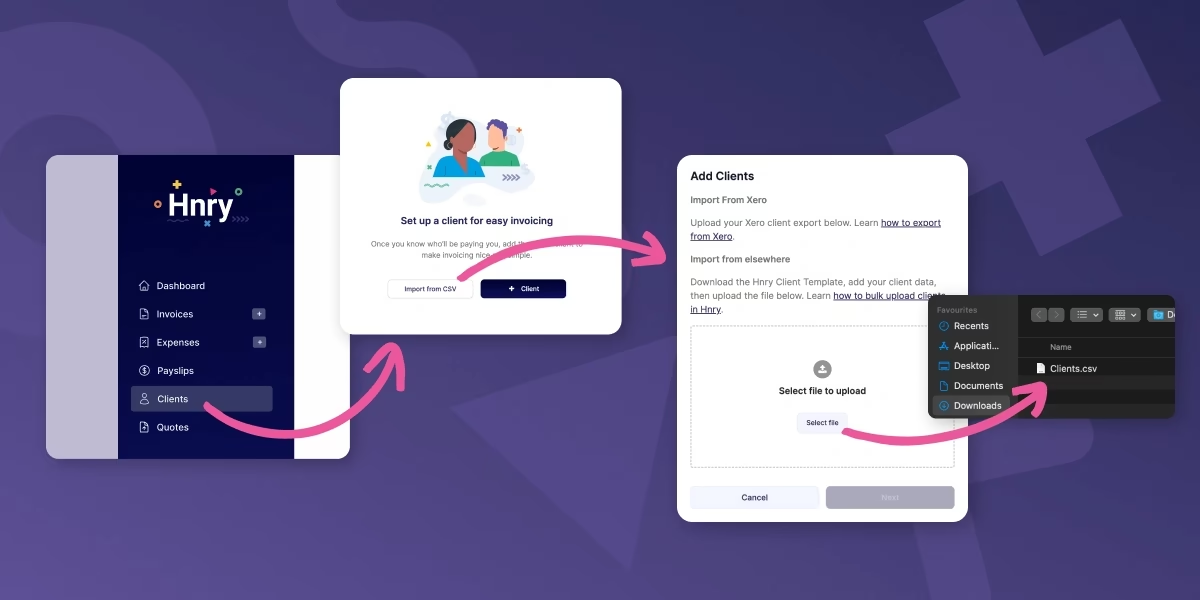

For the easiest way to do this, you can download and fill in our simple CSV templates.

Upload this CSV file under the “Clients” or “Services” tab, double check everything looks right, and hit “Next”.

And voila! French!

Step 4: Get Paid into Your Hnry Account

This part’s the real magic.

Make sure you’re paid into your Hnry Account by updating your payment details with your clients, or invoicing through our app. As soon as payment comes through, we’ll calculate and deduct your taxes, levies, and whatnot, and send it to the IRD on your behalf.

Everything else that lands in your personal bank account is yours to spend.

Forget a separate bank account for taxes, forget the surprise massive tax bill – our service has you covered for all that.

That’s it! You’re all set up and ready to go.

Hnry is for Sole Traders

Hnry is an award-winning app and service that’s designed specifically for the needs of sole traders. And we mean all your needs. If you get stuck during the switching process, you can call our team – we’re happy to help!

Share on: