On the 29th of November, major banks in New Zealand launched a new Confirmation of Payee service.

Basically, Confirmation of Payee (CoP) verifies that a payee’s bank account number matches the name given to the payor. It’s aimed at stopping accidental payments to the wrong person, as well as a way to mitigate the harms of financial scams.

But because of Hnry’s unique service, new or one-off payments to Hnry users might trigger a warning from the CoP system. It’s nothing to worry about, and shows the system is working as it should – you’ll just need to manually confirm that the details you’ve entered are correct.

Here’s everything you need to know.

- What is Confirmation of Payee?

- What does Confirmation of Payee look like?

- Why might payment to a Hnry Account trigger the system?

- How to pay a Hnry user

- Hang on – what is Hnry?

What is Confirmation of Payee?

The Confirmation of Payee service is a new way of confirming that you’re paying the right person, and the right bank account. From November 2024 onwards, every one-off or new payment you make through a banking app or internet banking account will be run through this service.

A secure software system will make sure that the name of the person you are paying, and the bank account number they’ve given you, match bank records. This way, it’ll be harder to accidentally send money to the wrong person, or for scammers to con people out of their hard-earned money. Definitely a good thing!

While it’s a new service for Aotearoa, the concept itself isn’t new – banks in the UK have been using their own CoP service since 2020!

What does Confirmation of Payee look like?

Every time you:

- Make a one-off payment,

- Pay a new person or account number, or

- Edit existing payee details, the CoP service will make sure that the bank account number entered matches the name entered. You’ll need to make sure that you have the right details on hand.

If everything matches, the payment will go through as per usual. But if the name and number don’t match, your bank will send you an alert letting you know that something is incorrect, or that the CoP service was unable to verify the details given.

You’ll still have the option to confirm the payment however, if you’re 100% sure that the details you’ve entered are correct. Which actually brings us to –

Why might payment to a Hnry Account trigger CoP?

Great question! It all has to do with how Hnry works.

Hnry Accounts are set up as Professional Trust Accounts. This means that money sent to the account legally belongs to Hnry users, but it gives Hnry access in order to deduct any taxes and levies owed, as per our user agreement. It’s a great way to protect the ownership of funds, while still allowing us to provide our (award-winning, incidentally!) service.

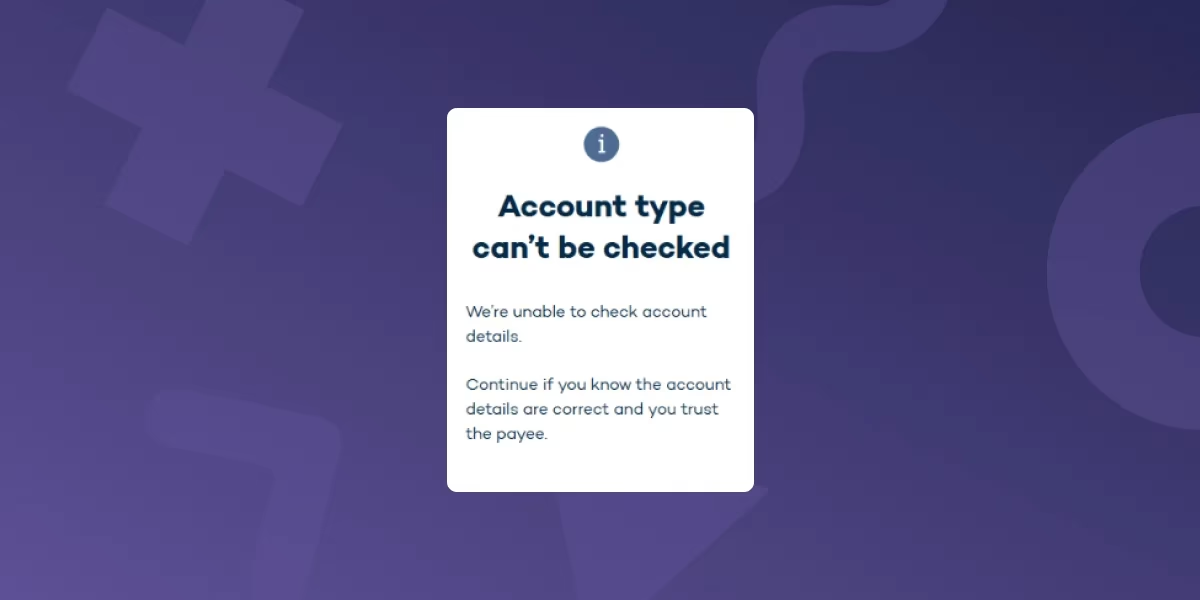

So while the details for the sole trader you’re paying may be correct, at this point in time, the CoP system may be unable to verify this due to the nature of the bank account. You might get an alert that looks something like this:

💡 Note: we are currently working with the banking industry to find a way to verify Hnry Accounts through CoP. Until then, any payment to a new Hnry Account will trigger this alert.

How to pay a Hnry user

CoP doesn’t actually block you from making a payment – it’s more an alarm system, designed to raise concerns (if there are any).

At this point, if you have any doubts at all, we thoroughly recommend triple checking to make sure the details you have entered are correct. But otherwise, all you have to do is confirm that you’d like to continue. You’ll be able to make the payment as per usual, and save the payee’s details for any future payments.

💡 Saving a payee’s details should stop CoP checks from being triggered for subsequent payments to the same recipient. It’s definitely worth it!

Hang on – what’s all this “Hnry” business?

We’re so glad you asked.

Hnry is an award-winning tax service designed specifically for sole traders. Basically, before Hnry came along, sole traders were entirely responsible for calculating and paying their own taxes. They even had to file their own tax return at the end of the financial year. Believe us when we say that all this admin can take hours each week.

That’s why Hnry was founded – to fully handle sole trader taxes, so they can focus on the good stuff. Like their business, for example.

For just 1% +GST, capped at $1,500 +GST each year, Hnry automatically calculates, deducts, and pays all taxes, levies, and compulsory repayments on behalf of our users. We even file their tax returns for them – it’s all part of the service!

Share on: