We know invoicing can be a bit of a faff, but the clearer your invoice, the better for your brand and business. A professional invoice is a great first impression – plus, it’s important for your clients to have all the information they need to pay you!

On top of this, the IRD has certain requirements for invoices, depending on whether or not you’re registered for GST. So while it’s a good idea to have clean, clear invoices, in some cases there are certain things you’ll actually need to include, for your own or your clients’ records.

Let’s lay it all out.

Free Invoice Template

Things to Include in Your Invoice

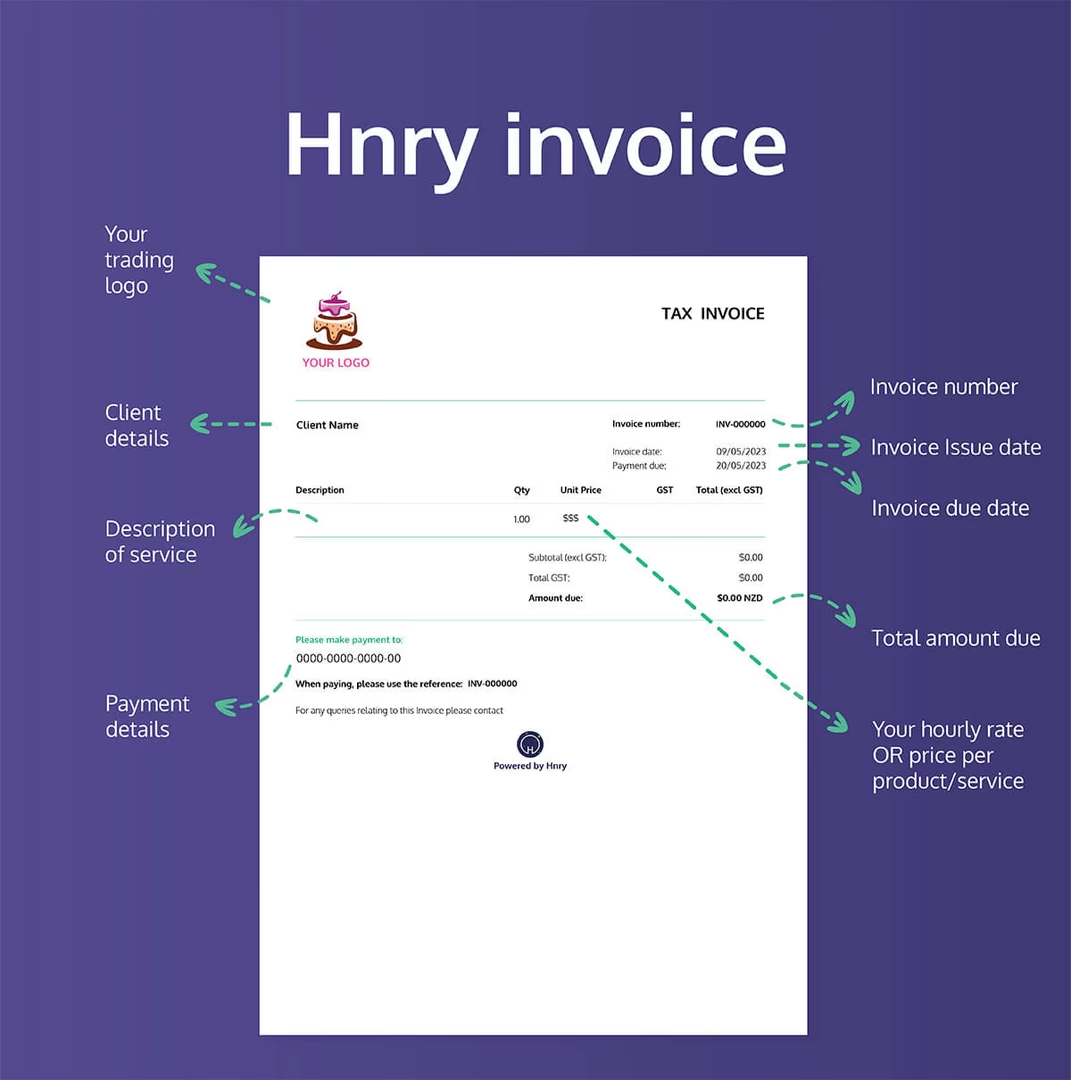

While there aren’t strict requirements for what your invoice should look like (unless you’re GST registered), there are definitely some essentials that’ll make you look professional and keep everyone happy. Here’s what to include:

- Your business details:

- Pop your business name, logo (if you have one), and contact details at the top. Remember, you don’t need to be a registered company to have a business name and logo!

- Invoice number:

- Super useful for keeping track of all the invoices you’re sending out, so you can stay across what’s been paid and by who.

- Client details:

- All you really need is their name, but you can add their address and phone number if you want. If they’ve given you a purchase order number, make sure to include that too.

- Description of goods/services:

- Be clear about what you’ve provided. Both you and your client should know exactly what they’re paying for.

- Quantity and unit price:

- If you’re charging hourly, record the number of hours worked. If you’re charging per service, note how many services you provided. Then add your rate per hour or per service.

- Total cost:

- This is simply quantity × unit price. Easy maths!

- Expenses (if applicable):

- If your client agreed to reimburse you for costs, include these separately. You might need to provide receipts, depending on your arrangement.

- Final total:

- Add up all your goods/services costs to get the grand total.

- Whether or not GST is included in your prices:

- Remember, if you’re registered for GST, you’re required to charge GST!

- Payment information:

- Add your preferred payment methods and bank account details. It’s smart to offer multiple payment options - bank transfer, credit card, or online payment services make it easy for clients to pay you quickly.

Things to include in your invoice if you’re GST registered

If you’re GST registered, the IRD has specific requirements for your invoices, depending on the amount you’re invoicing for.

(Fun fact: The invoicing requirements were tidied up as of 1st April 2023 – You don’t need to create “tax invoices” anymore like you used to – instead, you’re putting together “taxable supply information”!)

For invoices under $200:

You’ll need:

- Your name

- Invoice date

- Description of goods/services

- Price of goods/services

For invoices between $200-$1,000:

You have to have:

- Everything from above, plus:

- Your GST number

- Indication that the price includes GST

For invoices over $1,000:

The requirements are:

- Everything from above, plus:

- The recipient’s name

- The recipient’s address, phone number, email, trading name, NZBN, or website

💡 Pro tip: For regular customers, you can provide the non-variable information (like your name, contact details, and GST number) in a separate document. That way, your invoices only need the transaction-specific details.

Invoice through Hnry - it’s easy!

Ready to make invoicing even simpler? Hnry keeps track of your invoices for you – including when they’re viewed and when they’re paid. Plus, our platform allows for credit card payment, making it easier for your clients to pay you the way they prefer.

On top of all this, we (politely) chase up late-paying clients on your behalf, so you don’t have to. Our users get paid an average of 8 days sooner – just from this one feature!So go on then. What are you waiting for? Join Hnry, and make invoicing a breeze!

Share on: